Push for CapEx, laying the foundation for Infra players

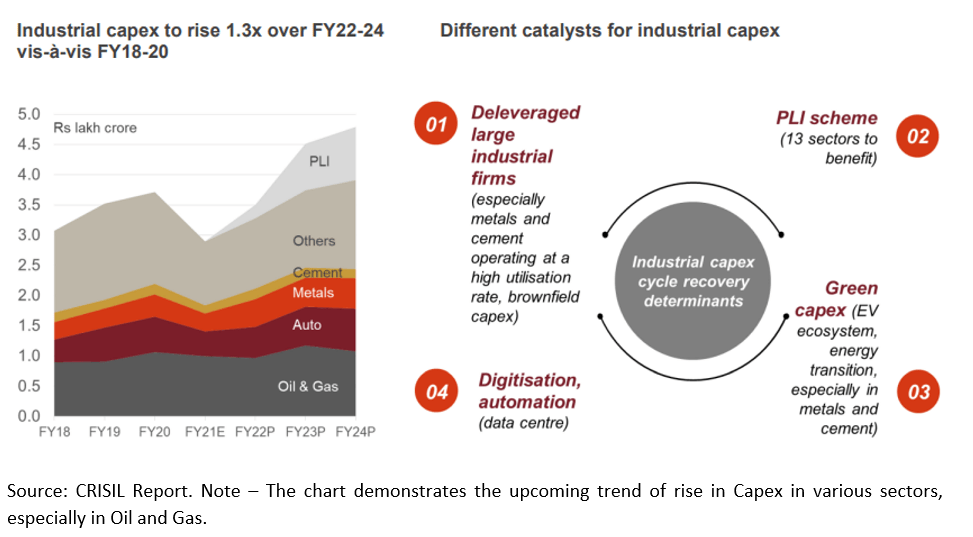

In response to capacity utilization reaching a 10-year high, Indian corporations have announced several investment projects within the country. As the production capacity of Indian companies rises, their demand for transportation services, power, and other utilities is expected to rise. Similarly, demand for constructive materials such as cement, steel, derivative steel products, and metal and metal derivatives products will be generated.

Here, we look at how the positive Indian macroeconomic conditions are leading to a push for higher capital expenditure, generating demand for infrastructure-sector companies.

1. Indian macroeconomic outlook

In August, S&P Global reported that it expects the Indian economy to surpass the German and Japanese economies by 2030 after having already surpassed the UK economy in 2022. In 2022, the Indian nominal GDP stood at USD 3.5 trillion. S&P Global expects the Indian nominal GDP to grow 9.62% annually from 2022 to 2030, to reach USD 7.3 trillion. This would make India the fastest-growing economy of this decade.

The Indian economy is estimated to be the world’s third-largest economy by 2027 according to IMF. The GDP growth is expected to be 6.5% from 2023-2027.

Some of the growth drivers for the Indian economy are:

- Large and fast-growing middle class

- Rapid digital transformation

- Foreign direct investment (FDI)

- Strong demand from the US

- Diversification in Asia away from China.

