The Indian hospitality sector has seen a strong rebound post-COVID, with revenue growth and profitability metrics returning to or exceeding pre-pandemic levels. However, as we analyze the financial and operational trends of six major listed hotel companies, a more cautious picture emerges.

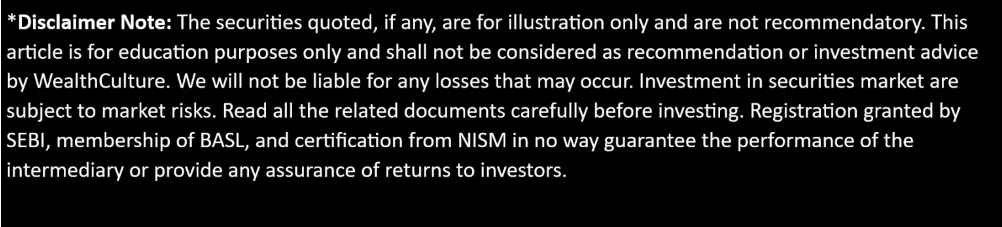

Chalet Hotels

- Revenues have grown back to pre-COVID levels; EBITDA margins have risen to 44%.

- ROCE is projected to rise to 13% by FY25, up from just 0.18% in FY21.

- Significant capex in place could pressure returns and delay payback.

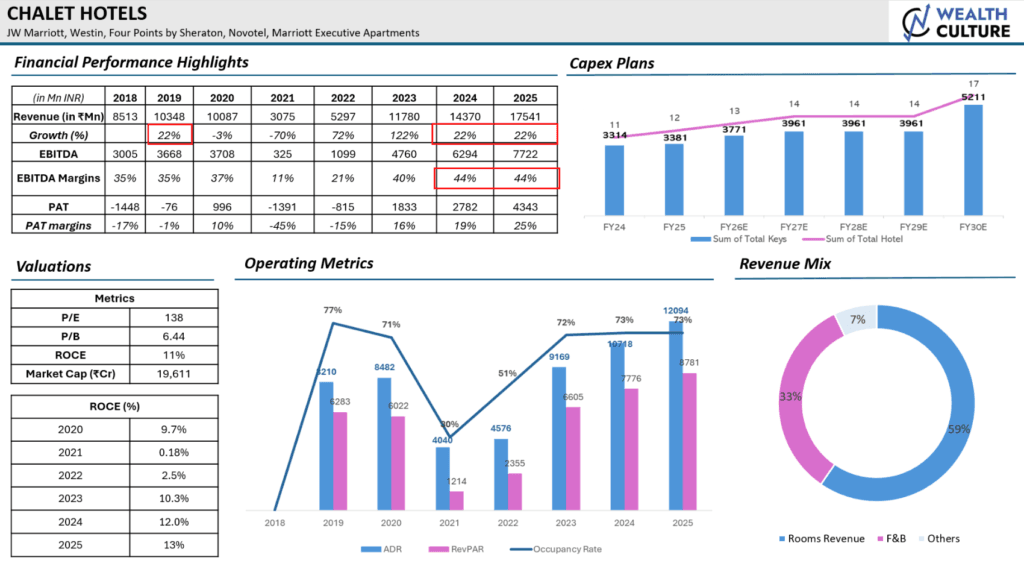

EIH Ltd

EIH is one of the most efficient players with expected ROCE at 20.8% in FY25

Margins have sharply rebounded post-COVID, with PAT margins stood at 30%.

Conservative leverage gives it a buffer, but incremental upside may be limited.

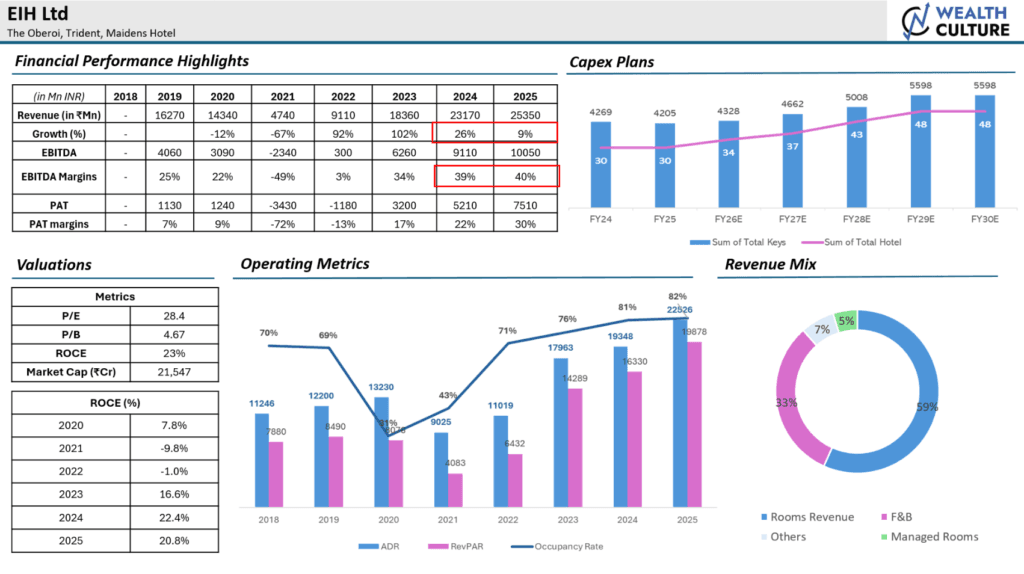

Indian Hotels Company Ltd

- Largest player in the segment with strong brand equity across formats.

