Gold is considered a “Store of Value” because historically, gold prices have moved in the opposite direction whenever the market has seen a correction.

Before we get into the factors behind the current Gold Rally, let’s first understand various factors that affect Gold prices:

What the factors that affect Gold prices:

- Gold is important in countries like China and India, where it is well merged with the customs and culture.

- Gold is seen as a hedge against inflation. As the value of paper currency decreases, people tend to invest in safer investment assets like Gold, which has maintained its value over centuries due to its rarity and global demand.

- Beyond this, Gold is considered a Global Commodity cum currency that is not tied to a particular economy or currency; hence, during tougher times, investors flock to gold to protect their investment from market volatility. Further, Gold is a tangible asset compared to stocks or security instruments.

- The state of the world economy directly impacts the price of precious metals. During periods of economic prosperity, people tend to invest more in stocks, shares, and other assets that some may consider riskier, resulting in a drop in precious metal investments. Precious metals are more in demand during recessions since they are frequently considered safe-haven investments.

Central Banks: Central banks purchase and hoard gold to diversify their reserves, guard against inflation, maintain currency stability, act as a buffer against crises, and improve the general stability and credibility of their financial systems. Because of its special qualities, gold is crucial to central banks’ reserve management plans.

A business insider report states, “It’s not just China and India. Other central banks, including Poland and Singapore, have also been snapping up gold to hedge against global economic uncertainties.”

How do economic indicators drive investments in Gold?

Interest rates: Higher interest rates generally lead to lower gold prices due to increased opportunity costs. Rising interest rates make stocks, government bonds, and other investments more attractive to investors.

- Low-interest rate -> high gold prices

- High-interest rate -> low gold prices

Inflation: Inflation is the biggest problem for bondholders, as it will eat up the value of future cash flows. Hence, in an inflationary environment, investors ditch bonds and flock to Gold for better returns, as Gold is seen as a hedge against inflation.

- Higher inflation -> high gold demand -> high gold prices

- Lower inflation -> lower gold demand -> lower gold prices

However, in the current environment, Interest rates and inflation are both at high levels. How is that possible?

Over the past couple of years, geopolitical issues (US sanctions) have created a fear among non-ally countries that the US can use forex reserves (denominated in the US dollar) as a weapon in the future. Additionally, the US dollar is getting devalued faster due to high inflation. There is a high chance that the US may get into a recession by the end of 2024. Hence, these countries have started dumping the US Dollar and hoarding Gold as their reserve. This fear created an artificial surge in the demand for Gold by the central banks. This geopolitical scenario has resulted in both the interest rates and Gold prices being high simultaneously.

What is the future outlook for Gold?

High inflation: According to the latest Consumer Price Index (CPI) data released on 10 April 2024 by the Bureau of Labor Statistics, inflation is 3.5%, 0.4% higher than the estimated inflation for the year ended March 24. This is the highest growth in inflation since October 23, mainly because of the rise in energy and gasoline prices (CPI data), as shown in the chart below.

This will lead to investors keeping their money parked in the yellow metal itself to safeguard the value of their investments.

Geopolitical tensions: Recent events, such as tensions between Israel and Hamas, Russia, Ukraine, and Iran, have created geopolitical unrest worldwide. This again points towards increased demand for yellow metal.

Now let’s talk about the other Precious metal, i.e., Silver

Before we discuss the recent increase in silver prices, let’s learn about this fascinating fact: 27% of silver is produced directly through silver mining, with the remaining 71% coming from the extraction of other metals as a byproduct, such as zinc, copper, lead, and gold.

Due to its historical use and significance in jewelry, art, silverware, and currency, silver was also regarded by investors worldwide as a safe haven. This used to be the reason why silver followed in the footsteps/direction of gold and even provided higher returns than gold during the bull market (refer to the chart below).

If we look at the above chart, Silver prices have still not reached their all-time highs, whereas Gold has. The major reason for this is that Gold is in higher demand due to the monetary aspects of the banking system.

