While Indian IT companies reported decent revenue figures for Q1 FY26, markets haven’t rewarded them. Why? Because forward-looking indicators — deal flows, client budgets, and macro signals — aren’t yet supportive. In this post, we decode exactly that.

Nifty IT vs Nifty Index

So here’s what happened once IT companies started announcing its Q1 FY26 results since mid July – 📉 The Nifty IT Index has corrected nearly 10% since the start of the result season, while the Nifty itself is down less than 2%. Companies like Coforge and Persistent has dropped by ~9% each in post result trading session despite delivering “better than expected results”.

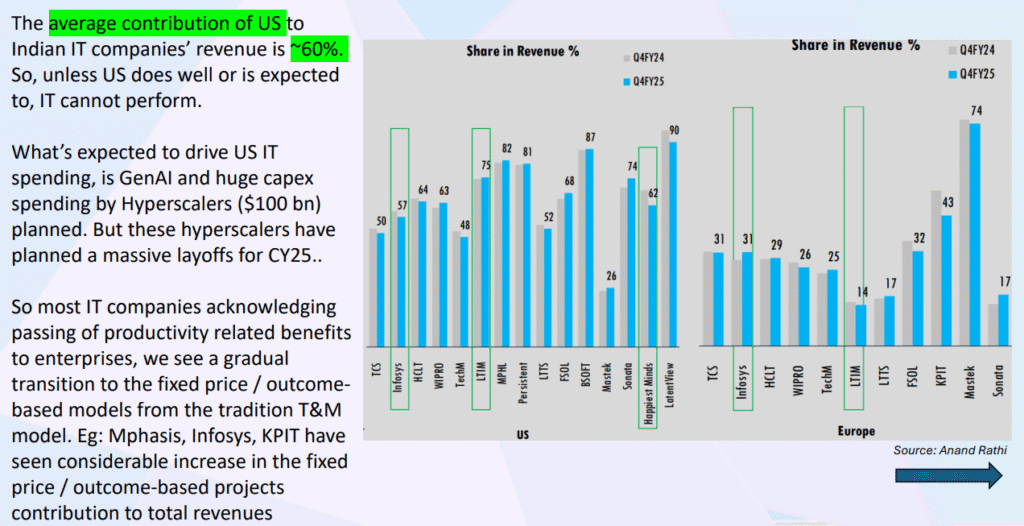

This suggests that the correction in IT isn’t just about recent results — it’s driven by expectations of muted growth ahead, soft order inflows, and rising caution in client spending (especially in the US, which contributes ~60% to Indian IT revenues).

Large Cap IT companies

In large cap IT, LTI mindtree seems to be an outperformer, that is because company has seen a drop already in Q4 FY25 driven by delay orders from clients. Other than that, BFSI has been driving the growth for most of the companies when it comes to new order book.

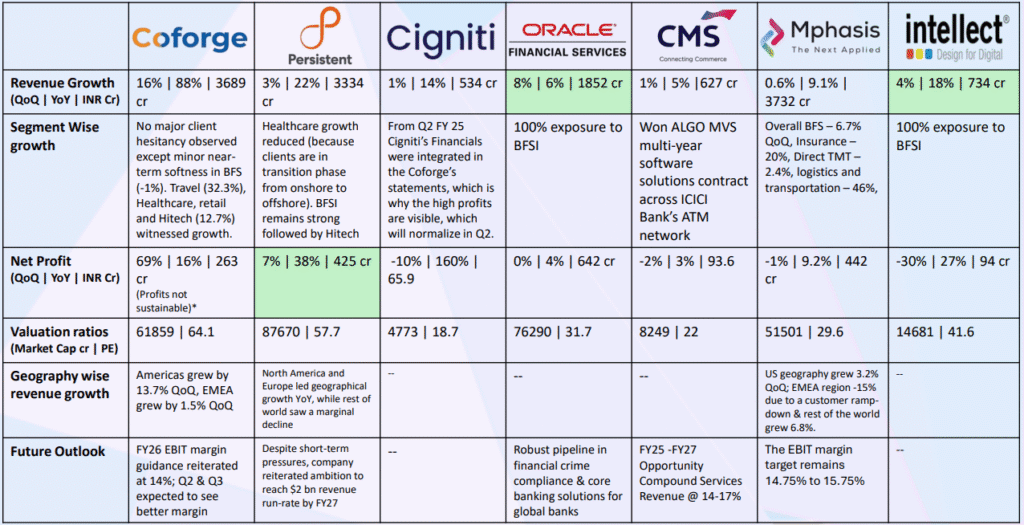

Mid Cap IT companies

As for, Mid cap IT companies, valuations are more expensive that what we witnessed in Large cap IT companies. Net profit growth for Coforge comes from acquisition of Cigniti and consolidation of both their balance sheets. These profits are not sustainable. Here as well companies operating in pure BFSI segment are better paid off as compared to others.