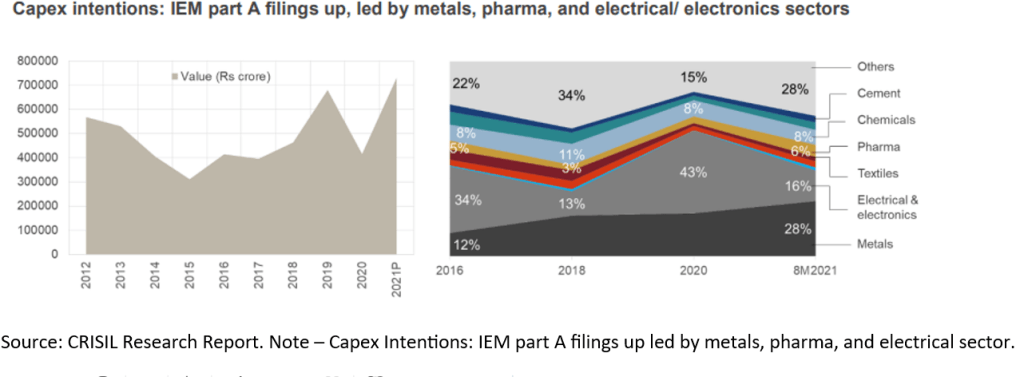

2. Rising capital expenditure across sectors

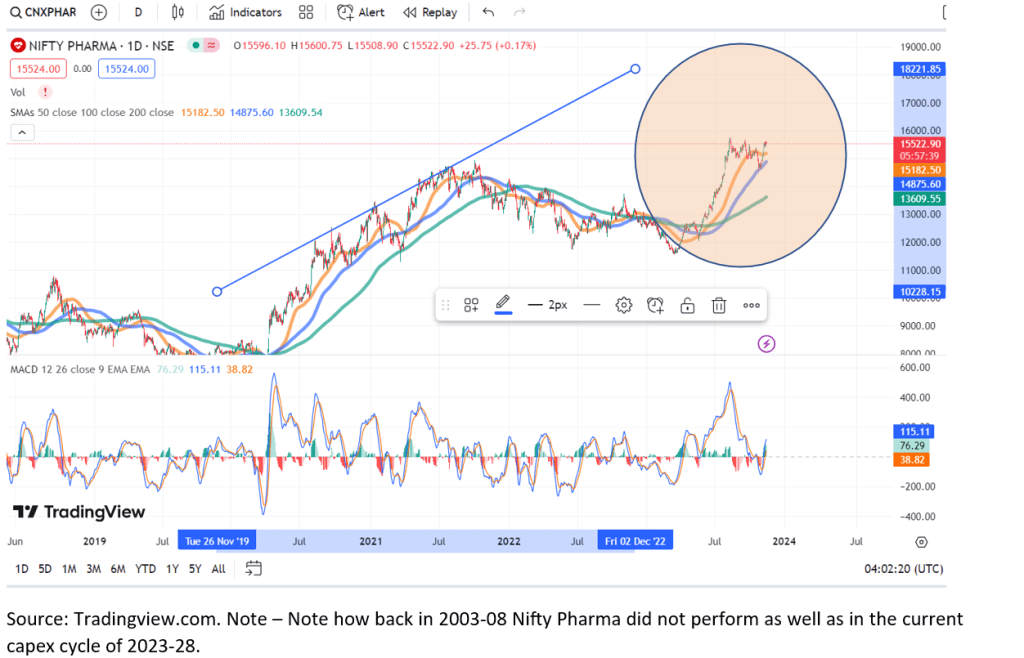

As the Indian economy embarks on its growth journey, more demand will be generated for companies catering to the Indian market. In response, companies from various sectors have announced new investment projects.

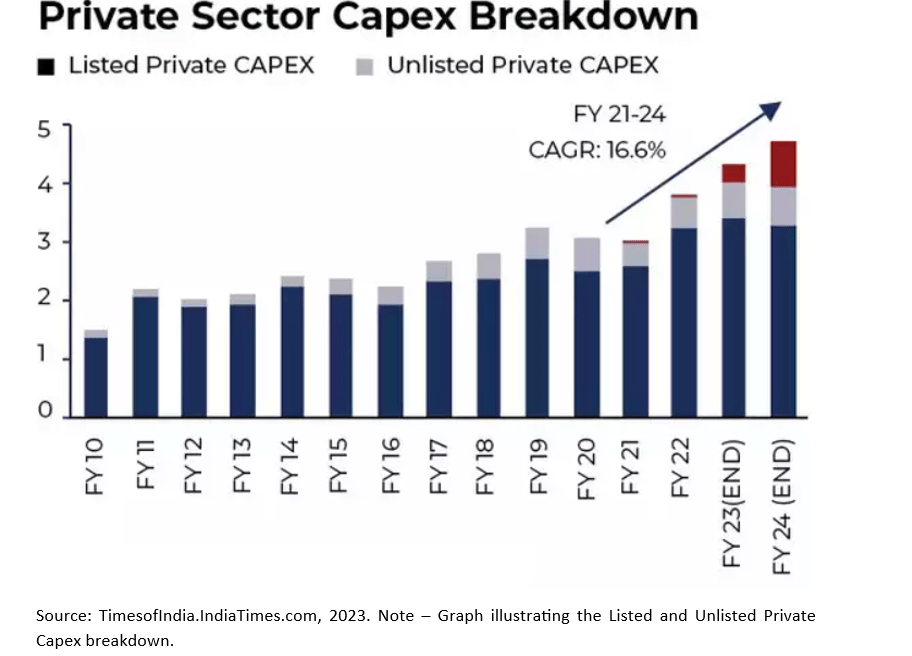

According to CMIE data, in Q1 FY24, the value of new investment projects by non-financial services, chemicals and chemical products, and miscellaneous manufacturing companies was at least 100% higher on a year-on-year. Further, according to a study by RBI, the private Capex allocation hit a decade-high in FY 2023. And it is believed to increase further in FY 2024.

