About

Aavas Financiers was started in Jaipur in 2012. Earlier, the company was known as AU Financiers and was owned by the AU Small Finance Bank group. However, due to RBI requirements for small finance banks, AU Small Bank had to sell its business to a group of Private Equity Players, viz—Kedaara Capital and Partners Group, in 2016. Later, the company’s name was changed to Aavas Financiers in 2017, and it got listed on the stock exchange in October 2018.

AAVAS (company) is a retail, affordable housing finance company primarily serving low and middle-income self-employed customers in semi-urban and rural areas in India (especially tier III cities and below). These loans have a ticket size of around 10 Lakhs or lower than that and carry interest rates of 12.5%. They offer customers home loans to purchase or construct residential properties and extend and repair existing housing units.

The majority of their customers have limited or no access to formal banking credit due to a lack of required documents, such as Income Tax Returns, etc.

Aavas relies heavily on in-house lead generation compared to other housing finance companies, which get their customers through agents or third parties. This has resulted in the company having the highest number of employees in the industry.

But how do they source funding?

Over the year, they have raised funds from the National Housing Bank, CDC Group, International Financial Corporation, and Asian Development Bank. Currently, the interest rate on borrowings is around 8%.

Business Strategy

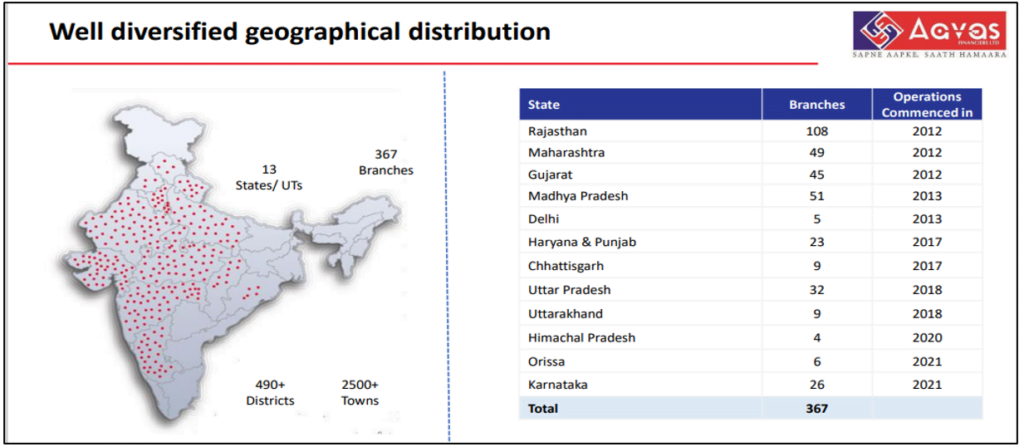

The company has long employed a concentrated geographic approach, focusing on a set number of states for a set amount of time rather than developing simultaneously in all directions. At the moment, the states of Rajasthan, Maharashtra, Gujarat, and Madhya Pradesh account for 82% of their business. They have started venturing into newer states like Karnataka, Odisha, Uttar Pradesh, Himachal Pradesh, etc. Management has guided that Karnataka and Uttar Pradesh will be key focus states for their new growth strategy.

They employ a localized technique, where their employees go to the client’s neighborhood to collect information and better understand the client’s credit profile. Most of their clients are first-time borrowers with no credit history, so this has so far resulted in a very positive experience for the company, with the lowest GNPA numbers.

Historical Performance

The company’s revenue has grown at a CAGR of 44%, whereas Profit has surged at a CAGR of 55% over the last 10 years.

