Clean Science and Technology: Share Price and Fundamental Analysis

Chemicals are essential for producing a variety of goods, including FMCG, textiles, pharmaceuticals, industrial goods, automobiles, and agrochemicals. This allows chemical manufacturers to diversify their customer base across industries and geographies.

Clean Science and Technology is one of the leading chemical manufacturing companies that produces FMCG, pharma and agro intermediates, and performance chemicals. It has a diverse clientele across different geographic regions.

Let’s examine Clean Science and Technology’s overview, history, management profile, and business segments to understand its impact on the share price.

Clean Science and Technology Overview

Clean Science and Technology is a company involved in manufacturing specialty chemicals. It manufactures FMCG chemicals, performance chemicals, and pharma and agro intermediates. Its products include Butylated Hydroxy Anisole (BHA), Monomethyl Ether of Hydroquinone (MEHQ), Guaiacol, 4-Methoxy Acetophenone (4MAP), Dicyclohexylcarbodiimide (DCC), Ascorbyl Palmitate (AP), and Anisole.

The company’s products are used as inhibitors, key starting level materials, or additives by its customers for products sold in regulated markets. The company’s production processes either have zero liquid discharge or release only water as discharge. The company’s manufacturing units are leased from MIDC in Pune. The company has a team of 90+ scientists, four Independent R&D labs, and three manufacturing units. By the end of FY23, the company’s products were sold in 35+ countries across Asia, North America, South America, and Europe. The Company has more than 500+ customers worldwide and employs over 1,300+ people. The company generates 72% of its revenue from exports.

Clean Science and Technology History

Here is a timeline of critical events in Clean Science and Technology:

2003: Clean Science and Technology was incorporated as Sri Distikemi Pvt. Ltd

2006: The Company changed its name to Clean Science and Technology

2009: The Company started manufacturing Monomethyl Ether of Hydroquinone (MEHQ) and Guaiacol

2011: The Company started manufacturing 4-methoxy Acetophenone (4MAP)

2014: The company started manufacturing Butylated Hydroxy Anisole (BHA)

2017: Anisole was commercialized using liquid-phase technology

2019: The Company started manufacturing Ascorbyl Palmitate (AP)

2021: Clean Science and Technology was listed on NSE and BSE

2021: The Company developed key products in the Hindered Amine Light Stabilisers (HALS) series

2022: The Company started commercializing para benzoquinone (PBQ) and Tertbutylhydroquinone (TBHQ)

Clean Science and Technology Management Profile

Clean Science and Technology is led by Pradeep Rathi, the Chairperson and Non-Executive Director, and Ashok Boob, the Managing Director (MD) and one of the promoters. Pradeep Rathi did his MS in chemical engineering from MIT, USA, and his MBA from Columbia University, USA. Ashok Boob has more than 25 years of experience in the chemical industry, had worked as an executive director at Mangalam Drugs and Organics in 2004, and is currently responsible for engineering, production, finance, and project implementation at Clean Science and Technology. In February 2023, Sanjay Parnerkar was appointed the company’s Chief financial officer (CFO).

Board of Directors:

- Pradeep Rathi – Chairperson and Non-Executive Director

- Ashok Boob – Managing Director (MD)