The push for capital expenditure can also spread to other sectors, since in March 2023, capacity utilization reached a 10-year high of 74.3%.

2.1 Reasons for the rise in Capex in Industrial sectors: -

- Conducive governmental stimulus via tax rebates and schemes such as PLI (Production-Linked Incentive) leading to incentives for private and public corporations to increase their Capex investments. The central government is providing interest-free loans to the state governments leading to the development of infrastructure of the tier-2 and tier-3 cities.

- Already peak interest rates are in future expected to come down leading to monetary stimulus

- Uptrend coming in the commodity cycles

- Supply-chain improvements and diversification especially post-Covid.

- Restructuring of various balance sheets and healthy financial statements of companies.

- Surge in FDI investments.

3. Current trends in infrastructure

As Indian companies ramp up their production, it would generate demand for a better infrastructural environment.

Here we look at the current trends in some individual sectors within infrastructure:

4. Electricity

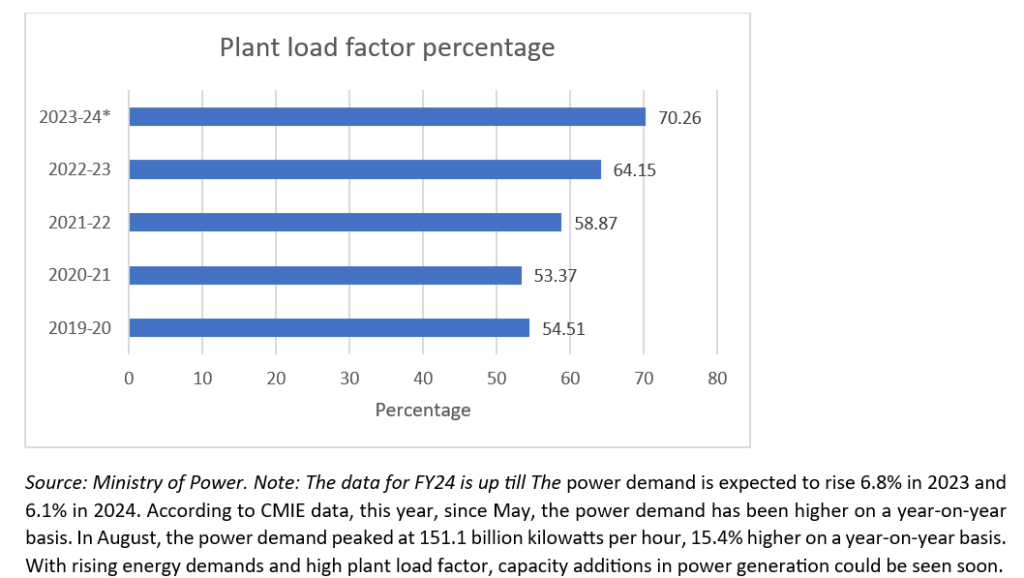

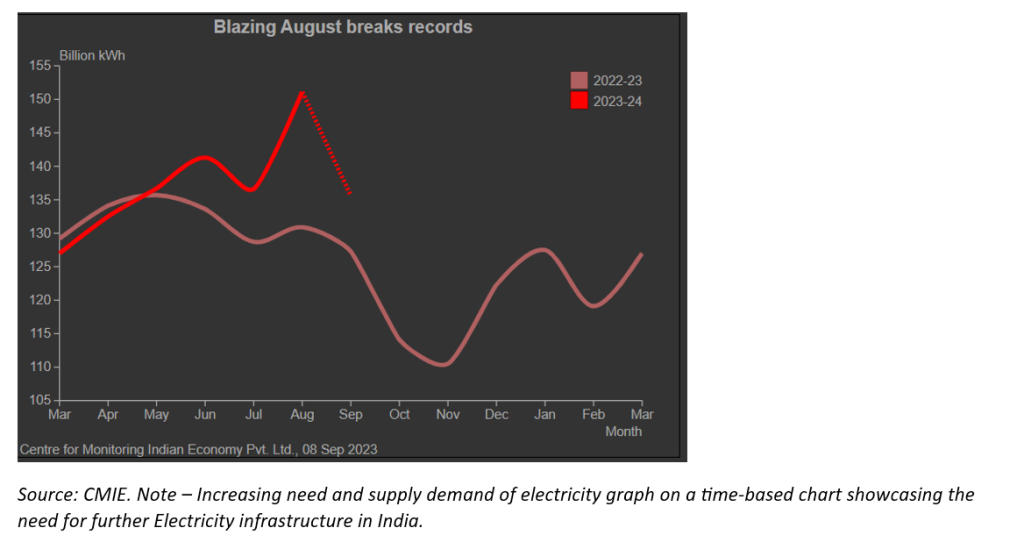

The plant load factor is the ratio of actual energy generated and maximum possible energy. In the last four years, the plant load factor has been steadily rising and in the first two months of FY24, it reached 70.26%.

This is also followed by the concept of data centers- coming in with additional investments of 23 billion USD creating a huge rise in Retail-sector space.

5. Transportation and Manufacturing

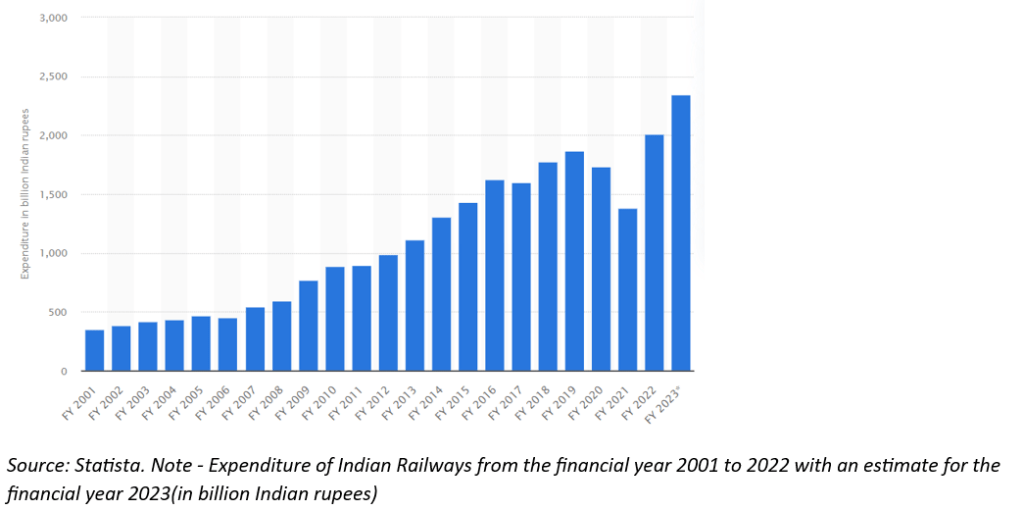

