Gland Pharma: Overview, Share Price, and Fundamental Analysis

Pharmaceutical companies are considered defensive companies because their products’ demand is not significantly affected by economic conditions and is sustained by long-term illness patients across various phases of the business cycle. Let us evaluate one such pharma company that recently came out with its IPO and caught our attention due to the sharp fall in its share price since its listing.

Gland Pharma is promoted by Shanghai-based Fosun (Group), a Chinese conglomerate controlled by billionaire Guo Guangchang. Fosun acquired a 74 percent stake in Gland Pharma for about $1.1 billion in 2017. It bought the stake from US private equity investor KKR. On 8th August, all eyes turned to Gland Pharma as it reported a 41% rise in revenue in Q1 FY24 on a YoY basis. On that day, Gland Pharma’s share price went up 20%.

This article covers a brief overview of Gland Pharma, its history, management profile, business segments, Gland Pharma’s historical share price, and then moves on to the fundamental analysis of the company.

Gland Pharma Overview

Established in 1978, Gland Pharma is a generic injectables-focused company that sells its products in over 60 countries, including the USA, Canada, Australia, India, and the European continent.

It has evolved from being a contract manufacturer of liquid parenteral products to becoming the largest and fastest-growing contract development and manufacturing organization (CDMO) for generic injectables. Its product portfolio consists of sterile injectables, oncology, and ophthalmic segments and focuses on complex injectables, NCE-1s, first-to-file products, and 505(b)(2) filings.

Gland’s products are currently delivered via liquid vials, lyophilized vials, pre-filled syringes, ampoules, bags, and drops, and efforts are underway to augment additional manufacturing capabilities in complex injectables such as peptides, long-acting injectables, suspensions, and hormonal products. The company is also in the process of including new delivery systems, such as pens and cartridges, into its product portfolio.

It has eight manufacturing facilities, of which four are cGMP-compliant formulation facilities and four are active pharmaceutical ingredient manufacturing facilities. Additionally, the company has two state-of-the-art R&D facilities in Hyderabad and is staffed by nearly 350 qualified scientists.

Gland Pharma History

Here is a timeline of some of the key events in the history of Gland Pharma:

- 1978: Gland Pharma was founded by PVN Raju for manufacturing and marketing heparin injections for the Indian market.

- 1994: Gland Pharma Private Limited converts to a public limited company.

- 2007: Gland Pharma enters the US market with Ketorolac PFS

- 2011: Gland Pharma enters the Australian and New Zealand markets

- 2013: Gland Pharma enters the European markets

- 2017: A majority stake in Gland Pharma is acquired by Fosun Pharma

- 2019: Gland Pharma files its first product in China

- 2020: Gland Pharma is listed on NSE and BSE. Gland Pharma’s IPO price band was INR 1,490 to 1,500, and it listed at INR 1,710, a 14% premium on the IPO price

- 2023: Gland Pharma acquires Cenexi

Gland Pharma Management Profile

Gland Pharma is led by Srinivas Sadu, the Managing Director (MD) and Chief Executive Officer (CEO), and Yiu Kwan Stanley Lau, the Chairman and Independent director. Srinivas Sadu joined Gland Pharma as the General Manager of exports in 2000 and rose to the post of CEO in 2019.

KVGK Raju has been with Gland Pharma since its inception and serves as its Chief Technical Officer (CTO). Ravi Shekhar Mitra joined Gland Pharma as the Chief Financial Officer (CFO) in 2019.

