Devyani International: Share Price and Fundamental Analysis

The ICRA expects quick-service restaurants to grow 20% to 25% in FY24 due to a rapid increase in number of stores. The demand for such restaurants is expected to be driven by rising disposable incomes and the preference for fast service, convenience, and hygiene.

Devyani International is a quick-service restaurant operator that has been aggressively expanding operations by opening new stores. Since its IPO 2 years ago, the company has almost doubled its number of stores.

Let us look at Devyani International’s history, management, business strategy, and financials and try to uncover the reasons behind Devyani International’s success and the growth potential the company holds.

Devyani International Overview

Devyani International is a company that operates chains of quick service restaurants (QSRs) such as KFC, Pizza Hut, and Costa Coffee. The company also has its own quick-service restaurant brand for South India called Vaango. The Food Street, the company’s food court brand, serves its quick service restaurants under one roof.

It operates in India, Nepal, and Nigeria. The company was incorporated in 1992, and in 1997, it signed a development agreement with PepsiCo Restaurants International (India) for opening Pizza Hut outlets in North India.

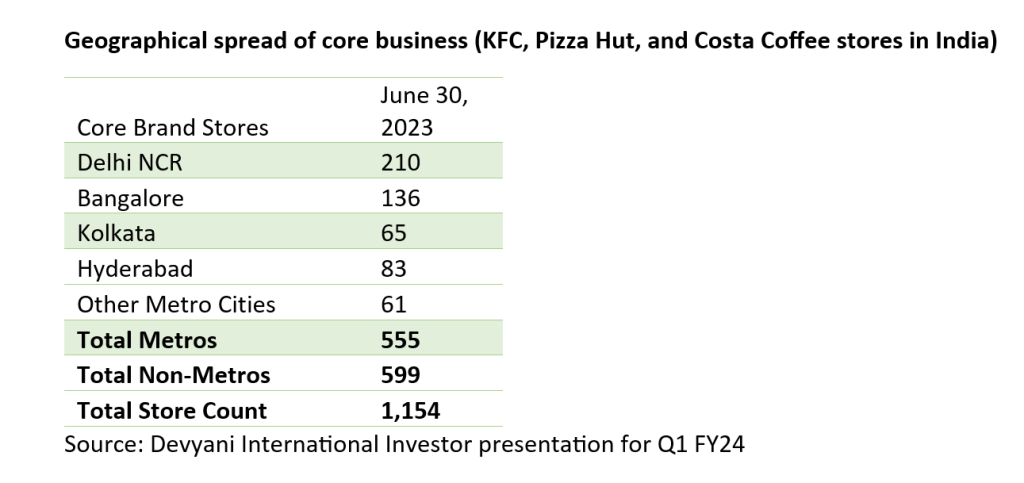

In India, the company has diversified geographically by having approximately a similar number of stores in metro and non-metro cities. The company operates more than a thousand stores in India itself and had 60 stores in Nigeria and Nepal at the end of Q1 FY24. Devyani International is a part of RJ Corp. Ravi Kant Jaipuria and Varun Jaipuria are the promoters of the company.

Devyani International History

Here is a timeline of some of the key events in the history of Devyani International:

- 1992: Devyani International gets incorporated.

- 1997: The company signed an agreement with PepsiCo Restaurants International (India) to open Pizza Hut outlets in North India.

- 2004: Speciality Restaurants Pvt Ltd, a subsidiary of the company, was merged into the company.

- 2010: The company opened its first KFC outlet in Nigeria.

- 2015: Duneam invested INR 400 crore in the company, and the company acquired Pizza Hut delivery outlets from Yum India in Western and Southern India.

- 2017: The company entered into an agreement to operate and maintain Hyderabad International Airport’s food court under the brand name ‘Food Street.’

- 2021: Yum India invested INR 230 crore in Devyani International.

- 2021: Devyani International gets listed on NSE and BSE. The company’s IPO price was INR 90, and on NSE, on listing day, it closed at INR 123.50, a 37% premium on its IPO price.