From FY18 to FY23, the originating freight loading handled by the Indian Railways in a year grew by 30.23% to 1,512 million tonnes. Also, in the first four months of FY24, the Indian Railways recorded 507.7 million tonnes of originating freight loading, 1.23% higher than the previous year. This recent rise in freight handled by the Indian Railways has been attributed to its ‘Hungry for Cargo’ initiative wherein it makes sustained efforts to improve the ease of doing business. In fact, according to TOI, the 2 ministries, namely the rail ministry and the Road ministry, are the major drivers of the public expenditure push contributing to almost 23% of the total money allocated to all sectors.

In FY23, major ports handled 55% of the cargo, while minor ports handled 45%. India’s major ports recorded the highest-ever cargo at 795 million tonnes, 10.4% higher than the previous year. The non-major ports reported a growth of 1.5% to 2% less than that of major ports. Inland waterways reported a 16% growth in cargo handled to 126 million tonnes. India’s exports have increased on a year-on-year basis, and its word share of exports has increased from 3.4% in 2021 to 7.2% in 2023.

The private sector investment has increased by 7.8% Y-O-Y while the government spending has also increased in the capital expenditure which is feeding the private consumption by 6% in the Indian domestic sector. According to the Centre for Monitoring India’s Economy’s database the capital expenditure there is a strong jump in the capital investments in the Indian economy leading to further construction in both the manufacturing sites and the export-import dockings, followed by further need for steel, cement, and other construction materials.