Our Observation

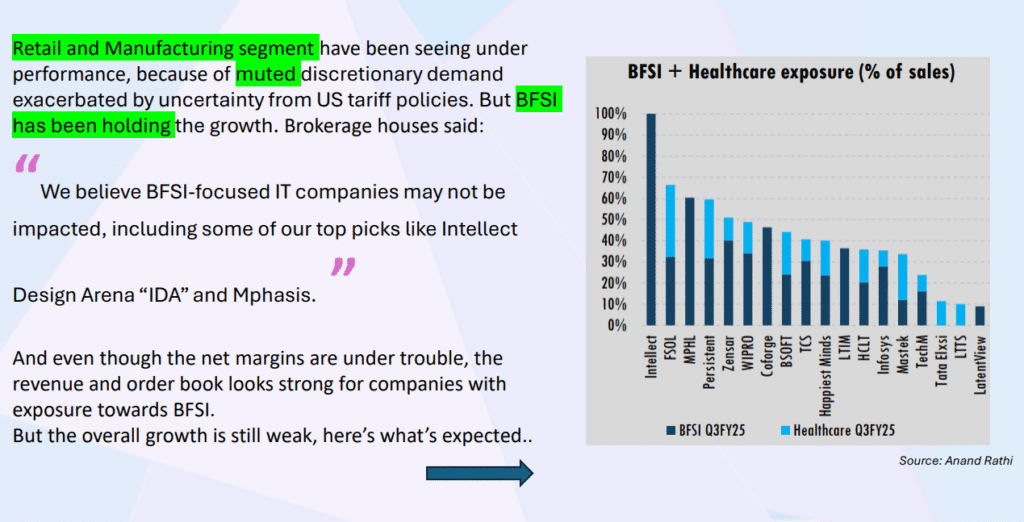

Segments like Retail, Manufacturing, and Healthcare have underperformed due to weak discretionary demand and cautious spending.

However, BFSI continues to hold the fort across most large and midcap IT players. Firms with higher BFSI exposure, such as Intellect Design Arena (IDA) and Mphasis, are relatively better positioned to navigate the slowdown.

Accenture (This is what global giant is expecting)

North America continues to pose challenges across verticals, while Europe and APAC have shown mild resilience.

Even global bellwethers like Accenture posted strong topline ($17.7B revenue and $1.5B in GenAI bookings) — but still saw their stock slide due to weak deal wins and a 9% fall in outsourcing revenues. The signal? Spending intent is cautious.

Outlook for Indian IT Companies

Hyperscalers (AWS, Azure, GCP) have announced $100B+ in capex plans, largely for data centers and AI infra.

However, this optimism is clouded by planned layoffs in CY25, and many IT vendors are seeing project delays. So while GenAI is promising, deal monetization is slower than expected.

Firms are now shifting from the traditional Time & Material (T&M) model to fixed-price and outcome-based contracts.

Companies like Infosys, Mphasis, and KPIT have reported a rising share of such projects. While this improves efficiency and long-term visibility, it often delays near-term revenue recognition — impacting QoQ growth.

Valuations & Outlook

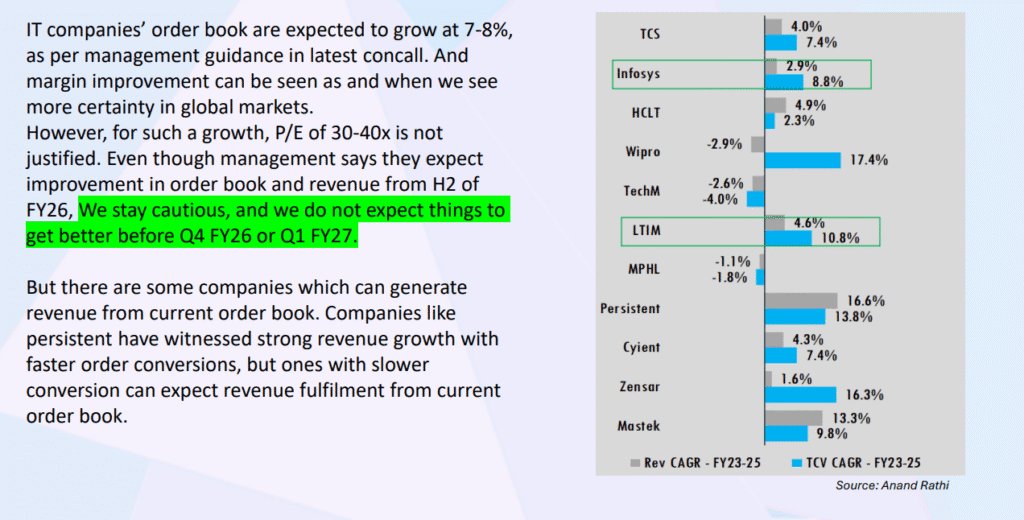

Most companies guided for 7–8% order book growth, but management tone has turned more guarded.

The earlier narrative of a recovery from H2 FY26 is weakening, with deal conversion cycles elongating. Firms like Persistent are exceptions, showing strong revenue conversion, but that’s not the norm.

Moreover, P/E multiples of 30–40x were not justifiable when order growth is sub-10%. However, valuations have now corrected meaningfully, with the Nifty IT index dropping ~10% in a matter of weeks. Markets are gradually re-pricing expectations in line with slower revenue visibility.

Indian IT is undergoing a strategic shift — toward new tech (GenAI), new pricing models, and cautious clients. This means revenue visibility is lower, cycles are longer, and investor expectations must recalibrate. Selectivity matters more than ever.