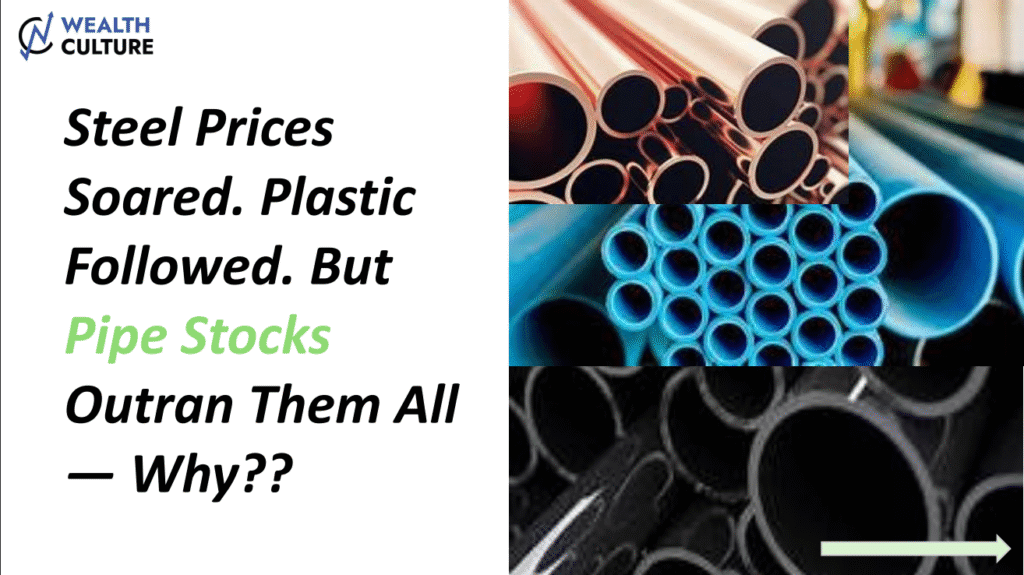

Steel soared. PVC tripled. But Pipe stocks ran even harder - and didn't fall back. Why?