In FY23, the National Highway Authority of India (NHAI) set the record for a combined length of highway built in a year by constructing highways of a combined length of 4,882 km. In FY24, NHAI is planning to break this record by constructing highways of a combined length of 5,060 km. It will also be increasing the highway projects awarded from 6,003 km to 6,036 km. In this year’s budget, INR 1.62 trillion was set aside for NHAI, aiming to raise another INR 1,50,000 to INR 2,00,000 million through private financing.

In Q1 FY24, the value of new projects announced has been 238.90% higher on a year-on-year basis in the transportation services sector.

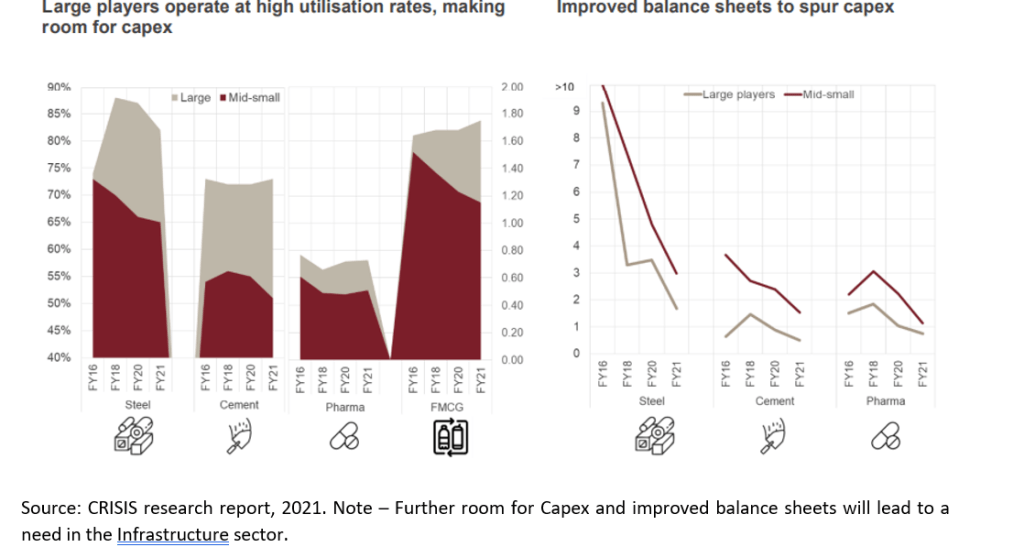

Further, with the rise in market shares for the steel and manufacturing companies in Indian markets, a further increase in Capex is required. This was further exacerbated by the fact that NCLT helped repair the asset values of various commodity companies leading to healthy balance sheets, coupled with a rise in commodity prices due to Macroeconomic reasons and geopolitical situations, the companies have invested more in the expansion. This Capex expansion is to be seen from FY2024 onwards.

