Before we discuss the reasons for the breakout, let’s first grasp the basics of the Pharmaceutical Sector and the factors that influence it.

Basics of Indian Pharma Industry:

India, often referred to as the “Pharmacy of the world”, plays a pivotal role in global healthcare due to its extensive capabilities in producing generic medicines.

The Indian pharmaceutical industry supplies 60% of the demand for different vaccines worldwide, 40% of the demand for generic drugs in the US, and 25% of all pharmaceuticals in the UK.

In the fiscal year 2023, India’s pharmaceutical and drug exports were valued at INR 2,08,231 Cr, or US $25.3 billion. The industry is poised for further growth, with pharma sales projected to reach US$130 billion by 2030 (EY), demonstrating a robust compound annual growth rate of more than 10%.

Indian Pharma companies derive approximately 29% of their revenue domestically, with the US contributing 28%, API/CRAMS 15%, and the remaining 28% from other sources. The prominence of the US market necessitates stringent inspections by regulatory agencies such as the US Food and Drug Administration (USFDA), which oversees the quality assessment of medications approved for sale in the US. Any unfavorable USFDA observation or warning letter could lead to import prohibitions and, consequently, a decline in these companies’ revenue. This underscores the significant role of the USFDA in the pharmaceutical industry. Here are a few instances where the USFDA’s unfavorable observations caused the share prices of pharmaceutical companies to plummet.

On the product side, the Pharma industry is mainly divided into the following categories:

- APIs— API stands for Active Pharmaceutical Ingredient, which is the component of a medication that produces the desired medical result. For instance, the chemical responsible for lowering pain would be the API in a drug intended to relieve pain. Companies like Divi’s Laboratories and Laurus Labs are major players in this segment.

- Formulations: To create the necessary medications in the form of capsules, tablets, injections, lotions, etc., APIs are further mixed with additional chemical components. Therefore, the ultimate product patients take to recover from their illness is the formulation. Next, formulations are separated into Generic and Patented categories. For instance, you have probably heard the phrase “Dolo” during COVID-19. Therefore, “Paracetamol” is the API that is added to Dolo, and Dolo is the formulation.

- Patented: Pharmaceutical items that government agencies have given patent protection are called “patented medicines.” For a predetermined amount of time, often 20 years from the date the patent application was filed, these patents provide the patent holder the only authority to produce, market, and sell the medication. The holder of this exclusivity can create a monopoly by recovering the costs of research and development (R&D) and making money from sales. Generally speaking, patented medications are costly and are generally owned by Western corporations such as Pfizer, Novartis, AstraZeneca, J&J, and Merck, among others.

- Generic: After the patent term expires, several companies reverse engineer the patented medication or drug and produce their own, which is strikingly similar. They sell identical medication for discounted prices. The majority of Indian pharmaceutical companies belong to this group.

- Complex Generics: These are advanced generics that are more challenging to develop, manufacture, and evaluate than traditional small-molecule generics. These complexities can arise from the drug’s formulation, delivery mechanism, structural characteristics, or the therapeutic use it targets. Examples include inhalers and injectables.

- CRAMS stands for Contract research and manufacturing services, which involves outsourcing R&D and Manufacturing activities for cost benefits. This is a hot theme in the Indian Pharma space as more and more inventor companies are looking to outsource to India due to the availability of a talent pool at cheaper rates as compared to Western countries. India’s projected market size in CRAMS is expected to be USD 12 bn with an expected CAGR of 12.5%.

Composition of Nifty Pharma Index:

What about tracking the performance of the Pharmaceutical sector? Is there anything that we may use to monitor the performance of Pharmaceutical Stocks?