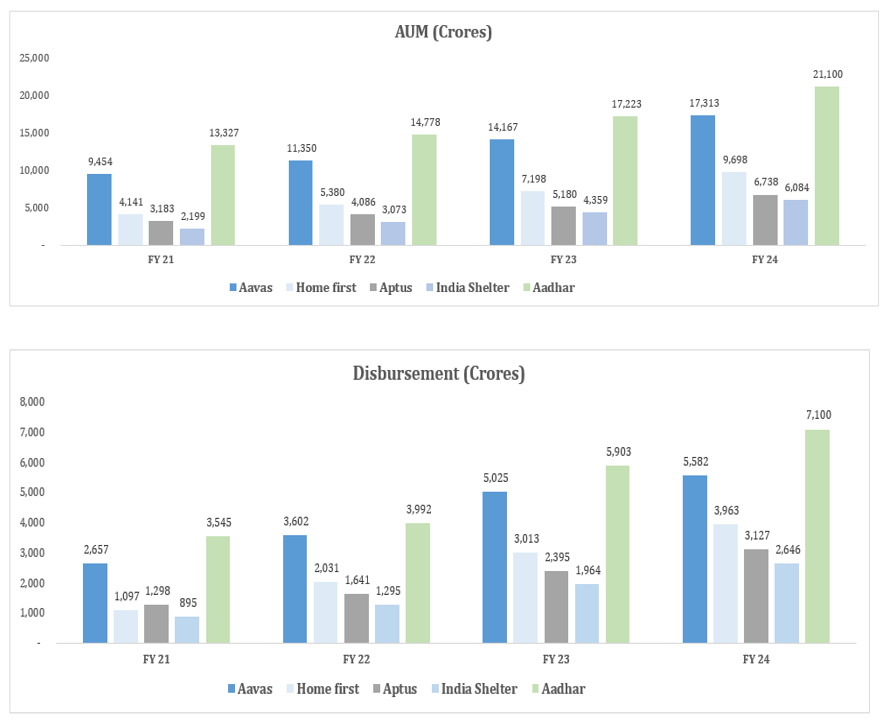

Aavas is the 2nd biggest among all the listed affordable housing finance companies with highest AUM and Yearly disbursement numbers.

Reason for such a wonderful graph of growth in revenue, profits, AUM and disbursement is because of the potential that affordable housing offers and that too for segment that barely gets served by the Banks and large housing finance companies.

Peer comparison

Prima facie, we should invest in Aptus rather than Aavas because, according to the above table analysis, Aptus outperforms Aavas in several parameters. This is mainly because Aptus’s portfolio contains a mix of business loans (20%). It should be highlighted that non-housing loans provide higher yields but are a more risky asset class.

Then, why are we investing in Aavas?

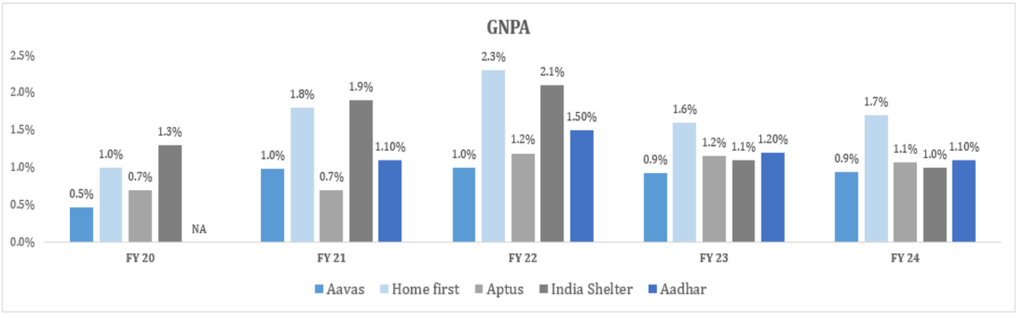

The answer to this question can be found in the companies’ Gross NPA numbers. The lower the Gross NPA number, the better the asset quality of the Housing Finance Company.

The following chart reveals that Aavas has the lowest Gross NPA figures and fared pretty well throughout the difficult COVID-19 years, when competitors’ Gross NPA figures skyrocketed. Aavas quality checks kept this figure low for them.

Thus, selecting a company with the finest asset class is crucial, given the past disasters in the housing finance industry.

Industry Outlook

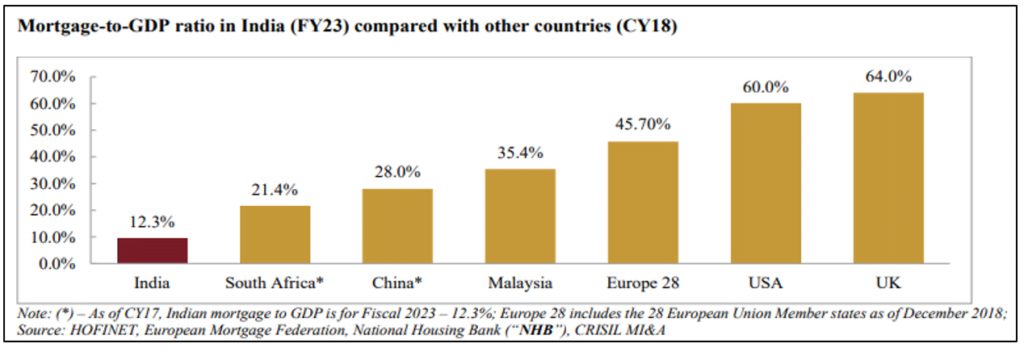

The housing finance sector is predicted to double over the next five years, according to market forecasts. In comparison to other comparable Asian economies, where the ratio typically ranges from 20 to 30 percent of GDP, India’s mortgage to GDP ratio hovers around 12%. As a result, this market has a lot of upside potential. According to the CRISIL research, by FY 25, this number is expected to reach 14–15%.