Following is a list of all the Board of Directors in Gland Pharma:

- Yiu Kwan Stanley Lau – Chairman and Independent Director

- Srinivas Sadu – Managing Director and CEO

- Qiyu Chen – Non-executive Director

- Frank Yao – Non-executive Director

- Udo Johannes Vetter – Independent Director

- Essaji Goolam Vahanvati – Independent Director

- Satyanarayana Murthy Chavali – Independent Director

- Naina Lal Kidwai – Independent Director

- Dr Jia Ai Zhang – Non-executive Director

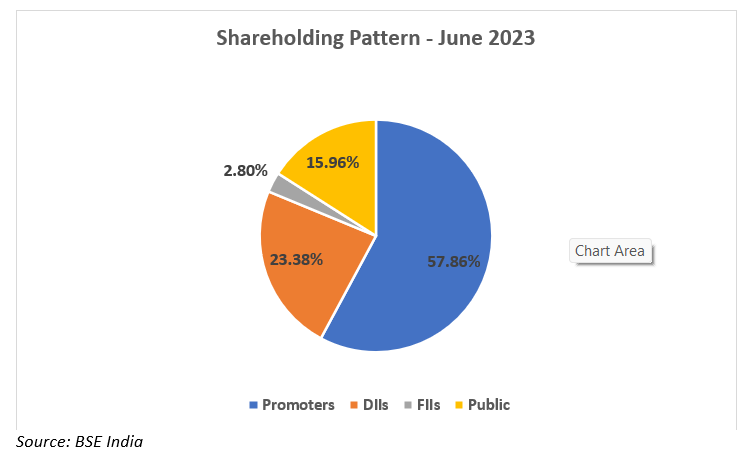

Gland Pharma Shareholding Pattern

Gland Pharma Business Segments

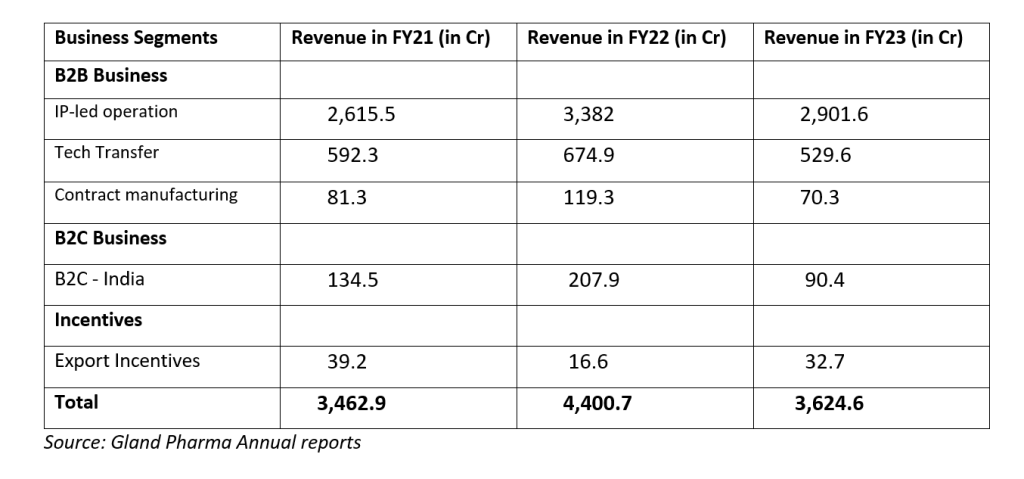

Gland Pharma’s primary business model is a business-to-business (B2B) model consisting of contract manufacturing, technology transfer, and intellectual property-led segments. Gland Pharma’s secondary business model is a business-to-consumer model (B2C) involving sales to customers such as hospitals.

Primary business model

Gland Pharma operates mainly in foreign markets through its primary business model. Following is the breakdown of revenue from various segments of the primary business model of Gland Pharma:

As a part of its intellectual property-led operation, Gland Pharma will undertake development, licensing, manufacturing, and supplying as a part of its agreement with pharmaceutical companies. This business can generate revenue through profit sharing, royalties, or selling price per unit dose of the product.

As a part of its technology transfer business, Gland Pharma will offer to conduct studies regarding elements method transfer and validation and execution of scale-up, and will support the customer with dossier compilation. Gland Pharma receives a selling price per unit dose of the product developed by the customer, royalties, and a technology transfer fee.

In the contract manufacturing model, Gland Pharma enters into loan and licence agreements with agreements to provide fill and finish services for already developed sterile injectables and receives manufacturing and packaging payments per unit manufactured. Here, Gland Pharma will retain the manufacturing rights during the term of the agreement.