Indeed, there is. It is known as Nifty Pharma. Twenty stocks make up the Nifty Pharma (sectorial index), which is intended to mimic the actions of the Indian pharmaceutical sector. Weightage is assigned to stocks according to their Free-Float Market Capitalization. Current weights are as follows (as of May 2024):

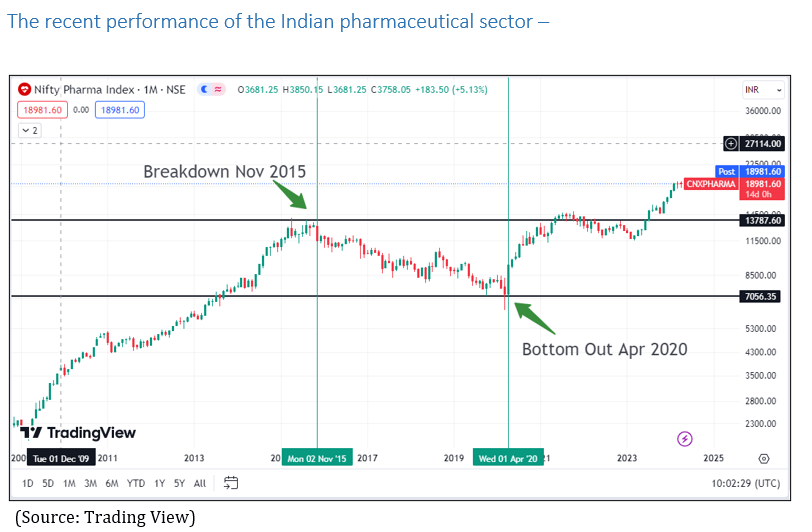

The recent performance of the Indian pharmaceutical sector –

As you can see from the above figure, the pharmaceutical industry saw a difficult period starting in 2015, with a 50% decline from its peak in that year and a bottoming out in 2020 (during the COVID-19-related recovery).

So, as a reader, you must ask what caused this fall.

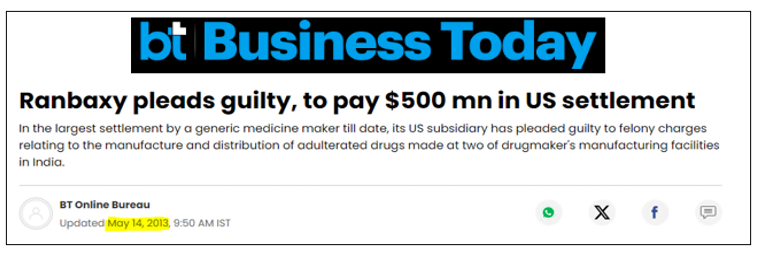

- In 2013, Ranbaxy pleaded guilty to felony charges relating to the manufacture and distribution of adulterated drugs made at two of the drug maker’s manufacturing facilities in India after one of their former employees became the whistleblower.

This essentially sparked the subsequent investigation of the manufacturing procedures and facilities used by generic companies, which were discovered to be poor.