- ROCE is steadily rising (expected at 19.4% in FY25), and EBITDA margins are healthy at 34%.

- Aggressive expansion through managed hotels may flatten returns in the medium term.

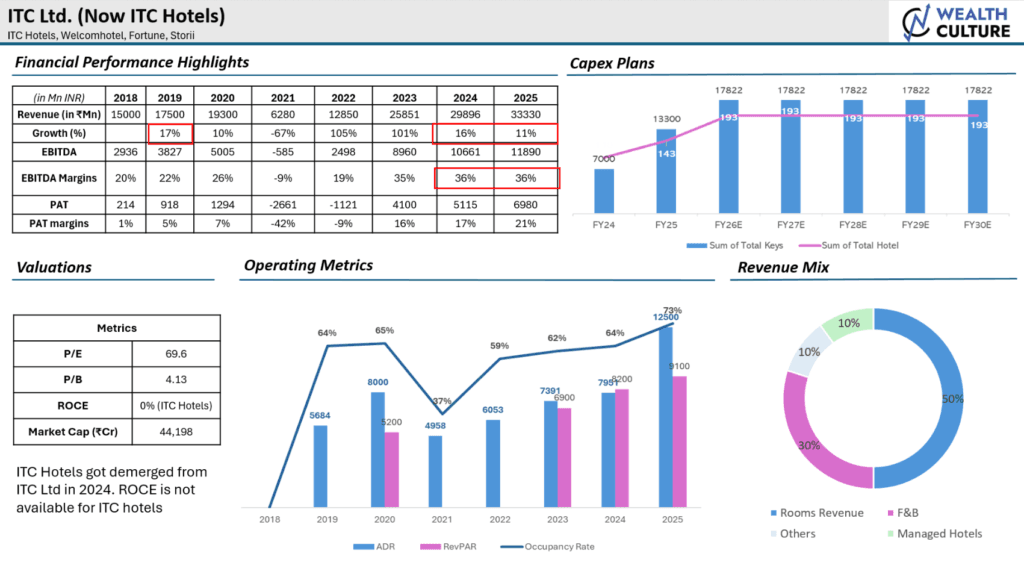

ITC Ltd.

Now a standalone entity post-2024 demerger from ITC Ltd.

EBITDA margins are strong at 36%, but ROCE data is yet to stabilize post-demerger.

Key watchpoint: How ITC Hotels scales independently and manages capital allocation.

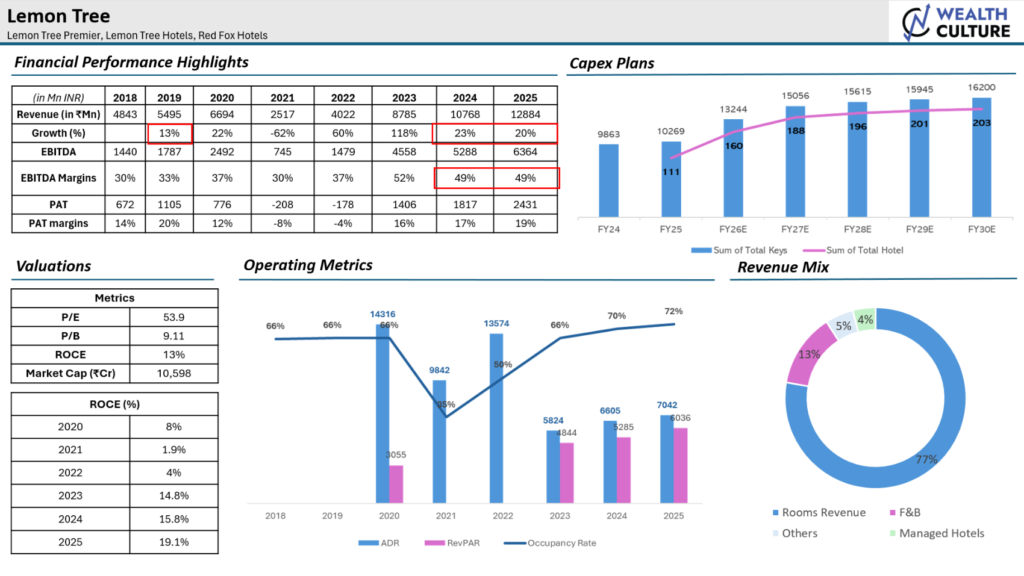

Lemon Tree

- Sector-leading EBITDA margins (~49%) with expansion via multiple formats.

- PAT margins are gradually improving (expected at 19% in FY25), but capex-heavy model remains.