Secondary business model

Gland Pharma’s secondary business model consists of a direct marketing operation in India for the sale of injectables to government facilities, nursing homes, and hospitals. In FY23, Gland Pharma earned revenue of INR 90.4 Cr from its secondary business model.

Gland Pharma Financials

Annual performance

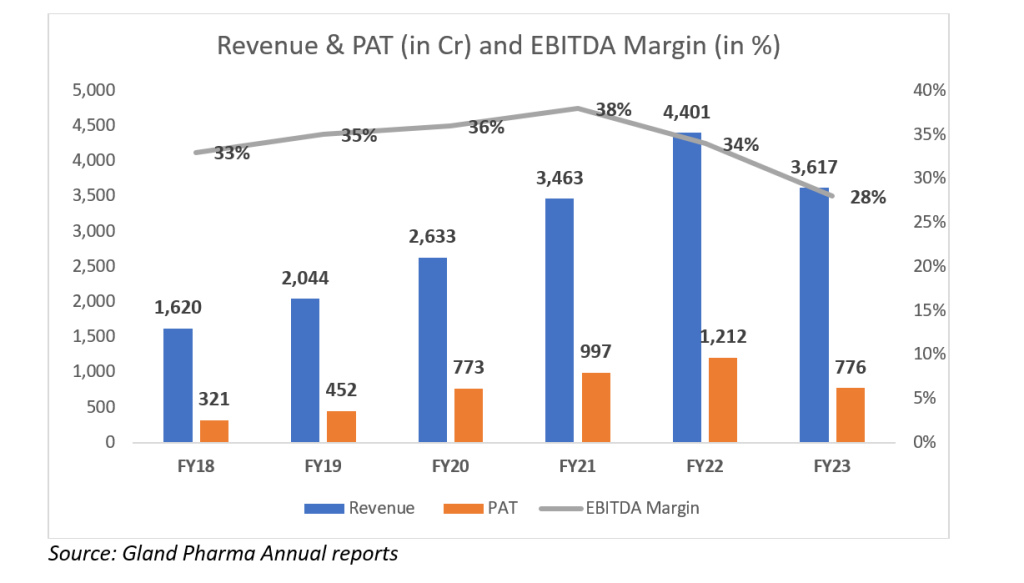

Over the last six financial years, Gland Pharma’s revenue from operations has more than doubled, having grown at a CAGR of 17.43%. Profits after taxes have grown at a CAGR of 19.31% during this time. The company has always maintained a low debt-to-equity ratio and is currently zero.

Gland Pharma’s performance over the years:

Recent developments

In FY23, the company endured a rough patch, with revenue from operations falling 17.81%. Gland Pharma’s EBITDA margin fell from 34% in FY22 to 28% in FY23. The worst quarter for Gland Pharma in FY23 was Q4, with profits after tax falling 35.97%.

The company notes that these subdued numbers are a result of inventory rationalisations in the US market, a higher base of FY22 because of COVID-related sales, and high price pressure with increased competition.