- Sanjay Kothari – Non-Executive Director

- Ganapati Yadav – Non-Executive Independent Director

- Keval Doshi – Non-Executive Independent Director

- Madhu Dubhashi – Non-Executive Independent Director

- Krishnakumar Boob – Promoter and Executive Director

- Siddhartha Sikchi – Promoter and Executive Director

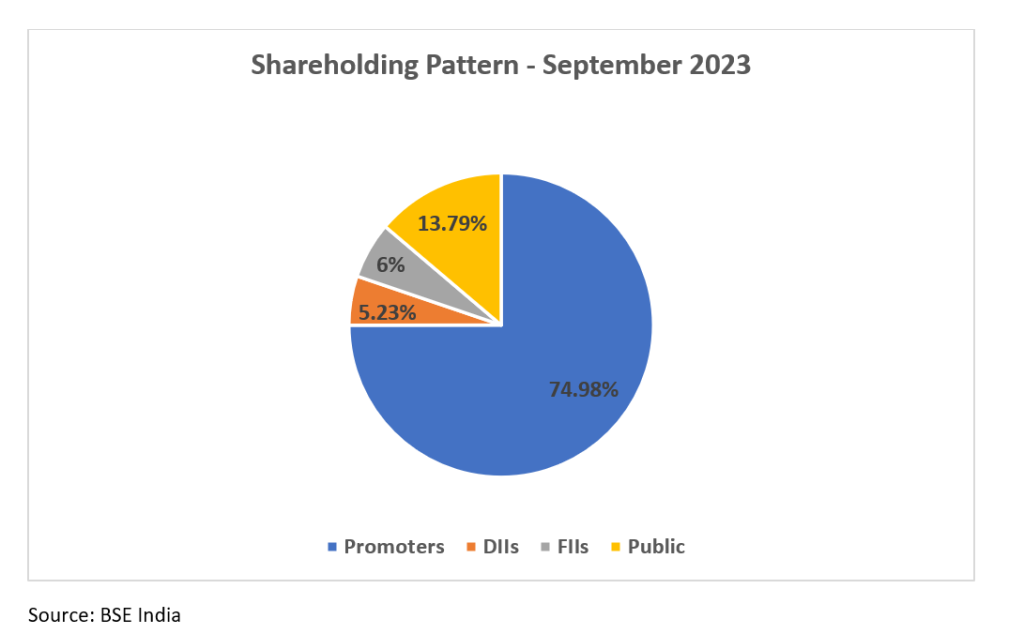

Clean Science and Technology Shareholding Pattern

Clean Science and Technology Business Segments

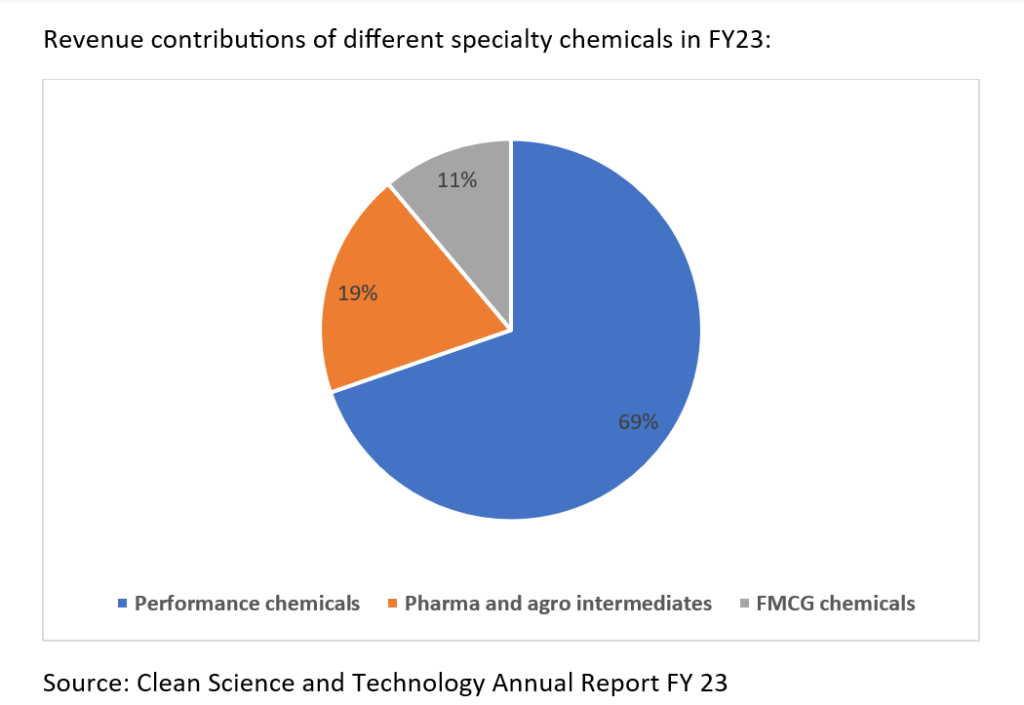

Clean Science and Technology is a company that manufactures specialty chemicals of three categories:

- Performance Chemicals

- Pharma and Agro Intermediates

- FMCG Chemicals

Monomethyl Ether of Hydroquinone (MEHQ), Butylated Hydroxy Anisole (BHA), Hindered Amine Light Stabilisers (HALS) series, Tertiary Butyl Hydroquinone (TBHQ), and Ascorbyl Palmitate (AP) are the performance chemicals in the company’s portfolio. These chemicals are used in the production of acrylic fibers, inks, paints, cosmetics, infant food formulations, edible oils, and in sectors such as automotive and construction.

Guaiacol, Dicyclohexyl Carbodiimide (DCC), and Para Benzoquinone (p-BQ) are the pharma and agro intermediates in the company’s portfolio. These chemicals are used as key starting agents in active pharmaceutical ingredients (APIs), the synthesis of food ingredients, the production of herbicides and fungicides, and the synthesis of amides, esters, and anhydrides.

4-Methoxy Acetophenone (4-MAP) and Anisole are the FMCG chemicals in the company’s portfolio. 4-MAP is used to manufacture cosmetic additives such as UVA filters in sunscreen, food flavorings, and cigarette additives. Anisole is used in the production of pesticides, fragrances, perfumes, and flavours.

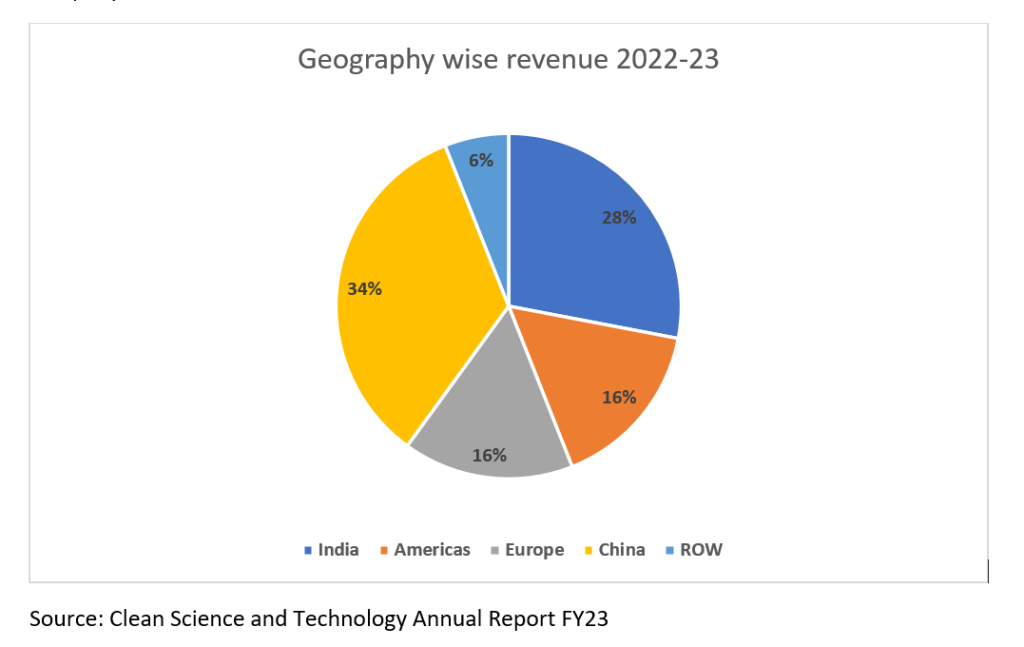

The company has customers across 35 countries from Asia, North America, South America, and Europe. In FY23, 34% of the revenue came from China, and 28% came from India.