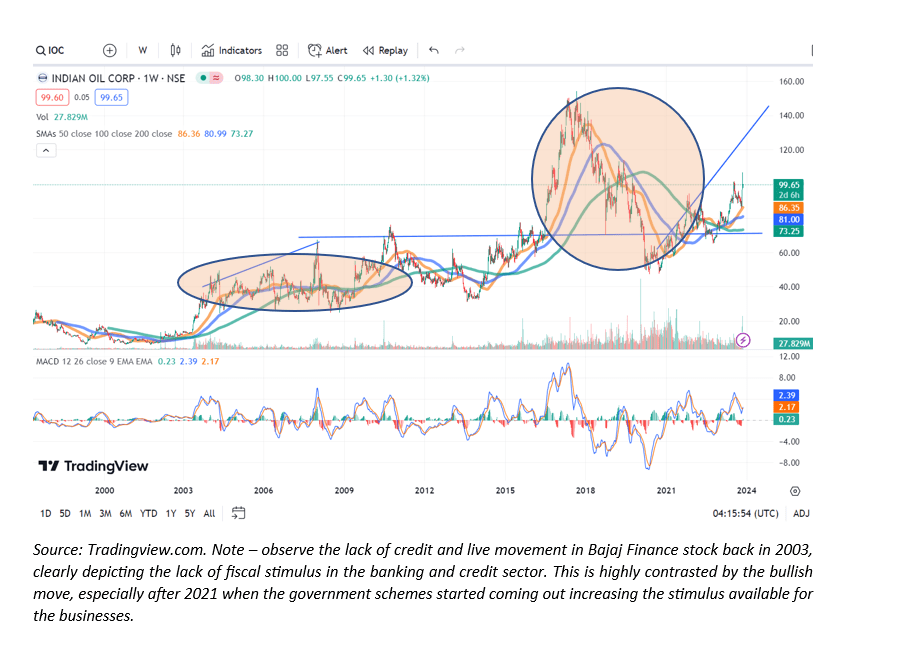

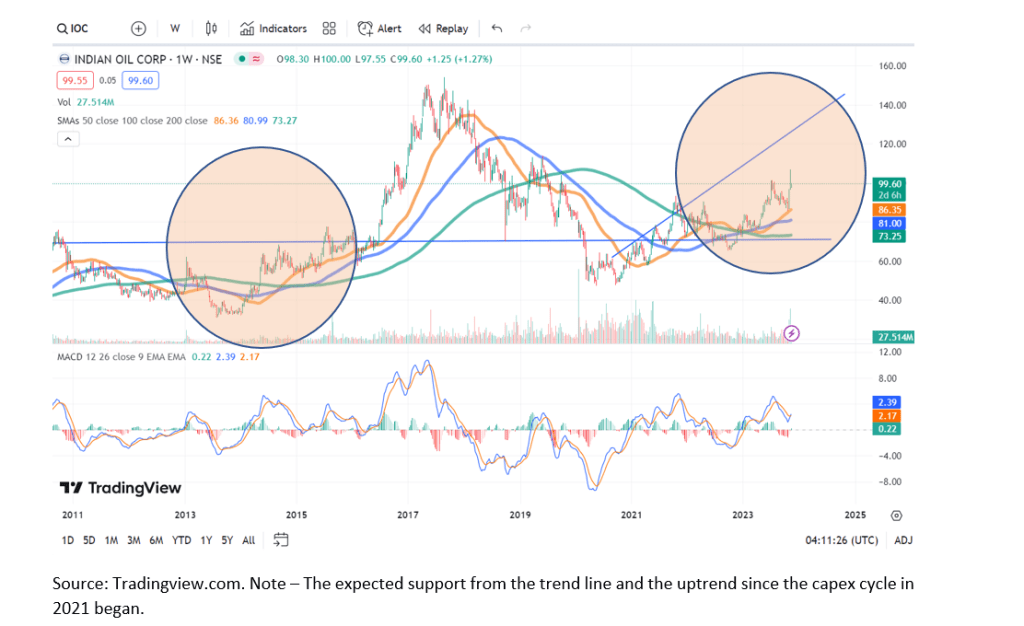

6. Oil and gas

In June, Petroleum Minister, Hardeep Singh Puri, called for aggressive upstream policy measures in the oil and gas sector. He is of the view that even as India transitions to net zero carbon emissions by 2070, being a developing country, accessibility and affordability aspects of energy should remain intact. Until the import-dependent natural gas industry ramps up production, and more capacity for eco-friendly energy sources is installed, energy demands would have to be met with petroleum products.

In FY23, petroleum product consumption rose 10.2% on a year-on-year basis, while production rose 4.8%. In the decade between 2023 to 2032, S&P Global expects India’s oil and gas production to achieve a mid-decade peak around 2027. This rise in production is expected to come from Kaveri and Godavari Basin projects operated by Oil and Natural Gas Corporation (ONGC) and Reliance Industries.

Further, the new capital allocated to the ‘green energy’ projects and energy-efficient products coming to the market will also bring new capex and add-on to the need for the Infra-sector.