CRISIL further adds that rural areas, which accounted for 47% of GDP, received only 8% of total banking credit, indicating a large market opportunity for banks and NBFCs to lend in these areas.

With the government’s increasing focus on financial inclusion, rising financial awareness, and increasing smartphone and internet penetration, the delivery of credit services is expected to increase.

Compared to overall housing loans, which increased by 14% between Fiscals 2018 and 2023, the growth in the low-income housing category has remained muted, with the segment experiencing a CAGR of 3% after expanding between Fiscals 2015 and 2018. The COVID-19 epidemic, a slowdown in economic activity, and financial difficulties brought on by the NBFC crisis are the leading causes. However, the situation has improved, and the low-income home loan market is predicted to rise at an 8-10% CAGR between FY 23 and FY 26.

There is a shift towards a nuclear family structure from the erstwhile joint family structure, which is increasing the need for housing in most parts of our country.

Beyond this, the broader reason for the growth of credit/housing, especially in Tier 2 to Tier 7 cities in India, is mainly driven by rapid urbanization, economic development, rising disposable incomes, and Favorable demographics. Government initiatives promoting financial inclusion, infrastructure developments, and expanding banking networks have facilitated easier access to credit. Increasing aspirations for better living standards and educational opportunities also spur loan demand. Cultural changes and improved access to information contribute to the growing consumer base seeking various forms of credit, from personal loans to housing finance. These factors collectively support the expansion of credit facilities in smaller cities and towns across India.

As per the RBI Report of the Committee on the Development of Housing Finance Securitization Market published in September 2019, the housing shortage is also largely in the EWS and LIG segments (Economically weaker section/Low-income group), with 45 million houses in the EWS segment and 50 million houses in the LIG segment, which together account for 95% of the estimated housing shortage in India.

Hence, the government of India has specially come up with PM Awas Yojna to provide affordable housing for the urban and rural poor in the country. Pradhan Mantri Awas Yojana (PMAY) is a flagship housing scheme launched by the Indian government to provide affordable housing to urban and rural poor by 2022 (extended till Dec 2024). It aims to promote affordable housing through financial assistance, subsidies, and home construction and renovation incentives. The scheme targets economically weaker sections (EWS), low-income groups (LIG), and middle-income groups (MIG) across India.

So companies like Aavas financiers benefit from it, and small housing finance companies contribute significantly to the growth of tier 2 and 3 cities by providing accessible financing options tailored to local needs. They bridge the gap in housing finance, catering to underserved segments with flexible loan terms and personalized customer service. By facilitating easier access to housing loans, they stimulate real estate development, boost home ownership rates, and contribute to overall economic expansion in these cities.

Role of Housing Finance Companies like Aavas Financiers in Pradhan Mantri Awas Yojna (PMAY)

Aavas links eligible loanees with the concerned Government scheme (Pradhan Mantri Awas Yojna) to access available subsidies. This coordination with the government has helped moderate the customer’s monthly installments during loan tenure. They have a dedicated team that looks after the subsidy cases.

So far, the company has provided PMAY assistance to around 20,000 customers, which has resulted in interest savings of 280 Crores for the loanees.

So, in the previous section, we covered the broader outlook of the country’s affordable housing segment. Now let’s have a look at company-specific growth factors based on management guidance;

Growth Drivers for Aavas

Aavas’s management is confident it will achieve 20-25% growth in the AUM while bringing down costs.

The company has deployed a strategy of entering new states every four to five years. This focus and contiguous approach have reaped the benefits so far and will continue to do so in the near future.

Under this approach, Karnataka and Uttar Pradesh will be the focus states for the near future. Management believes that they want to use an Opex-light approach to RRO, i.e., appointing a “Regional Rural Officer,” and once this fructifies, only setting up a dedicated branch with proper infrastructure. This will help the company have more touch points while ensuring minimal Opex.

Further, Aavas has started venturing into non-housing loans as well, which are generally taken against for business financing requirements such as business expansion, working capital needs, etc. These loans carry interest rates of around 15% (vs. home loans—12.5%).