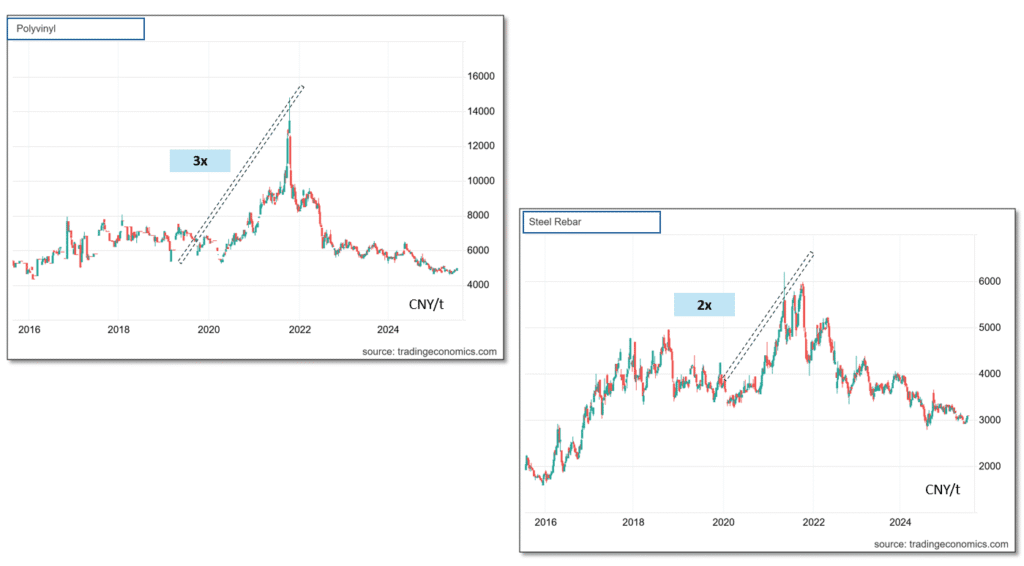

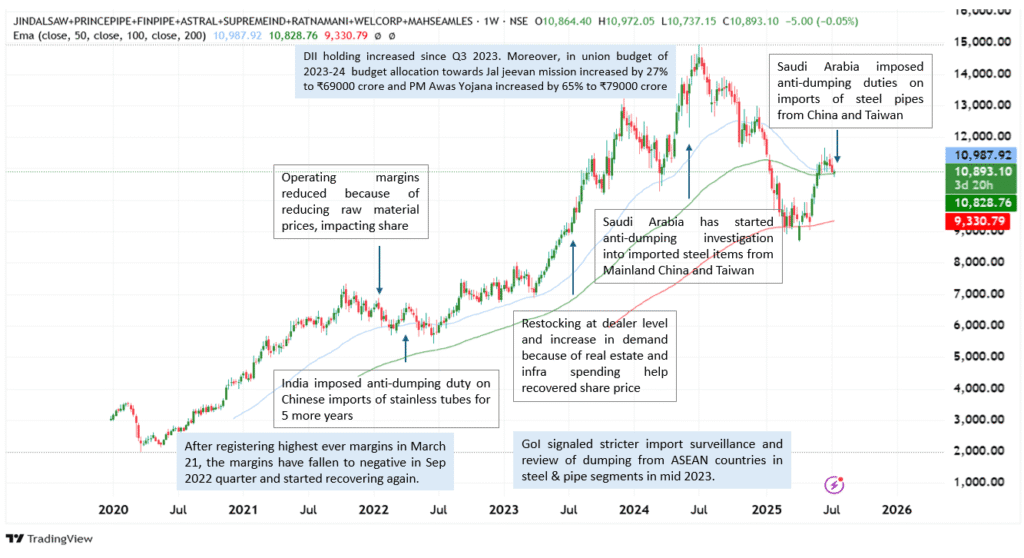

From 2020 to 2022, raw material prices witnessed an unprecedented surge. PVC prices rose nearly 3x, and steel rebar prices doubled, driving sharp gains in realisations and EBITDA margins for pipe manufacturers across the value chain — including steel pipes (DI, seamless, SAW, ERW), stainless steel tubes, and plastic pipes (UPVC, CPVC, PPR, OPVC).

Margins did fall — the sector saw peak margins in March 2021, only to report negative margins by Sep 2022 in several cases. But a few strong tailwinds kicked in:

👉 Restocking by dealers as input prices stabilised

👉 Strong demand recovery from real estate and infra segments

👉 And most critically, government budget support:

Jal Jeevan Mission allocation was increased by 27% to ₹69,000 crore

PM Awas Yojana saw a 65% jump to ₹79,000 crore

On the trade front, protectionist moves provided stability. India extended anti-dumping duties on Chinese stainless steel tubes for five more years. Meanwhile, Saudi Arabia imposed anti-dumping duties on Chinese and Taiwanese steel pipe imports, giving Indian exporters like Ratnamani, Welspun, Jindal SAW a tailwind. Back home, the Indian government initiated surveillance on ASEAN steel imports from mid-2023.

However, after 2022, while raw material prices corrected sharply, pipe stock prices remained elevated — and in most cases, kept rising. The obvious question: What sustained this rally?

Stock Price ran up continued even post 2022….

Institutional interest also picked up. DII holding rose starting Q3 FY23, showing renewed confidence in the sector’s long-term growth story.

So while commodity prices corrected, volume visibility, policy protection, and structural demand helped these companies avoid a price collapse till Q2 FY25.