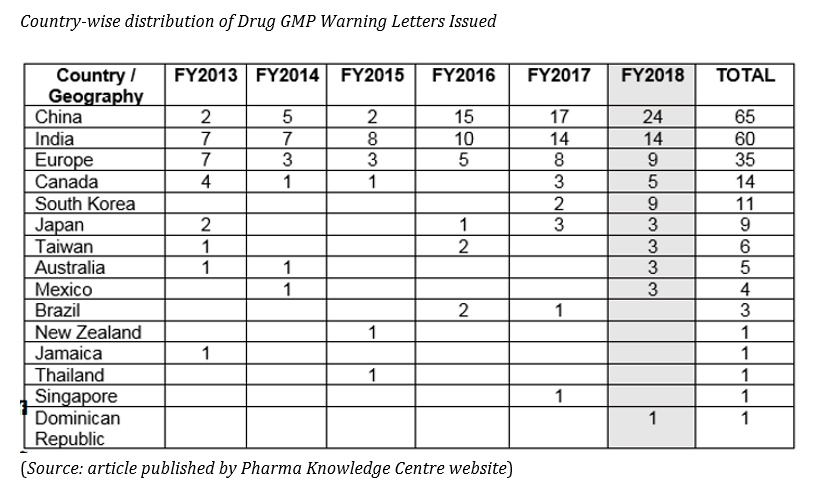

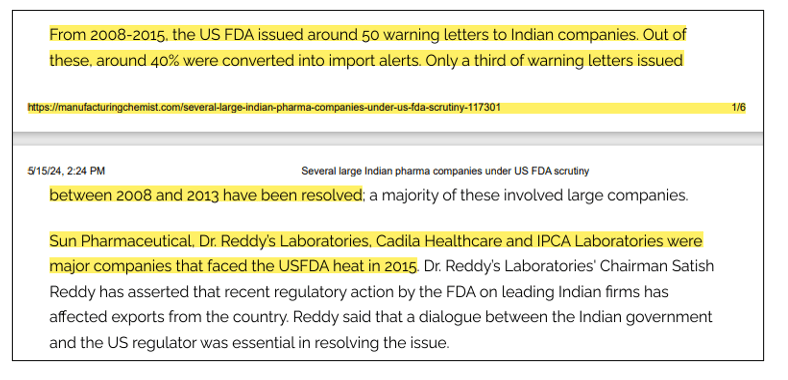

Beyond this, it was also reported that the US FDA issued 50 warning letters from 2008-15 to Indian Pharmaceutical companies, and only one-third of these were resolved. A majority of these involved large companies.

Pharma businesses were performing well before this crackdown; however, as a consequence of these measures, their revenue growth slowed down as existing goods from present facilities were placed on hold and new product launches were postponed.

Due to price control measures implemented by the Indian Drug Price Authority, there was pressure on prices in the domestic market as well.

If we look at the following chart, we will see that the major Pharmaceutical players’ revenue grew at a median CAGR of just 4% during these years (2015-20). This led to the fall of Nifty Pharma by 50%.

Covid led market rally

Given that India is a global pharmacy, Covid was actually a blessing in disguise for the Indian pharmaceutical business. As a result, the Nifty Pharma Index increased by 140% in just 1.5 years, primarily due to a spike in demand for medicines.

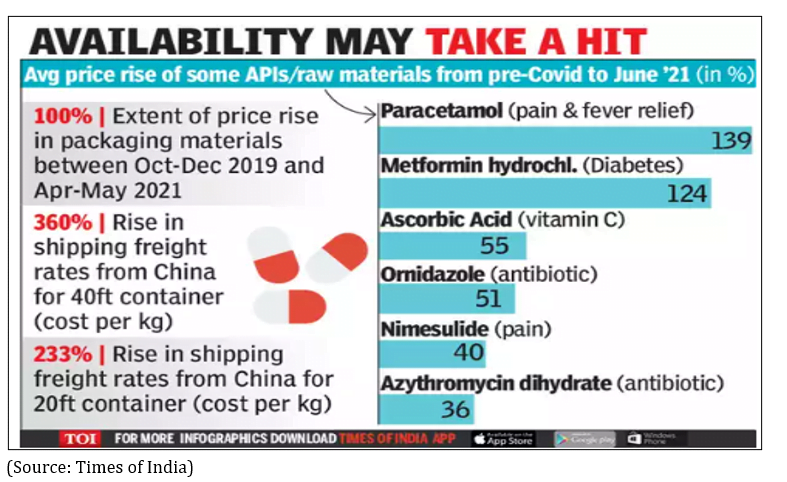

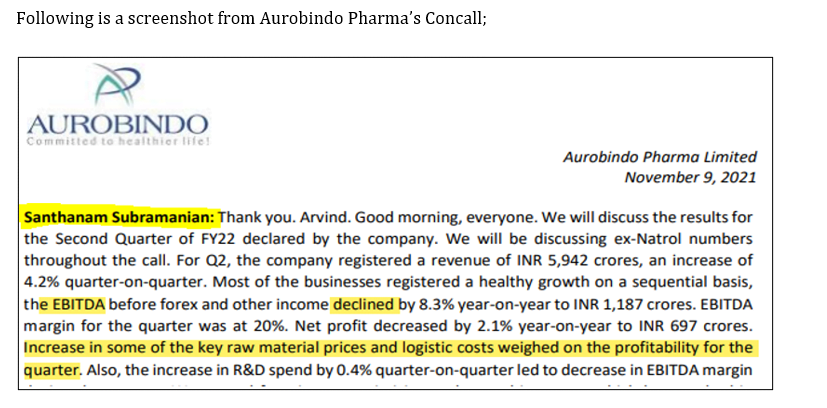

However, beginning in October 2021, Nifty Pharma began making corrections due to rising raw material costs, freight expenses, and US inventory destocking.

