INTRODUCTION:

Industry

India made an announcement in G20 summit to increase the green energy capacity from 178 GW to 500 GW by 2030. Thereby, the contribution of solar energy would increase from 67 GW to 280 GW. India anticipates substantial growth in solar PV (photo voltaic cells) and ACC (advanced chemistry cells) investments to meet this target.

Company

Sterling & Wilson Renewable Energy Ltd. is one of the major EPC (Engineering, Procurement & Construction) players in the solar segment. It has current EPC portfolio of 18 GWp (Giga Watt peak) and O&M (Operations & Maintenance) portfolio of 7.6 GWp and presence in 26 countries. As of Q4FY24, 80% of the revenue comes from domestic EPC, 15% from International EPC and balance from O&M.

Promoters

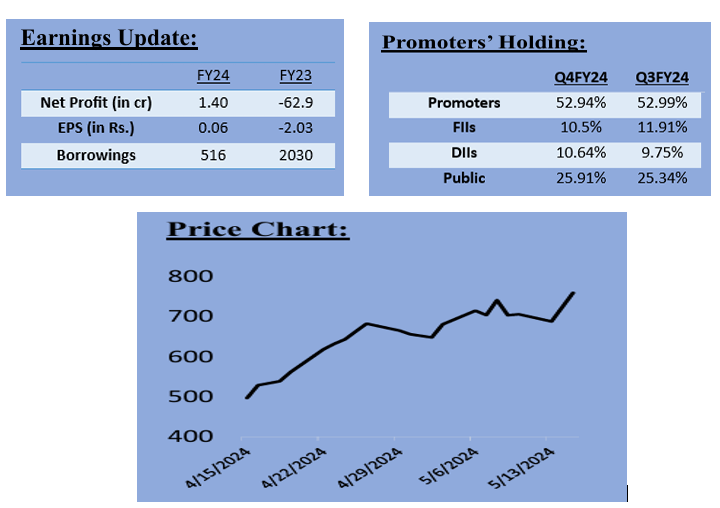

In March, 2022, Reliance New Energy Limited acquired 40% stake in the company, with stake dilution of major promoter, Shapoorji Pallonji, from 42% to 24%. Both the promoters combined stake is 52.94% as of March 2024.

Recent QIP in Dec 2023

The company raised INR 1,500 crores through a Qualified Institutional Placement (QIP). They issued 4.32 crores of equity shares at an issue price of INR 347. Out of the funds raised, INR 1,140 crores of funds were used in repayments of debt and INR 330 crores were used for general corporate purposes (Working capital, repayment of short-term borrowings etc). The holding of Reliance stands at 32.5% now.

Opportunities

RIL plans 10GW solar module capacity by mid-2024 and 20GW generation by 2025; SWREL may secure EPC orders worth INR 20,000 crores.

The closure of the INR 20,000 crores Nigeria agreement is expected soon, with the Nigerian government reaffirming its MoU with Sterling & Wilson. This MoU involves developing, designing, and commissioning 961MW of solar PV power plants and 455MWh battery energy storage systems, aiming at USD10bn long-term prospects in Nigeria.

Latest Quarter Summary:

The company has recently turned almost debt free with less than INR 120 crores of debt left from approximately INR 2,000 Cr a year ago. The interest payments for FY25 is expected to be less than 35 Cr.

Company received its second international order in Q4 from Enfinity for a BOS project in Italy amounting to ~INR 180 Cr.

They have received total orders / LOI in 13 projects worth INR 6,023 crore in FY24 compared to new order inflow of INR 4,387 Cr in FY23.

Unexecuted order value at INR 8,084 Cr as of Mar 2024 compared to INR 4,913 Cr as of Mar 2023.

OUR THESIS

Turn Around

The Company got listed in 2021. Thereafter because of delay in payment of EMIs for loan taken, the stock price came crashing down to INR 60 from INR 700. It was only after the commentary from management about regular repayments, that the stock price again started going up. However, with the hit of COVID, company wasn’t able to recover expenses (raw material became expensive), and now after 3 years of negative PAT, company experienced profits for the first time in Q4. Moreover, the company has unexecuted order book value of more than INR 8,000 crores of which INR 6,000 crores revenue is expected to generate in FY25 which is 2x revenue of FY24.

Order Book

The Company has two huge projects, other than the current unexecuted order book, for which confirmation is yet to be received. One is the Nigeria order (Order value INR 12,000 crores), which company is in talks with the Nigerian Government for approvals and other is RIL order inflows (INR 20,000 crores). With both the order coming in, the revenue can increase significantly. Moreover, the company is reducing the overhead and employee costs (which has been a major expense in their income statement) which will help in increasing profit margins.

Technical Breakout

The Company is trading at its all-time high as on 16th April, 2024. It has seen a 5-year breakout. With the huge buy volumes being traded, investors seem resilient about the company with display of positive PAT numbers.

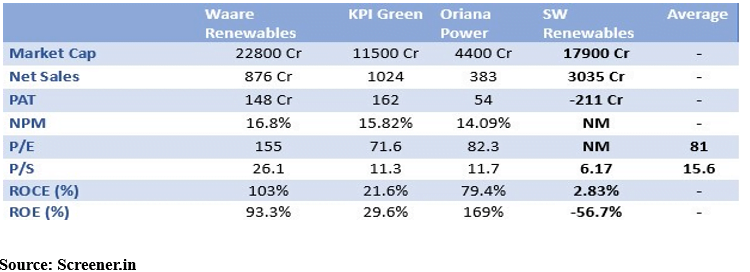

Comparable Analysis

Following is the comparison of various other players in solar EPC industry. It gives us a broad understanding of the industry average and competitors. Based on the data here, we were able to forecast the intrinsic value of the company as mentioned further.

Valuation

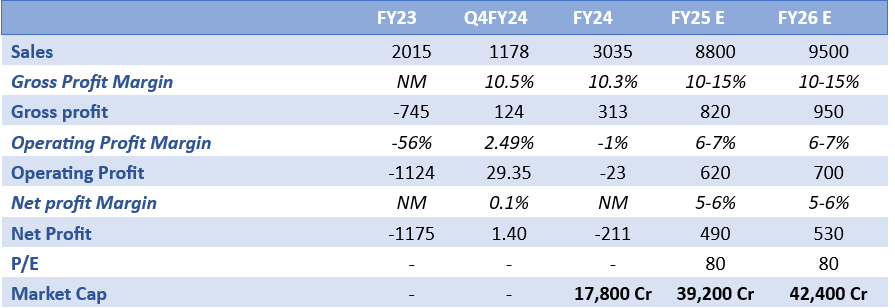

The company has unexecuted order book value of INR 8,750 crores, out of which, 70-75% will be executed in FY25 as per management commentary which adds up to total sales value of INR 6,000 crores and the additional orders expected in coming years gives estimated sales value of INR 8,800 crores in FY25. In FY26, with more clarity on much anticipated orders like Nigeria and RIL, the company is expected to see YoY sales growth of ~10 to 15%.

With management focused towards maintaining gross margins of 10-15%, conservatively we can expect INR 950 crores in gross profit in FY26 and NPM of 6-7% totals to PAT of INR 530 crores for FY26. With average industry P/E (70x-80x), the company can reach the market capitalisation of INR 37,000 – 42,000 crores by the end of FY26 as per our estimate.

CONCLUSION

As per our strategy of TechnoFunda, the company appears to be

→Going through a turnaround situation and fundamentals seem to be improving. Valuation is very attractive at this point of time

→Giving a technical all time high breakout.

Hence, we give a “BUY” rating to SWSOLAR with a target price of ~1800 per share by end of FY26.