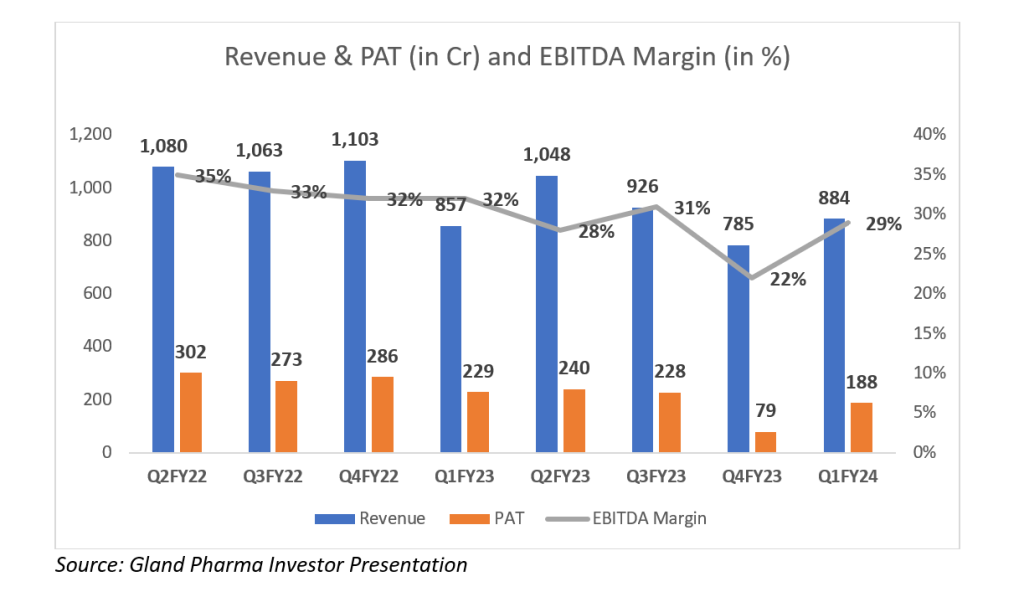

Quarterly performance

Gland Pharma posted revenue from operations of INR 884 Cr during Q1 FY24 compared to INR 785 Cr during Q4 FY23, an increase of 12.6 %.

On the profitability front, the company has posted a PAT of INR 188 Cr for Q1 FY24 as against the PAT of INR 79 Cr for Q4 FY23.

Gland Pharma’s Revenue, PAT, and EBITDA Margin over the last eight quarters:

Key financial ratios

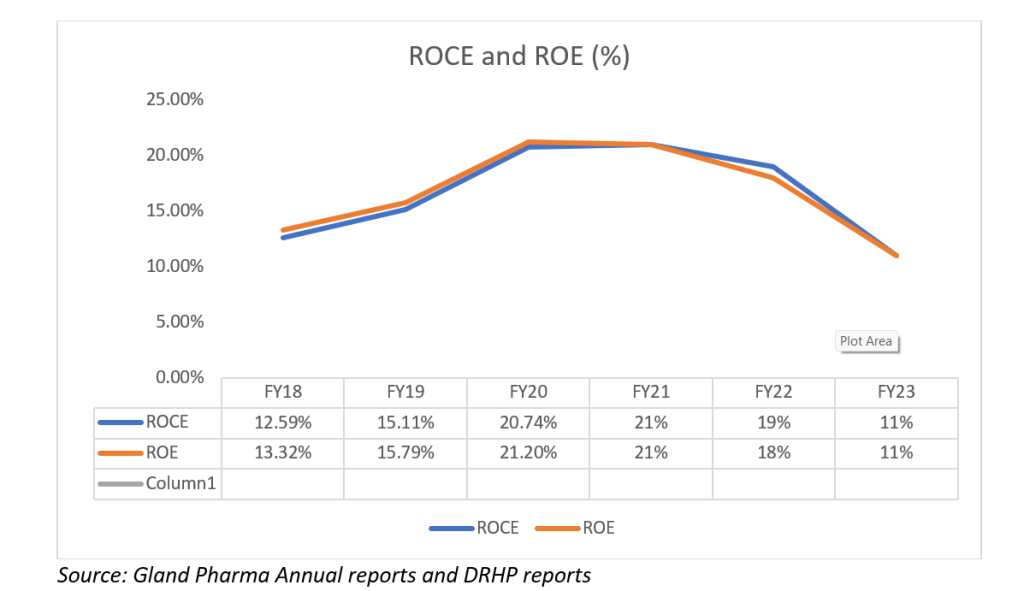

Gland Pharma’s ROCE and ROE performance over the years:

Gland Pharma Share Price Analysis

Gland Pharma was listed on the Indian Stock Exchange on 20 November 2020 at a price range between INR 1490 to 1500 per share. At the time of IPO, the market cap of Gland Pharma was INR 24,750 Cr ( assuming 1500 per share and 16.5 Cr equity shares).