Devyani International Management Profile

Devyani International is led by Ravi Kant Jaipuria, the Promoter and Chairman, and Virag Joshi, the Whole-time Director, President, and Chief Executive Officer (CEO). Ravi Kant Jaipuria has over four decades of experience in managing the food, beverages, and dairy business. Virag Joshi has been a Director on Devyani International’s board since 2004 and has been a key strategist in the expansion of Pizza Hut, KFC, and Costa Coffee outlets. Manish Dawar is a Whole-time Director and Chief Financial Officer (CFO) and has wide experience across industry domains and geographical regions. Rahul Shinde is a Whole-time Director and the CEO of Yum! Brands business at Devyani International. Rajat Luthria is the CEO of the KFC business at Devyani International.

Board of Directors:

- Ravi Kant Jaipuria – Promoter and Non-executive Chairman

- Varun Jaipuria – Promoter and Non-executive Director

- Virag Joshi – Whole-time Director, President, and CEO

- Raj Gandhi – Non-executive Director

- Manish Dawar – Whole-time Director and CFO

- Dr Ravi Gupta – Independent Director

- Rashmi Dhariwal – Independent Director

- Dr Naresh Trehan – Independent Director

- Dr Girish Kumar Ahuja – Independent Director

- Pradeep Khushalchand Sardana – Independent Director

- Prashant Purker – Independent Director

- Rahul Suresh Shinde – Whole-time Director

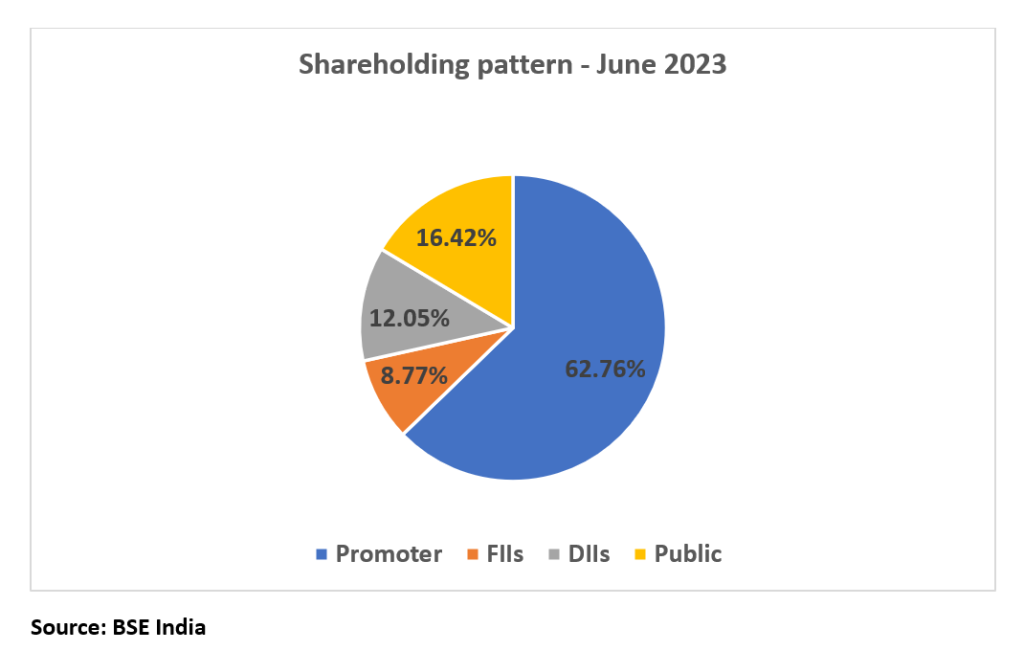

Devyani International Shareholding Pattern

Devyani International Business Segments

Devyani International’s operations can be divided into core business, international business, and other business. The company’s core business involves operating KFC, Pizza Hut, and Costa Coffee in India. The company’s international business involves operating KFC and Pizza Hut in Nigeria and Nepal. The company’s other business involves operations in the food and beverage (F&B) industry, such as its own brand, Vaango, and Food Street.

As you can see, the company has an approximately similar number of stores in metro and non-metro cities. The core business operations are spread across 242 cities, including Delhi NCR, Bangalore, Kolkata, and Hyderabad.