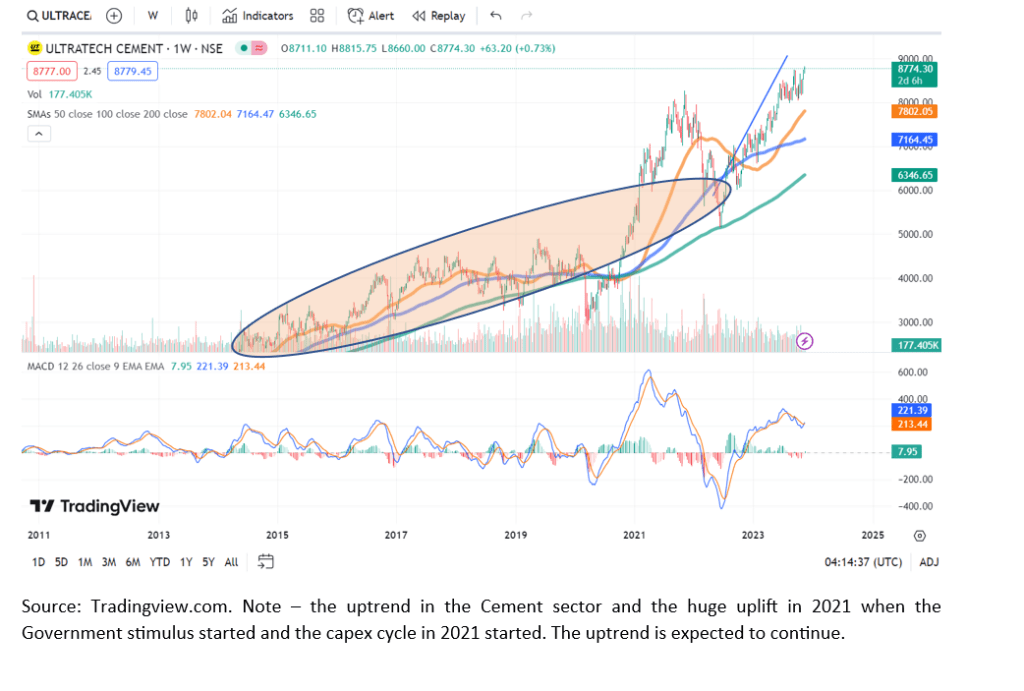

7. Spillovers on cement companies

According to Axis Direct, even though cement capacity has steadily increased by 12.87% from FY21 to FY23, capacity utilization reached 67% in FY23 from 65% in FY21. This points to a steadily rising demand for cement. Infrastructure projects such as roads, bridges power capacity additions, and investment projects in other industries would also boost demand for cement and other building materials.

