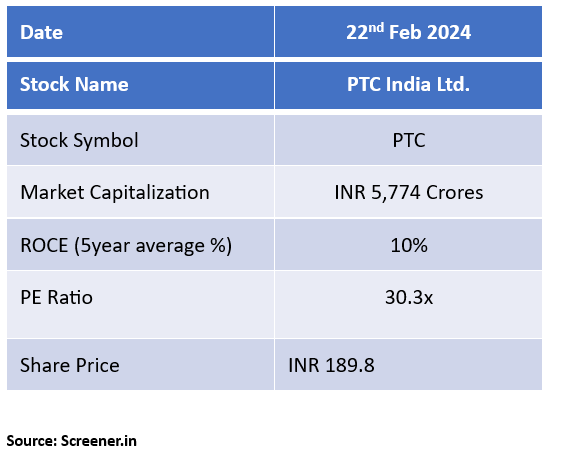

PTC India: Overview, Share Price, and Fundamental Analysis

Company Background

• PTC India Limited (“PTC”) was established in 1999 by the Government of India as a Public-Private Initiative and is in the power trading business.

• It is promoted by Power Grid Corporation of India Limited (PGCIL), NTPC Limited (NTPC), Power Finance Corporation Limited (PFC) and NHPC Limited (NHPC). Together these promoters own 16.22% of PTC India.

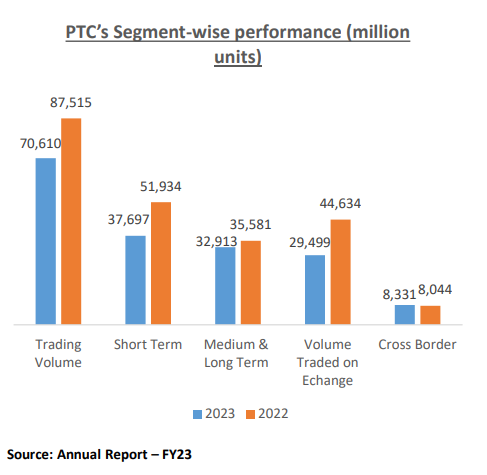

• It is the largest player in the power trading market with share of over 35% in fiscal 2023. PTC India traded around 71billion units in fiscal 2023 (around 87 billion units in fiscal 2022).

• PTC India has two main subsidiaries: PTC Energy Limited (PEL) and PTC India Financial Services (PFS).

• Additionally, PTC is a sponsor of Hindustan Power Exchange (HPX), an associate company engaged in power exchange across all segments.

Business Segments

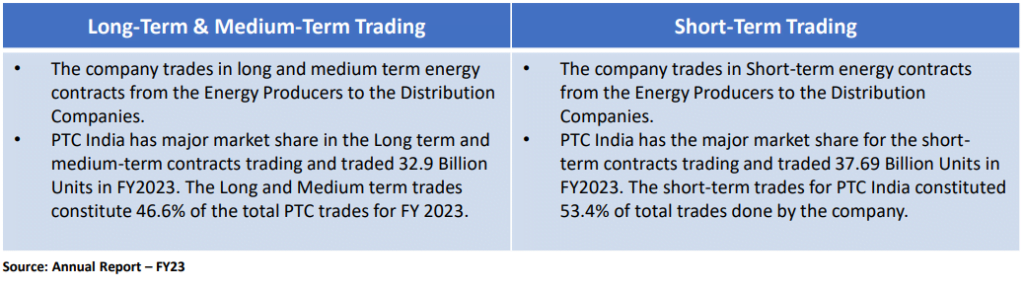

• PTC undertakes trading activities which include long term trading of power generated from large power projects as well as short term trading arising as a result of supply and demand mismatches, which inevitably arise in various regions of the country.

• Breakup between various segments is as follows:

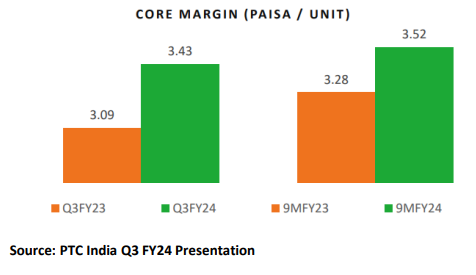

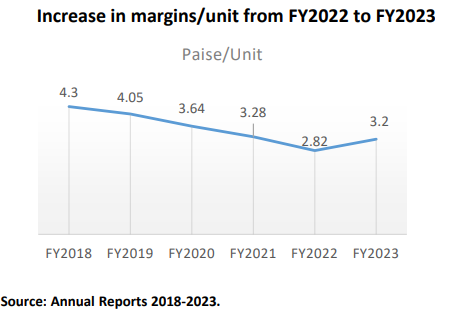

Improving Financials

• Core margin of PTC India Limited has seen a significant surge on 9M basis, making an impressive 7.3% year-on-year increase. The core margin stood at 3.52 paisa per unit in 9M FY24 compared to 3.28 paisa per unit in 9M FY23.

• Trading volumes are consistently on the rise. The Trading Volumes in 9MFY24 was 56,817 MU compared to 54,220 MU in 9MFY23, an increase of 5%.

• Management has indicated that the company intends to derive 50% volumes from Long & Medium term contract and remaining from short term contracts. This should results in consistency of margins going into the future as well.

Subsidiary companies – Contributing positively

• PTC Energy Ltd – PTC India in October announced that the upstream firm ONGC had emerged as the successful bidder for acquiring its 100 per cent stake in PTC Energy. Enterprise value of PTC Energy includes INR 925 Cr bid of the ONGC as well as over INR 1,100 Cr debt component which will be transferred to the oil company after the transaction is complete.

• PTC Financial Services – PFS has embarked on a strategic path of transformation, beginning with comprehensive overhaul of its management team. This move is aimed at addressing the hurdles encountered in last few quarters. With a steadfast commitment to enhancing the quality of its asset portfolio, PFS is poised for sustained growth and success in the forthcoming years.

• HPX – The Hindustan Power Exchange (HPX), sponsored by PTC, is making significant strides in business volume and has garnered a third of the market in the Term Ahead Segment. With the introduction of products like HP-TAM and AS-RTM, HPX is expanding its market presence. The recent policy initiatives like market coupling operator will create a favorable business environment for HPX. PTC India has 22.62% shareholding in HPX.

New Opportunities

• Deepening of Energy Derivatives market.

• Rising contribution of renewable energy sources in the contribution mix.

Valuation

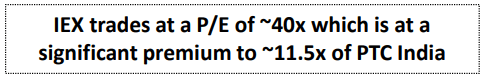

SOTP valuation of various businesses within PTC India can be done as follows:

1. PTC India standalone – PAT of 400 Cr * P/E Ratio of 10x = INR 4,000 Cr

2. PTC India’s investment in PFS – 65% of Mcap (~5000 Cr) = INR 3,250 Cr

3. PTC India’s value from sale of PTC Energy Ltd = INR 900 Cr

4. PTC India’s investment in HPX = 22.62% of ~1000 Cr Mcap of HPX = INR 230 Cr

Sum of the Parts Valuation of PTC India comes out to be INR 8,380 Cr and the current Mcap is INR 5,840 Cr.

Conclusion:

We therefore believe there is ~40% upside in the stock price of PTC India Ltd and hence recommend a BUY rating on the stock with a Target Price of INR 283 per share.

Risks

• Major risks might arise from the market coupling not happening or any other governmental regulation coming in that would act as a barrier to the power exchange trading on the exchanges.

• Changes in asset volatility, or decrease in margins for trading might lead to closure of business of exchange trading.

2 Comments.

Nice Post.

Nice Post.