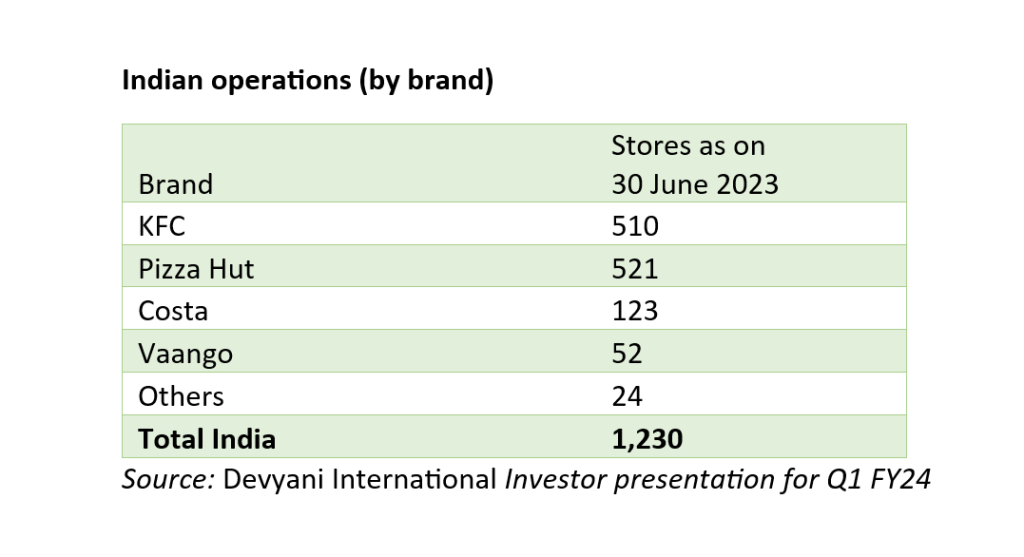

84% of Devyani International’s India stores are KFC and Pizza Hut. The company depends on its arrangements with Yum! Brands to operate KFC and Pizza Hut stores.

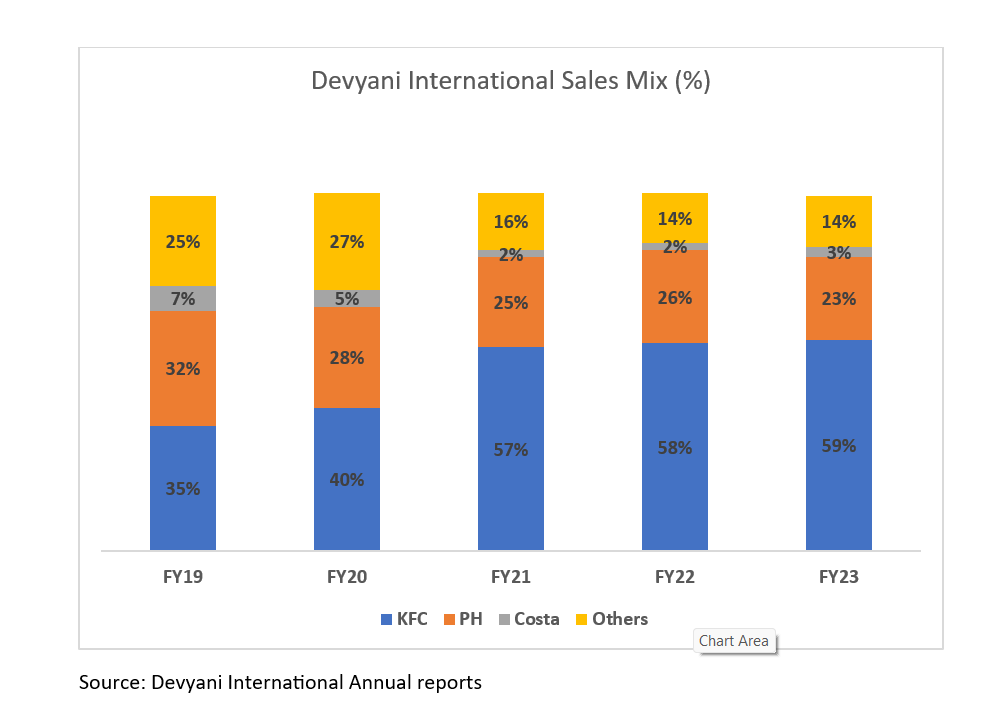

Here is the Sales mix of the core business and other businesses of Devyani International

In FY 23, the company generated 59% of its revenue from KFC, 23% from Pizza Hut, 3% from Costa coffee, and 14% from others. This indicates the company’s dependence on its core business segment. KFC and Pizza Hut are the major revenue generators in the core business, with KFC alone responsible for over 50% of the total revenue.