Valuation Analysis

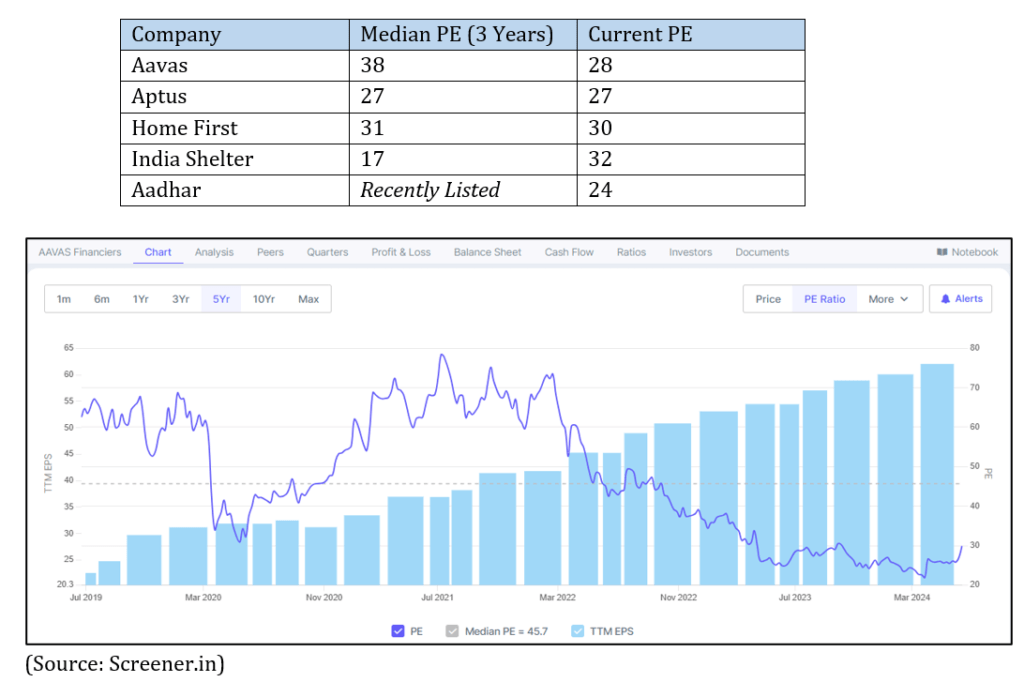

Price to Earnings ratio of various housing finance companies

Over the last five years, Aavas has been a market darling with a median PE of 45 because of its strong loan book and risk measure; but, recently, there has been some correction to this due to reasons including the company’s founder and CEO leaving in 2023, among other things.

However, we believe that the market will start giving it a higher PE multiple, which can bring it closer to its historical PE of 35+ once the growth from the new states of Karnataka and Uttar Pradesh starts to materialize.

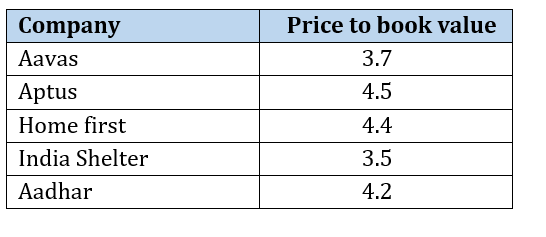

Price-to-book value comparison.

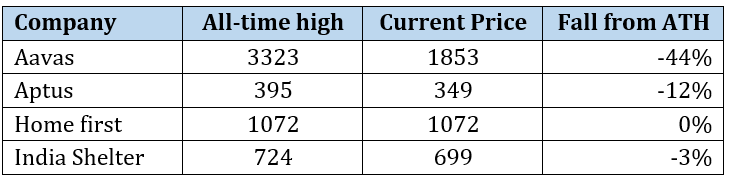

Because of the fall in stock price over the last two years, Aavas is also commanding the lowest multiple on the price-to-book value front.

As a result, while peers have not seen any notable corrections, Aavas has been in a consolidation phase since February 2022.

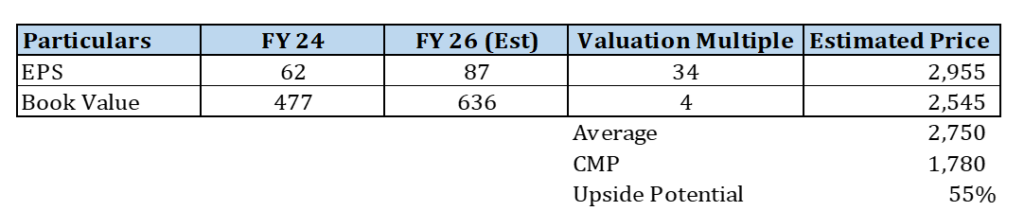

We believe that the EPS/Book Value will grow at CAGR of 18%/14% over the next two years and will help us reach levels of

Conclusion

Affordable housing financing companies are experiencing a decadal upcycle, and almost all will continue to grow in the long run. However, there is still a risk, namely the possibility of asset quality or loan default. This is the most crucial consideration when investing in affordable housing financing companies whose clients are from the informal sector (economically weaker section or lower income groups).

Therefore, we think Aavas is the safest option, especially given its remarkable resilience during the COVID era, as evidenced by its lowest GNPAs. Furthermore, the stock is currently trading at one of the lowest valuation levels among its peers. Therefore, with a price target of INR 2750, investors may want to consider long-term investment in this stock.