- ROCE is rising but could be at risk if occupancy/utilization lags amid capacity additions.

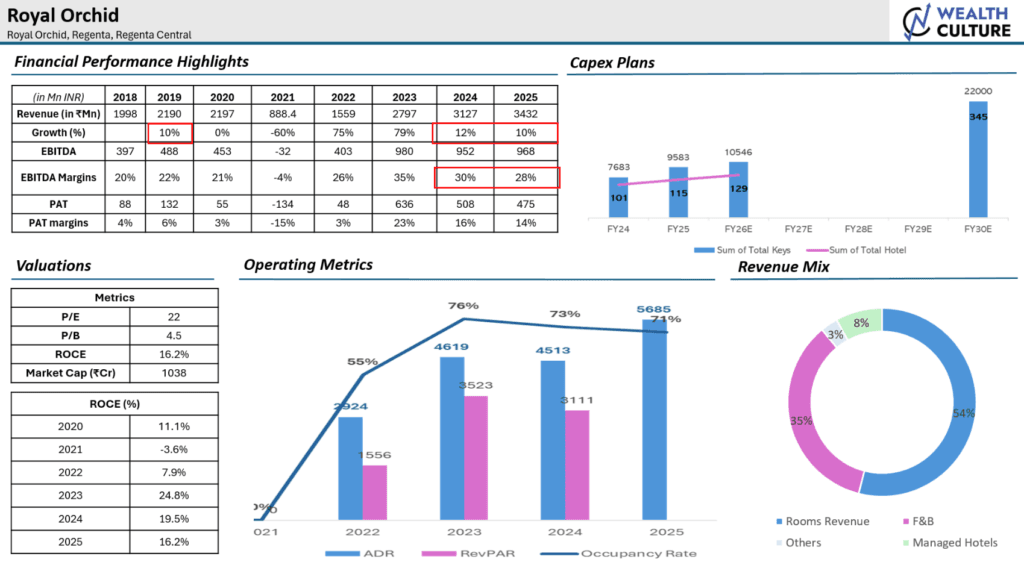

Royal Orchid

- Smaller scale player, saw peak ROCE of 24.8% in FY23, now normalizing to 16.2% by FY25.

- EBITDA margins expected to taper from 35% to 28%.

- Risk of margin pressure remains as growth moderates and competitive intensity rises.

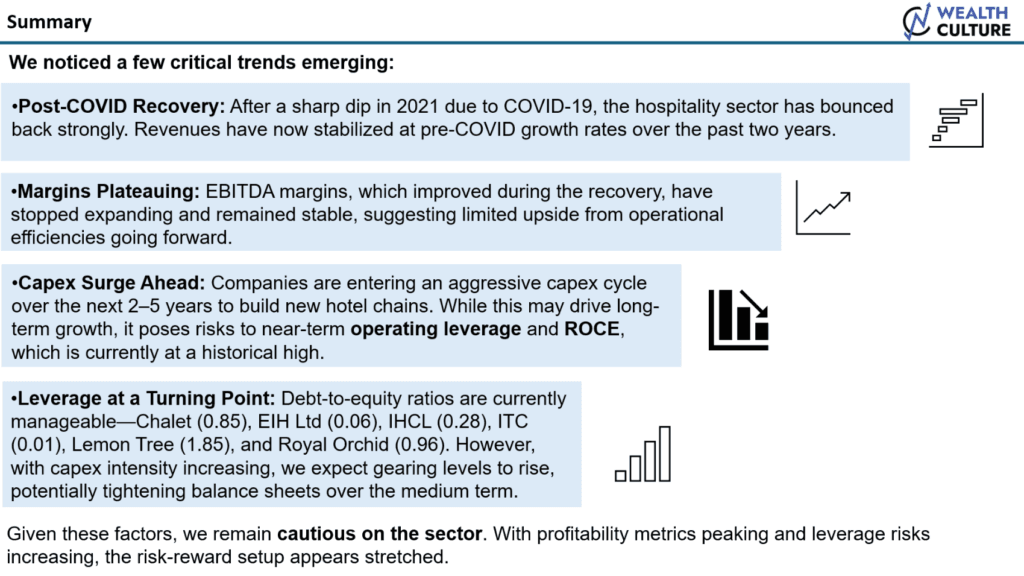

Summary

The hospitality sector has staged a strong recovery, with revenues and EBITDA margins stabilizing at pre-COVID levels over the past two years. However, our analysis of six leading hotel companies suggests that the cycle may be maturing.

A fresh capex wave is underway, with players investing heavily in new hotel developments over the next 2–5 years. While this signals confidence in long-term growth, it could start weighing on operating leverage and ROCE, which are currently at elevated levels.

As capital intensity rises, we may also see early signs of consolidation across the sector—driven more by strategic alignment than distress. With profitability metrics peaking and return ratios potentially tapering, we believe a cautious and selective approach is warranted.

Disclaimer: This is not a buy/sell recommendation. Kindly speak to your registered advisors before taking any positions in the stock markets