According to certain media reports, the increase was roughly 50% on average, but it was as high as 140% in some cases. Additionally, many drugs had price controls, so the manufacturers had to absorb the price increase and see a decline in profit margins.

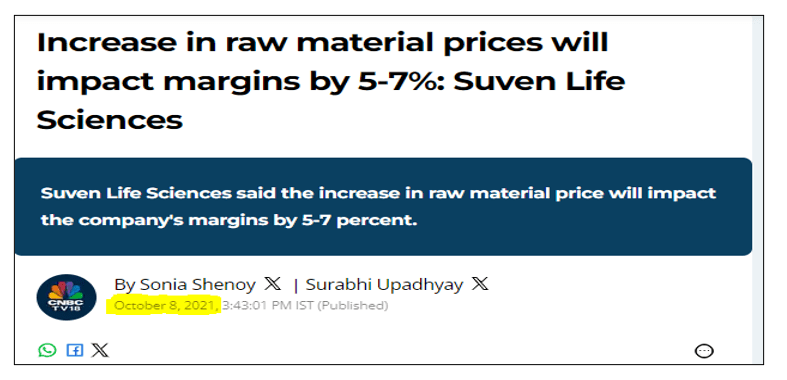

Here’s another such commentary from CEO of Suven life Sciences in Oct 2021, stating that their margins can be impacted to the extent of 5-7% due to rising raw material cost.

This created a scenario of negative sentiments around the Pharmaceutical sector, which led to profit booking (as the investors had already witnessed Nifty Pharma’s 140% returns in just 1.5 years).

Reasons for the current Breakout in the Pharma sector?