However, silver’s price behavior has differed from that of gold over the last few years. But Why?

Muted demand for Physical Silver

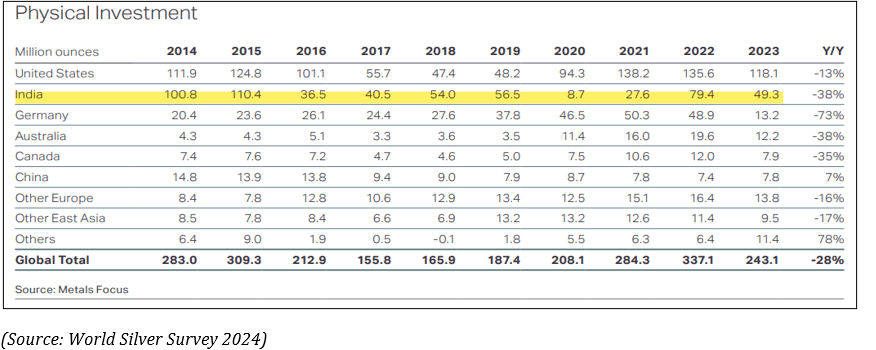

Along with this, post demonetization, a general trend of muted demand is witnessed in Physical investment of silver in India (refer to the pic below), where India’s share in physical investment of silver has gone down from 36% to 18-20%

See, India is the second largest holder of Physical investment in Silver worldwide. So any muted demand for it will impact demand and prices. If we look at last year’s data, Indian demand has witnessed a massive drop of 38%. We can say that this shift has gone to Gold, as that has given better returns during the same time frame.

Then there is the profit booking; people tend to sell silver at peak prices to safeguard their returns.

Dependence on Global Economic Growth

As we covered above, people are more interested in gold when the world economy struggles since it’s a safe haven for investments. This isn’t the situation with silver these days, as most of it is used in industrial applications.

Hence, major emphasis is given to the economic outlook for Silver price movements, which have not been that good due to the economic impact of issues like COVID-19, Russia, Ukraine, War, Israel, and the Hamas war.

These are the primary explanations for why silver’s absolute performance has been disappointing relative to gold,” i.e., silver hasn’t reached its all-time high levels while gold has. However, there may be hope for a future bull run in silver prices if the economic situation improves.

What is the future outlook for Silver?

As per World Silver Survey 2024 – “The Fed’s aggressive monetary tightening and a prolonged downturn in the Chinese property sector weighed on confidence in silver among institutional investors, despite its sizable structural deficit.”

Hence, a revival in the Chinese economy and some rate cuts by the US Fed will be the key triggers.

There have been negative sentiments about the Chinese economy for quite some time now, mainly due to the Real estate crisis, rising local debt, and weak consumer spending. However, during the March quarter, it reported growth of 5.3%, higher than the analyst’s expectation of 4.6%.

Suppose we witness similar numbers in the coming quarter and the US Fed Interest Rate is relaxed. In that case, sentiments will change, and silvers can become the next bet for Institutional investors.

Additionally, there has been a deficit in the supply of Silver compared to the demand over the last couple of years.

This rise in demand can be attributed to Electric Vehicles and Solar Energy. Reports state that the auto industry, which accounts for 5% of the world’s silver consumption, uses 25–50 grams of silver per electric vehicle (EV) instead of 18–34 grams per light vehicle (ICE).

About 30MT of silver is needed to generate 1GW of solar electricity (which makes up 10% of the world’s silver use).

Beyond this, there’s another thing, i.e., speculation. As per CNBC, silver has a track record of outperforming Gold during the Bull Run. Since 1967, silver has outperformed gold in 6/7 major bull markets.

This has not been the case so far; hence, market reports are indicating that we might be witnessing the “FOMO – Fear of Missing Out” scenario from speculative investors, which can drive the silver price to higher levels.

So overall, it looks like both Gold and Silver will do well over the next few months

- Due to high demand from China

- High inflation in the US, along with high chances of the US economy going into a recession

- Supply-demand mismatch