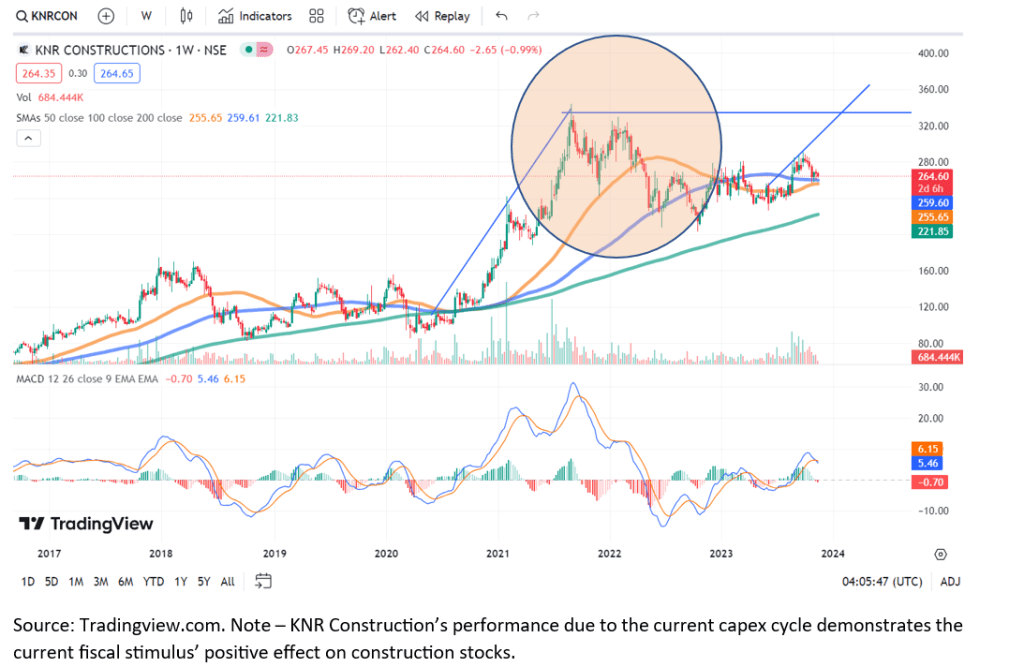

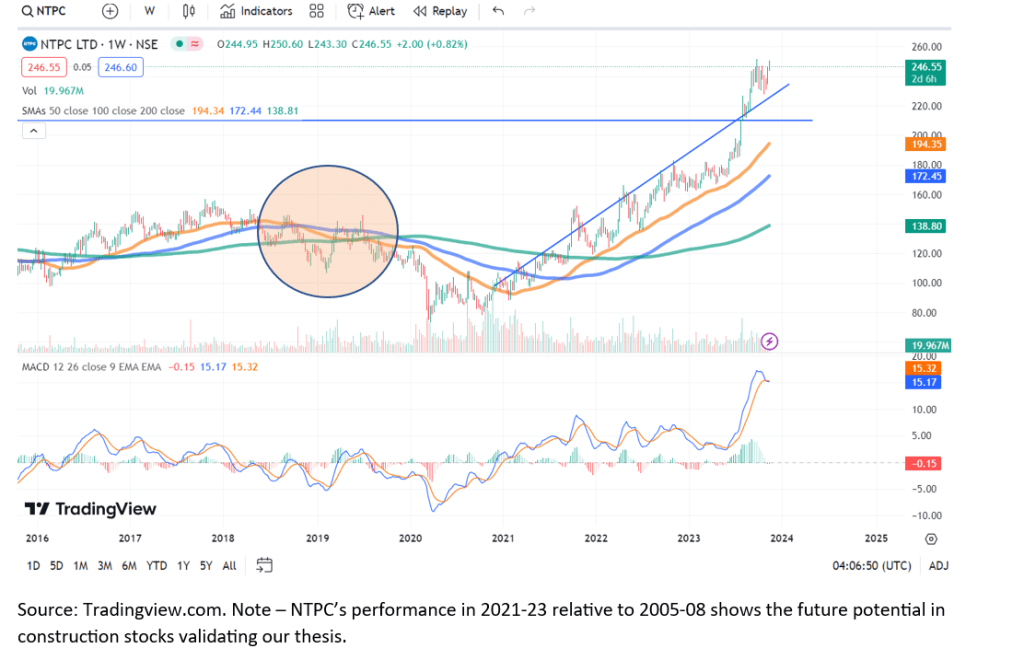

There have been concerns that risks are there in this theme because of the depreciation concerns in the overall market for Capex and the increase of non-performing assets within 2-3 years. It is worth noting that even though this capex cycle is very similar to the last 2003-2008 cycle and was eventually busted in 2008 due to the Global Financial Crisis, the overall market depreciation stands at 1.6% compared to last cycle’s 7.8% depreciation.

Further, the lending policies and government controls were not that strict in the 2003-2008 era, which is not the case now leading to strict rules and regulations for investments in the assets. Readers should also note that Bankruptcy proceedings also lagged in the last cycle, however, this is not the case as we have already seen the efficiency of NCLT’s efficiency in removing and repairing the fallen and impaired assets. Other factors are also in play such as well-capitalized banks coupled with the NPA cycle almost over and a rise in domestic demands as discussed previously. The debt-to-equity ratio is at a 15-year low, making the leveraged companies’ problem invalid, further, the expected interest rate reduction would improve the future debt covenants hence increasing the interest coverage ratios for the companies.

7.1 Role of Digitisation

Because of the improvement in the technology and services, the efficiency in the top 4-5 cement players has increased by 33% from 3000 Tonnes/employee to 4000 Tonnes/employee from 2016 to 2021. This digitization has led to improvement in almost all sectors such as manufacturing, exports, and others.

8. Summary

India is expected to be the fastest-growing economy in this decade. Higher production would require more investments for capacity additions as overall capacity utilization reached a 10-year high in March. A spillover from upgrading production capacity would be a higher requirement for infrastructure such as transportation, electricity, and oil and gas. Demand for cement would be generated from infrastructure projects and capacity additions from other industries.

Further, looking into the graph shown below, the fact that investments are not only coming from state and central governments but also from private players demonstrates the confidence of the corporate players validating the fiscal and monetary stimuli provided by the Indian government.

In an overall sense, the development of the Infrastructure and construction industry is directly related to the upcoming improvement in the economy of a nation. The theme to pursue the steel and cement sector regarding the overall development in the Capex boost in infra players is a perfect theme where the risk is minimal since the Beta is spread across different sectors while the returns are compounding from all sectors combined. This asymmetric risk-reward ratio has skewed our perspective more towards this theme for investing in long-term in the Indian Equity market.