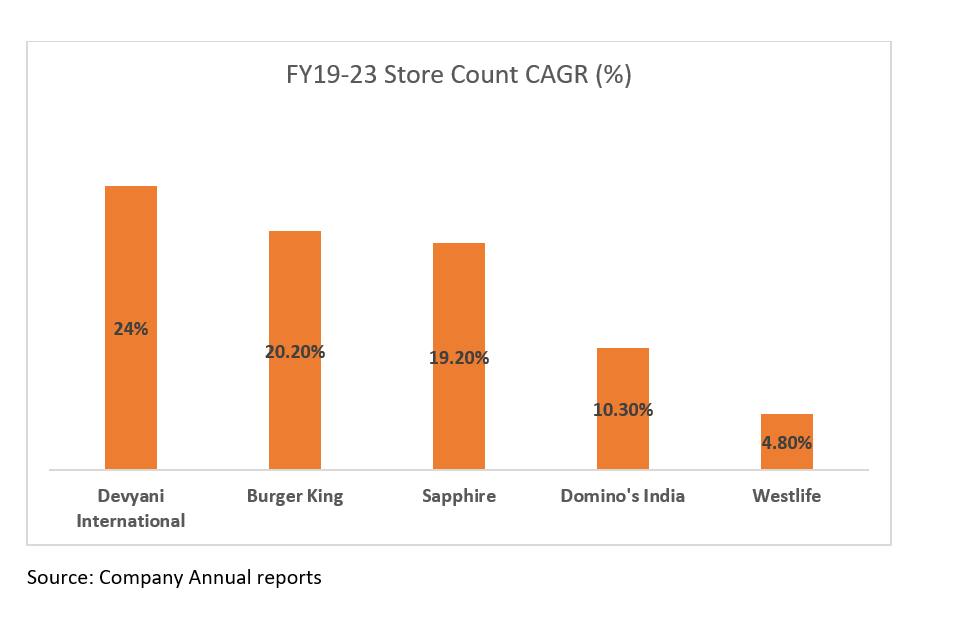

Expanding faster than peers

A comparison with other QSR chains shows that Devyani International has been aggressively expanding its stores over the last four years. Devyani International stores count CAGR from FY19-23 is 24%, which is the highest among the peers as shown in the chart below.