On 12th August 2021, Gland Pharma reached its all-time high of ₹4,316.75. Since then, it had been falling until hitting its all-time low of ₹893.55 on 22nd May 2023. Since May 2023, Gland Pharma’s share price rose by more than 80%, largely due to a 41% increase in revenue in Q1 of FY24.

Beyond the basic financial statements

Here we look at some key details that might miss your eye:

Drop in major revenue generator:

A major component of Gland Pharma’s revenue is the abbreviated new drug applications (ANDA) filed by the company with its partners. In FY23 and FY22, this segment contributed 47% and 53%, respectively to the company’s revenue. But, in FY23, revenue from this segment dropped by 27%. This led to the company’s revenue falling 18% in FY23 as compared to FY22. Going forward, there is a need to keep track of this figure.

Boost to revenue from acquisition:

The Cenexi Group is a contract development and manufacturing organisation (CDMO) like Gland Pharma. It has expertise in narcotics, psychotropics, high-potency products and fill and finish work for biological products.

Cenexi generates 70% of its revenue from sterile and injectable products and has production capabilities for sterile liquids, non-sterile liquids and pastes, and solids. Its 4 manufacturing facilities are in France and Belgium.

In FY23, Gland Pharma closed the acquisition of Cenexi. This resulted in better-than-expected results for Q1FY24.

Manufacturing capabilities:

Gland Pharma’s eight manufacturing facilities include four finished formulation facilities and 4 API facilities. In FY23, Gland Pharma shut down its penem facility to expand capacity.

Formulation facilities consist of 28 production lines and have a capacity of 1,000 million units per year. The need for installing additional production lines due to altered product specifications is sidestepped by equipping formulation facilities with production flexibility.

The API facilities have a total capacity of 11,000 Kg per year and support 28 ANDAs. The API facilities focus on ensuring better control over the supply chain.

Gland Pharma Growth Potential:

One of the purposes of Gland Pharma’s IPO of issue size of ₹6,479.55 crore was to raise money for capital expenditure. In the last three financial years, Gland Pharma has spent ₹973.9 crore on capital expenditure for increasing API and formulation capacities, establishing a new research and development facility at Pashamylaram, and routine maintenance.

The next phase of Gland Pharma’s growth and expansion is inorganic growth, with the Cenexi acquisition being the first step. The acquisition is expected to have good synergy while increasing its presence in Europe.

Other possible benefits of the Cenexi acquisition:

- Imbibing know-how and development capabilities for solids and non-sterile liquids and pastes in addition to sterile injectables

- Establishing a presence in branded CDMO space and biologics

In Q1 FY24, Gland Pharma made its entry into the Chinese market with dexrazoxane and is expecting to launch 4 more products in the next 9 to 12 months. The company expects China’s pricing to be better than that in the US, its primary market.

Gland Pharma is also expected to benefit from having filed the first-to-file for a product with a US market size of around USD 170 million.

Key Risks

- Foreign currency risk: A 1% change in the USD-INR exchange rate would have caused an almost equal change in profits before tax for Gland Pharma. Hence, investors must keep an eye on the USD-INR exchange rate when investing in Gland Pharma.

- Drop in revenue from abbreviated new drug applications (ANDA): Partner ANDA contributes nearly 50% of the company’s revenue. However, in FY23, partner ANDA revenue fell by 27%.

- Chinese ownership: Due to the existing geopolitical tensions between India and China, Chinese companies are at risk of being caught up in policies aimed at curbing Chinese presence in India. This risk applies to Gland Pharma as its owner is a Chinese company.

Frequently asked questions

Who is the CEO of Gland Pharma?

Srinivas Sadu is the CEO of Gland Pharma. He is also the company’s managing director. He joined the company in 2000 as the general manager of exports and rose to the post of CEO in 2019.

Who owns Gland Pharma?

Gland Pharma is owned by Fosun Pharma Industrial, a Singaporean company holding 57.9% shares of the company.

Is Gland Pharma a debt-free company?

Yes. As per its annual report for FY23, Gland Pharma has zero long-term debt.

1 Comment.

I found your post to be well-structured and insightful. To delve deeper, click here.