Clean Science and Technology Financials

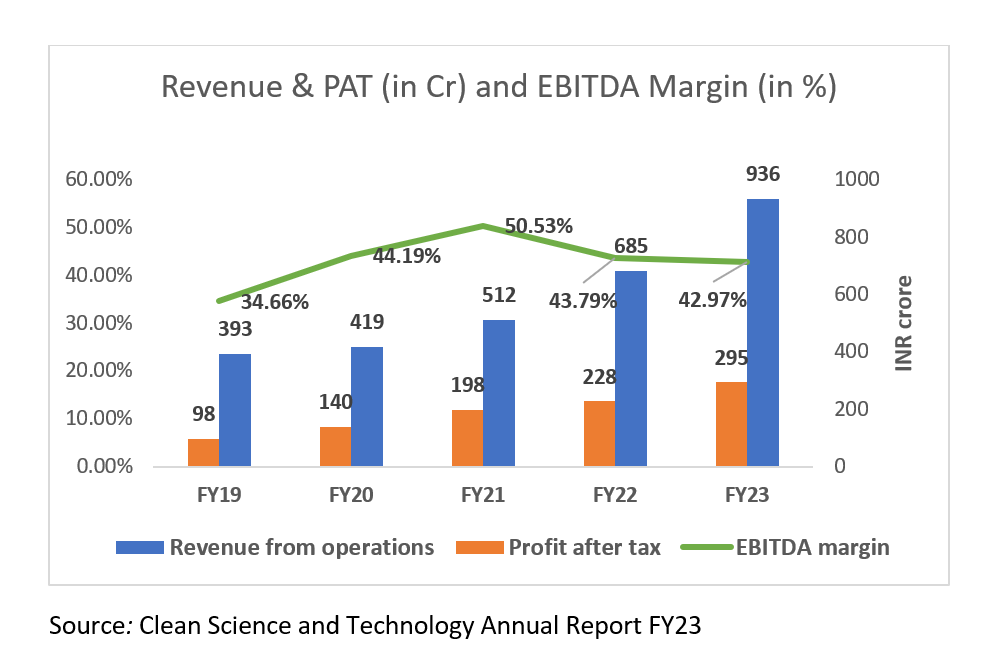

Over the past five years, Clean Science and Technology has achieved the remarkable feat of almost tripling its annual revenue. In the fiscal year of 2019, the company earned INR 393 crore in revenue, which grew at a Compound Annual Growth Rate (CAGR) of 24.23% over the last four years, resulting in INR 936 crore in revenue in FY23. Following FY19, the company was able to maintain an EBITDA margin of over 40%. Additionally, over the last four years, the company’s profit after tax has grown at a CAGR of 31.72%, resulting in INR 295 crore in profit in FY23.

Clean Science and Technology performance over the last five years:

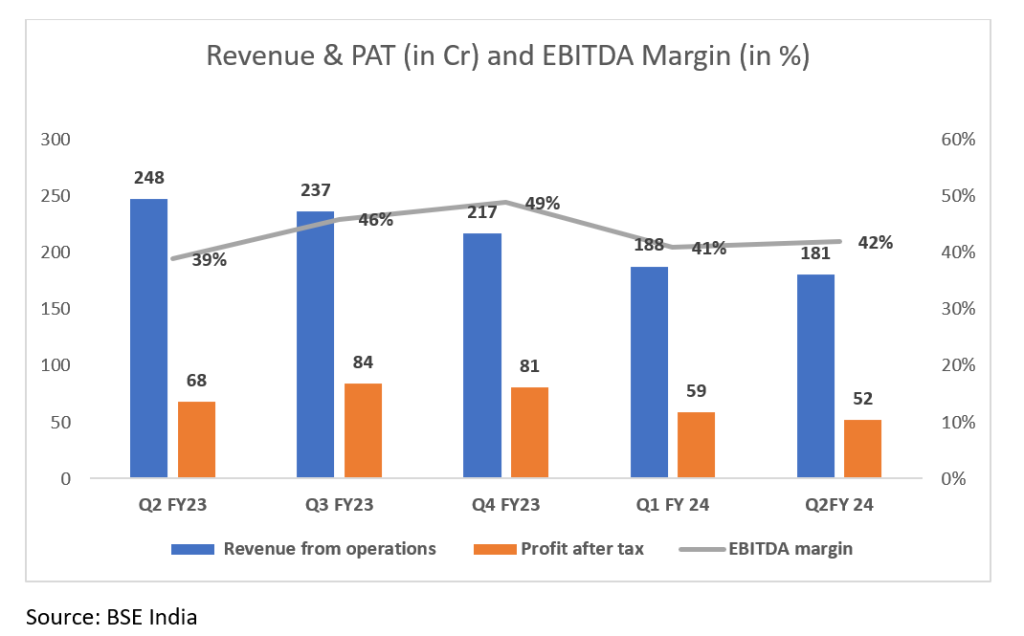

Consolidated performance over the last five quarters

Over the last five quarters, the company has maintained an EBITDA margin close to or over 40%. However, after the company’s revenue peaked in Q2 FY23, it has been gradually falling. The company’s revenue in Q2 FY24 fell 27% on a year-on-year basis. This drop in revenue can be attributed to a drop in overall demand, high levels of inventory with clients and pricing pressure from China.

Key financial ratios

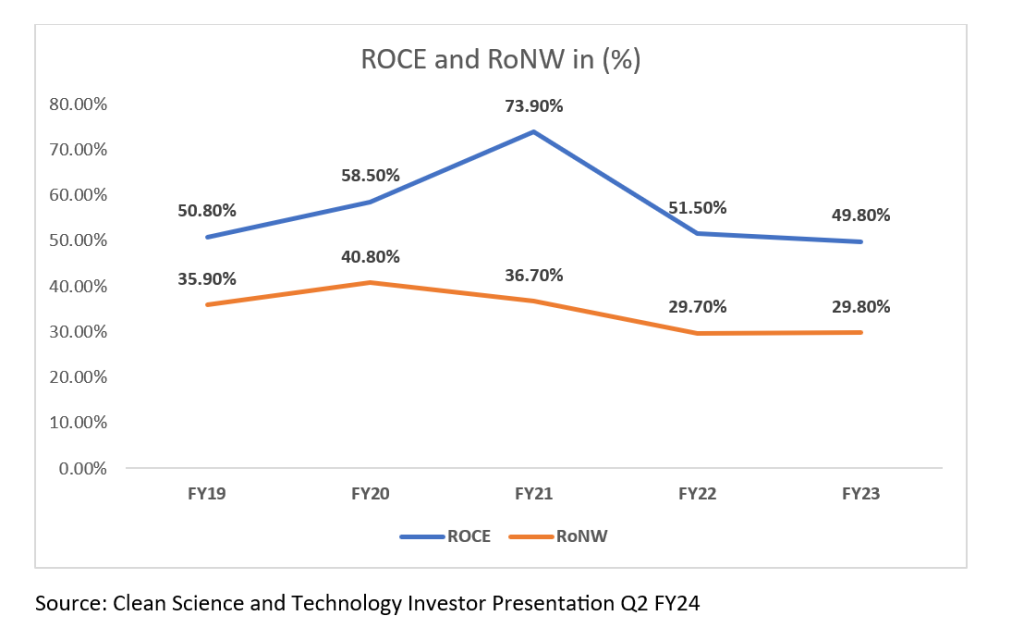

Clean Science has delivered an ROCE of over 50% over the last five years. That’s a fantastic return, and not only that, but it outpaces the average of 14% earned by companies in a similar industry. There are very few specialty chemical companies that can deliver such performance on a consistent basis across different cycles.

Geography-wise revenue

Clean Science is quite diversified in terms of its geographical exposure and it is fascinating to see 34% of the revenue from China, which by itself is a low cost major chemicals manufacturer. This proves that the company has capabilities that cannot be replicated easily and hence can be called a speciality chemicals company in the true sense.

Clean Science and Technology Share Price Analysis

Clean Science and Technology’s IPO price band was INR 880 to INR 900, and it listed at INR 1,583, a 76% premium on the IPO price. Then, the company’s share price rallied to a peak on 4 January 2022. This rise in share price can be attributed to Q2 FY23 earnings results that showed growth of 62% in revenue, 42% in EBITDA, and 26% in profits after tax. The company’s share price has since corrected close to its listing price on account of falling revenue in quarters after Q2 FY23. The drop in revenue can be attributed to global macroeconomic conditions.