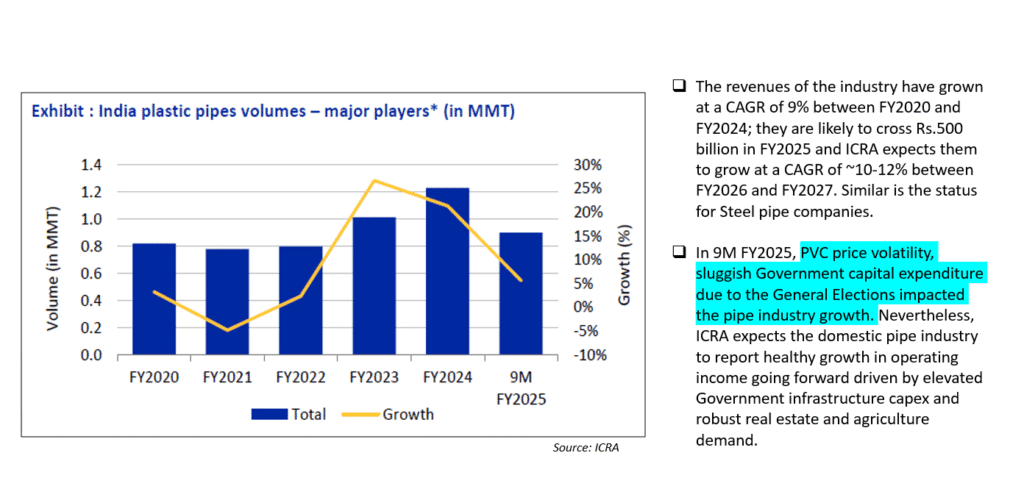

Current Status (FY25 was dull)….

What began as a raw material-driven margin play is now evolving into a capex-backed, export-leveraged growth story.

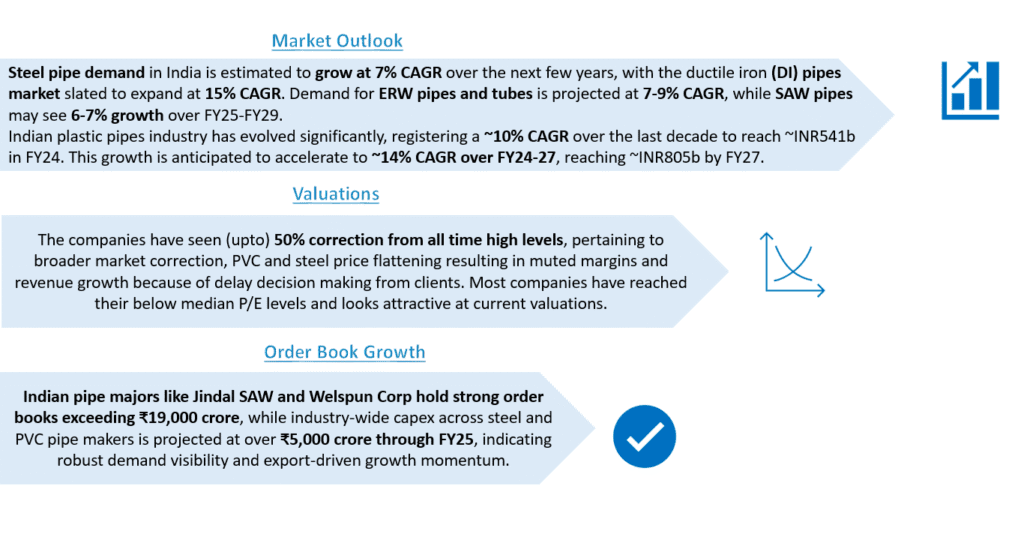

Future Outlook?

While FY25 began with revenue and margin contraction, early Q1 FY26 results show clear signs of revival, with management commentary from key players like Welspun Corp, Jindal SAW, and APL Apollo guiding for 20–30% revenue growth in FY26, aided by improving project execution and margin normalization. According to Crisil, domestic plastic pipe demand is expected to grow at 10–12% CAGR, with strong traction in DI and OPVC segments due to sustained investments in urban water infra. As raw material prices stabilize and execution ramps up, improving order book visibility, sector consolidation, and more attractive valuations post-correction could set the stage for a stronger rerating cycle across the pipe value chain in FY26–27.

What began as a raw material-driven margin play is now evolving into a capex-backed, export-leveraged growth story.