Devyani International Financials

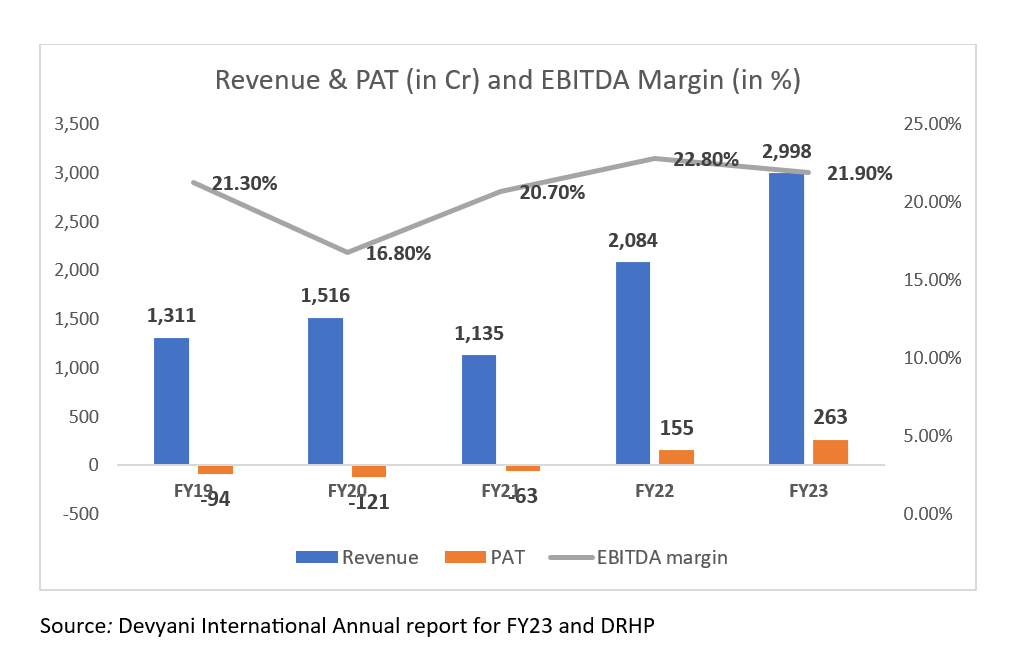

Over the past five financial years, Devyani International’s revenue from operations has grown at a CAGR of 22%, from INR 1,311 crore to INR 2,998 crore. The company maintained an EBITDA margin of above 20% in the period except FY20. While the company was making losses in FY19, FY20, and FY21, the company has started making profits since FY22. Since its IPO, the company has expanded from having 655 stores in India at the end of FY21 to having 1,230 stores in Q1 FY24. This can be the reason why the company started turning profits.

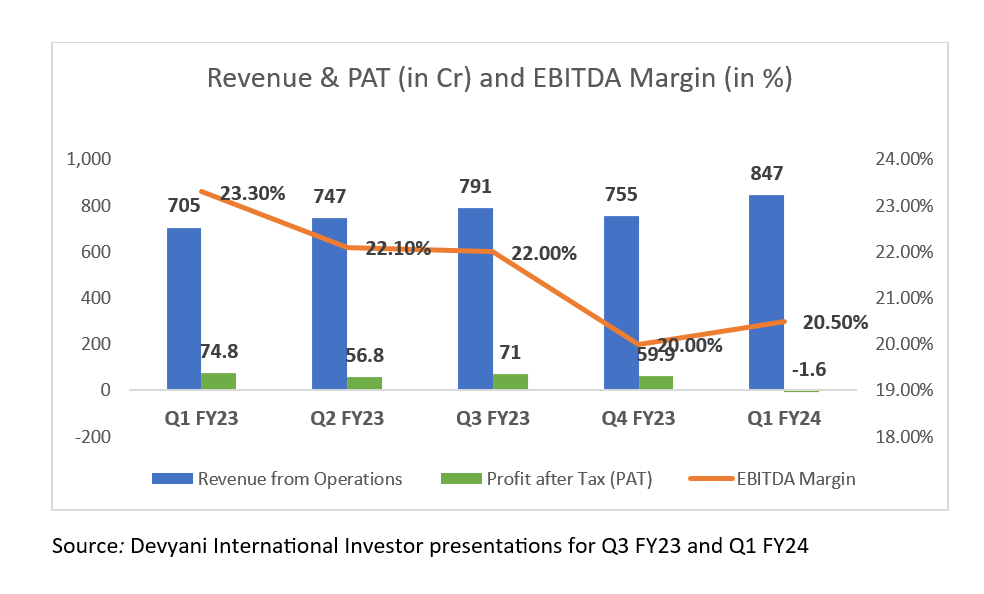

Over the last five quarters, Devyani International has been making a steady amount of revenue, except in Q1 FY24, when its revenue from operation jumped 20% on a year-on-year basis and 12% on a quarter-on-quarter basis. However, the company’s profits after tax were negative INR 1.6 crore as opposed to INR 59.9 crore and INR 74.8 crore in Q4 FY23 and Q1 FY23, respectively. This is mainly due to the devaluation of the currency earned through the Nigerian operations, but this did not have any cash impact.