Beyond the basic financial statements

Here we look at some key details that might miss your eye:

Manufacturing facilities on leased premises from MIDC

During the year, the Company made an additional INR 650 crore equity investment in Clean Fino-Chem Limited (CFCL), a Wholly-owned Subsidiary, to establish a manufacturing facility. CFCL acquired a 33.17-acre land on lease from MIDC Kurkumbh, Tal. Daund, Dist. Pune to set up a state-of-the-art facility to manufacture specialty chemicals, including the HALS series.

Global leader in manufacturing

Clean Science and Technology is number one in the world in manufacturing Monomethyl Ether of Hydroquinone (MEHQ), Butylated Hydroxy Anisole (BHA), and Ascorbyl Palmitate (AP). The company is number one in manufacturing the HALS series in India. It is also number two worldwide and India in manufacturing Tertiary Butyl Hydroquinone (TBHQ). Additionally, these products are demanded by companies from various industries. Thus, Clean Science and Technology has low dependence on any single industry while capturing the leadership position in market share.

Focus on R&D

Clean Science and Technology is actively engaged in research and development activities with a strong pipeline of 8-10 new molecules across different chemistries at any given time. The primary objective is to expand the product portfolio and offer a wide range of solutions for diverse applications such as pharmaceuticals, food, paints, antioxidants, stabilisers, and more.

HALS Series

Clean Science and Technology was the first company in India to develop and manufacture the Hindered Amine Light Stabilisers (HALS) series. This product is used as a stabilizer in various polymers used in industries like automotive, industrials, agriculture, construction, paints, and pigments. HALS series has a global market size of USD 1 billion and is registering a CAGR of 10%. The company seeks to become a significant player in this segment through its subsidiary, Clean Fino-Chem.

Clean Science and Technology Growth Potential

As of 2021, China was the world leader in chemicals by a humongous margin, followed by the European Union and the USA. In 2021, China’s chemical sales amounted to EUR 1,729 billion, while the second largest seller, the EU, had sales worth EUR 594 billion. However, China is experiencing an economic slowdown amid increasing state intervention in the private sector and crackdowns in various industries. Dependence on Chinese exports is a significant concern for all industries worldwide amid uncertainties surrounding the Chinese economy. Additionally, production costs have been rising in Europe due to energy and commodity costs.

This represents an opportunity for leaders like Clean Science and Technology to capture a greater market share and diversify their product portfolio.

One of Clean Science and Technology’s strengths is that its development and manufacturing processes have zero liquid discharge, and most of the solid waste is reused and recycled. Such practices have enabled the company to get certified as ‘GreenCo Silver Rating’ by the Confederation of Indian Industry.

As water pollution and waste management become a priority for societies, green chemistry, i.e., sustainable production of chemicals, will be demanded. Clean Science and Technology can be expected to have a head start in this regard.

Key risks

- Dependence on the Chinese market: In FY23, 34% of the company’s revenue came from China. Due to the existing geopolitical tensions between India and China, there is a risk of the company being caught up in trade wars or worse situations.

- Raw material risk: Clean Science and Technology’s manufacturing process requires various commodities as raw materials for producing its specialty chemicals. So, the company is exposed to volatility in the price of raw materials. Rising raw material prices might erode the company’s high EBITDA margin.

- Regulatory Risk: Clean Science and Technology must obtain, renew, and maintain permits and licenses for its operations. Any delay may affect the company. It maintains a compliance checklist, monitors it closely, and ensures compliance through regular audits.

Frequently asked questions

What does Clean Science and Technology do?

Clean Science and Technology is involved in the manufacturing of specialty chemicals.

Who is the CEO of Clean Science and Technology?

Clean Science and Technology does not have a Chief Executive Officer (CEO). The company’s managing director (MD) is Ashok Boob.

What is the Face value of Clean Science and Technology?

As of 5th Dec 2023, the face value of Clean Science and Technology is INR 1 per share.