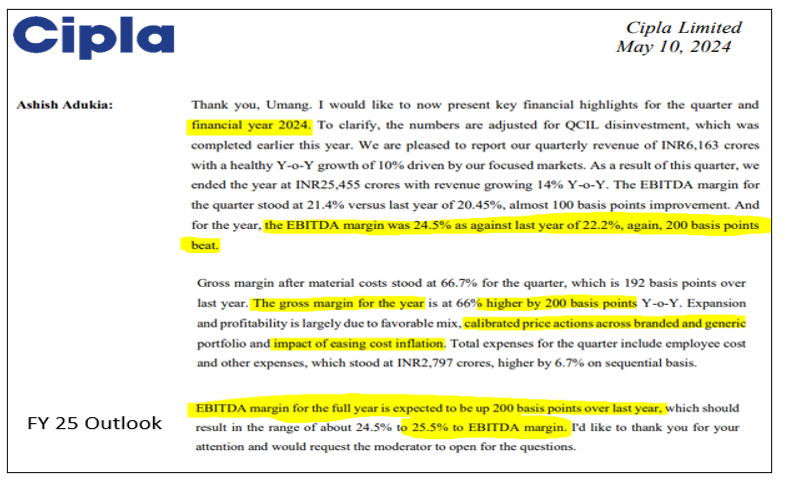

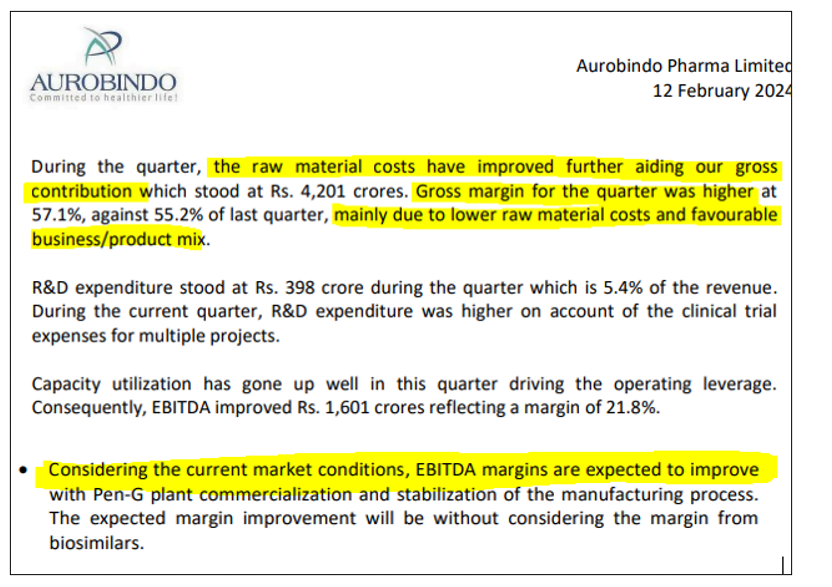

Because of the favorable tailwinds from the US generic markets, including improved prices due to drug shortages, lower raw material prices, and the introduction of high-value pharmaceuticals in the US market, Nifty Pharma delivered an all-time high breakout in November 2023. This suggests a bullish outlook for FY 25. In the coming year, even the management of pharmaceutical businesses has expressed plans to expand their margins. Press stories and management response screenshots corroborating these events are included below.

In addition to these, the management outlook for FY 25 is optimistic. Below are some excerpts from a recent management call;

Which particular segment in Indian Pharma is poised to do well in the long run?

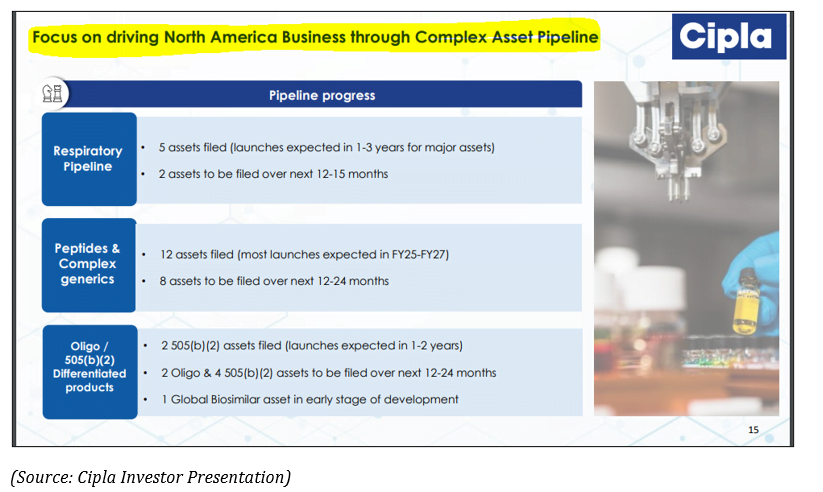

As we’ve seen in previous paragraphs, fierce competition has resulted in price erosion in the US generic markets, which has posed a challenge for Indian pharmaceutical companies over the years. The generic market is becoming increasingly competitive, which has been eating into this industry’s margins for a while now.

Therefore, switching to complex generics—which have high margins and are mostly shielded from price erosions—is essential for improving returns and stabilizing margins.

Complex generics are more difficult to develop, and there is less competition and a greater profit margin. Indian companies like Cipla, Lupin, Sun Pharma, Dr. Reddy’s, and numerous others have begun to concentrate on these high-margin products.

CRAMS is one of the fastest-growing sectors as well. Huge investments followed by low productivity in R&DS are driving companies to cut manufacturing costs by outsourcing their research and manufacturing activities to low-cost countries like India.

This is a brief excerpt from CIPLA’s investor presentation outlining its US market strategy, which prioritizes the launch of complex generics over the long run.

Having understood the cause of the Pharma industry breakout, let us look at one of our TechnoFunda picks……

GlaxoSmithKline Pharmaceuticals Ltd

GSK’s performance has been steady over the past five years, earning an average Return on Capital Employed of over 35% while remaining debt-free. But there was one thing the business lacked, namely growth. Over the previous five years, GSK’s sales increased at a CAGR of just 1% with stable margins. We believe that this was the primary cause of the consolidation phase. However, things have changed, and the management has projected double-digit growth due to the introduction of new products (vaccination) and increased margins (achieved through cost-cutting measures). We believe this was the primary catalyst for the current breakout, so we think this company is a good pick due to its strong fundamentals and promising future.

On the technical aspects, the stock has given an 8-year breakout. Strong fundamentals, a good future outlook, and a technical breakout make GlaxoSmithKline Pharma a good TechnoFunda Pick in our opinion.