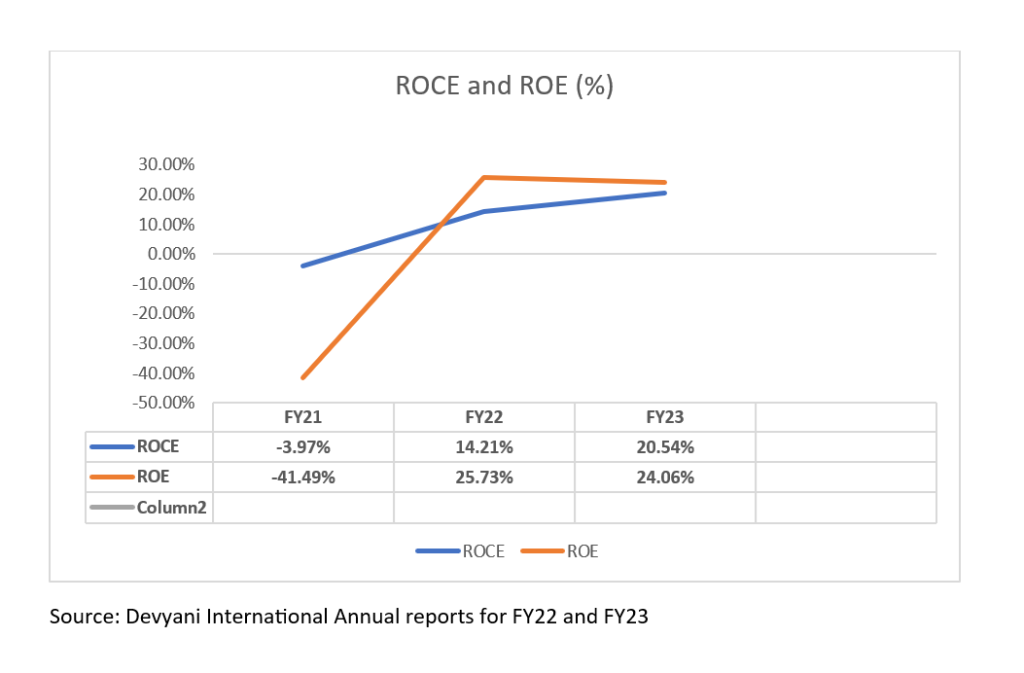

Key financial ratios

Devyani International Share Price Analysis

On its debut on NSE on 16th August 2021, Devyani International’s closing share price was INR 123.5, which was 37% over its IPO price. In 2 years, Devyani International’s share price has increased by 80% from INR 123.5 to INR 222(9 September 2023). The surge in the share price of Devyani International comes from the fact that in the last two years, the company’s number of stores has grown by 86% in absolute terms.

Devyani International Growth Potential

Expanding Brand Presence – DIL is keen on expanding its operations beyond metro and tier-one cities and establishing a strong foothold in high-potential markets across India. The Company is strategically expanding its store network of Core Brands to tap into the growing demand for organized players in the food services industry.

By 2026, Devyani International is targeting to have 2,000 stores. As of Q1 FY24, the company has a total of 1,290 stores. If the company can achieve its goal, its revenue from operations could almost double.

Some of the drivers of growth for the Indian quick service restaurants (QSRs) are a young demographic, rising per capita income, rapid urbanization, and expanding influence of food aggregators. 65% of the Indian population is under 35 years of age. From 2010 to 2022, India’s per capita GDP has almost Doubled to $2389. A rising per capita income suggests that more people would have the disposable income to eat out.

Food aggregator companies such as Zomato and Swiggy bring a lot of volume to restaurants. On New Year’s Eve of 2023, 5 lakh orders were placed on these apps. As India becomes more digitized and urbanized, food aggregator apps will have deeper penetration. This is expected to have a complimentary effect on quick service restaurants.

Key Risks

- Dependency on Yum! Brands: By the end of Q1 FY24, of Devyani International’s 1,290 stores, 1,091 of them were Pizza Hut and KFC outlets. Devyani International depends on its arrangements with Yum! Brands to continue operating these outlets. Thus, unless Devyani International diversifies, it will be dependent on Yum! Brands. Similarly, the company’s fate also depends on the reputation of its core brands, viz. Pizza Hut, KFC, Costa Coffee, and Vaango.

- High lease liabilities: Devyani International leases locations for its outlets for initial terms of 5 to 20 years. In these lease agreements, there are provisions for renewals of some of the leases, but the lessors might insist on higher rents. In FY23, lease liabilities formed close to 50% of Devyani International’s total liabilities.

- Demand slowdown due to external environment

Frequently asked questions

What does Devyani International do?

Devyani International operates more than a thousand quick service restaurants (QSRs) in India, Nepal, and Nigeria.

Who is Devyani International owned by?

Devyani International is owned by RJ Corp, which is owned by Ravi Jaipuria, an Indian billionaire who also owns Varun Beverages, PepsiCo’s biggest bottler outside the USA.

Is Devyani International a debt-free company?

Devyani International is not a completely debt-free company, but its debt-equity ratio at the end of FY23 was 0.08.

Is Devyani International profitable?

Yes, Devyani International’s profit for the year ended on 31st March 2023 was INR 263 crore.

1 Comment.

Valuable info. Fortunate me I found your site byy chance, and I’m

stunned why this coincidence didd not took pace earlier!

I bookmarked it. http://Boyarka-inform.com/