A decade ago, India’s consumption story was largely defined by price sensitivity and limited discretionary spending. Fast forward to today—Indians are spending more, borrowing more, and aspiring for better. The transformation is structural, not cyclical—and it’s just getting started. Here are a few key trends that highlight how India’s consumption story is undergoing a fundamental transformation

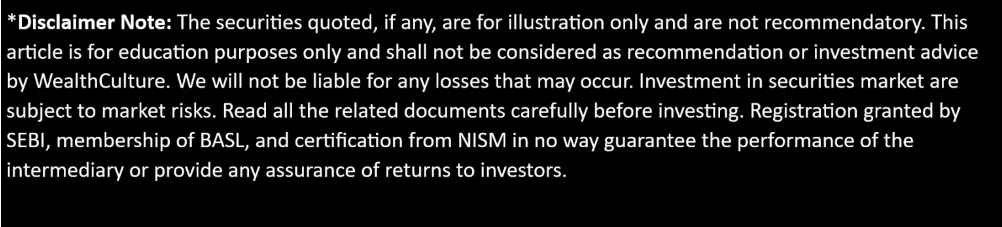

Demographic Advantage Driving Long-Term Growth

With nearly 67% of the population in the working-age group (15–64 years) and an additional 24% aged 0–15 years, India enjoys a significant demographic dividend. This young, energetic base is poised to drive sustained economic activity and consumption-led growth over the coming decades.

Rising Affluence and Expanding Middle Class

India’s rapid economic growth is transforming household income profiles. By 2030, the number of high and upper middle-income households is projected to reach 200 million, a threefold rise from 69 million in 2018. The share of these households will grow from 24% to 56%, dramatically shifting the socioeconomic composition.

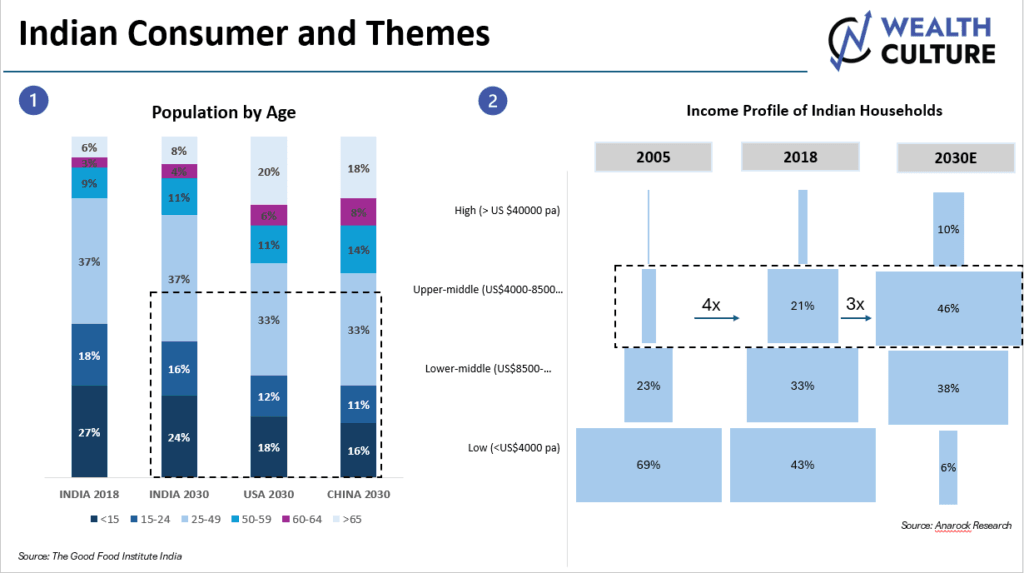

Changing Consumption Priorities and Lifestyle Upgrade

The share of non-food expenditure (travel, entertainment, conveyance) in urban areas has increased from 57% (2011–12) to 61% (2022–23). Luxury goods demand in India grew 33%, outpacing markets like China (14%) and the U.S. (19%). Over two decades, monthly per capita consumption has grown at a 9% CAGR, from ₹855 to ₹6,459.

Private Final Consumption Expenditure (PFCE) Gaining Share

As of FY24, PFCE forms nearly 60% of India’s GDP, up 5 percentage points from pre-pandemic stabilised levels. However, while financial asset levels remain stable, net financial savings are falling, indicating increased spending and possibly tighter household budgets.

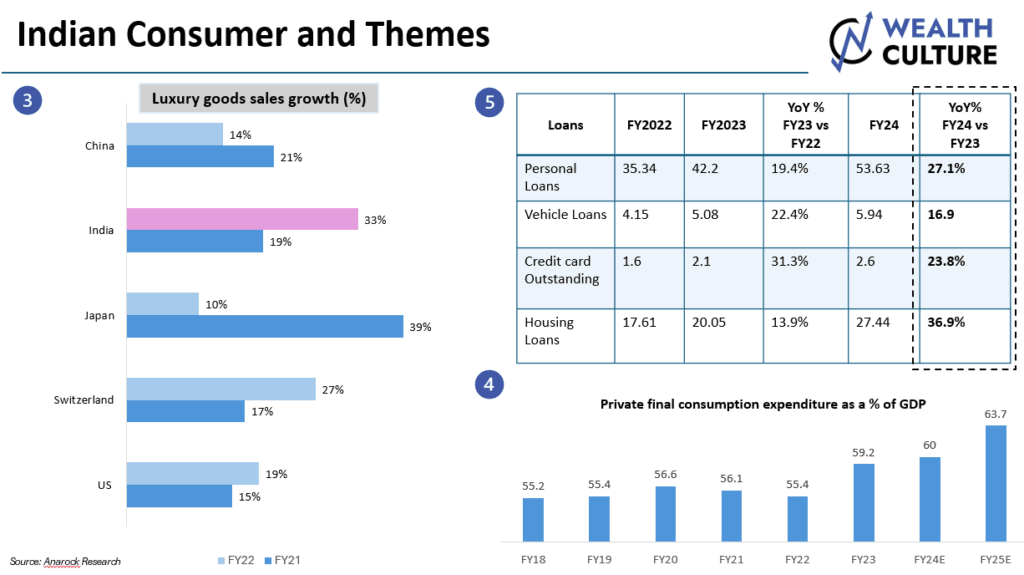

Credit-Fuelled Consumption on the Rise

Household consumption is increasingly credit-driven. There has been a sharp rise in personal loans, credit card usage, vehicle finance, and housing loans. This indicates a fundamental behavioural shift in how Indians fund lifestyle upgrades and big-ticket purchases.

The Indian consumer is in the midst of a historic transition. Young, increasingly affluent, and driven by lifestyle aspirations, today’s consumer is not just spending more—but spending differently. With a greater share of income going toward discretionary purchases and experiences, and with growing ease in borrowing, the consumption engine is shifting into high gear.

This evolution also brings a subtle warning: with falling net financial savings, consumption-led growth must be supported by parallel improvements in income, financial literacy, and risk management. Still, for businesses and investors, the message is clear—India’s next decade belongs to the consumer.

As consumption deepens and diversifies, multiple sectors stand to benefit:

- Retail & E-commerce – Driven by urban demand, digital penetration, and convenience.

- Financial Services & Fintech – Credit demand, investment platforms, and insurance uptake.

- Travel, Leisure & Hospitality – Growing preference for experiences over possessions.

- Luxury & Personal Care – Fast-growing appetite for branded, high-end offerings.

As India enters this new consumption phase, businesses that align with the evolving aspirations of a young, credit-comfortable, and brand-conscious consumer will be best positioned to ride the next wave of growth.