SIS Ltd: Share Price, Overview, and Fundamental Analysis

Security & Intelligence Services Ltd. (a.k.a. SIS) provides security, facility management, and cash logistics solutions in India and international markets like Australia, New Zealand and Singapore. The company is a market leader in the geographies that it operates in, as shown below.

Over the next decade, India is expected to be the fastest-growing economy in the G-20. The Indian commercial real estate market is expected to grow at a CAGR of 21.1% till FY28. These factors are expected to drive demand for organized security solutions and facility management services.

This article covers a brief overview of SIS, its history, management profile, business segments, and the share price of SIS, and then moves on to the fundamental analysis of the company.

SIS Overview

SIS Ltd was formed in 1985 by RK Sinha, currently serving as the company’s group Chairman.

Services provided by SIS Ltd include:

- Security solutions

- Facility Management Solutions

- Cash Logistics Solutions

At the end of FY23, SIS had over 283,000 employees, 42,888 sites, 17,603 customers, and 374 branches in 630 districts. The company operates not only in India but also in Australia, New Zealand, and Singapore.

SIS History

Here is a timeline of some of the critical events in the history of SIS Ltd:

1985: Security and Intelligence Service was formally registered

1998: SIS became the first security company to receive ISO certification

2006: The company ventured into the cash logistics segment.

2008: Acquired Australia’s largest security company Chubb Security

2009: The company ventured into the facility management and partnered with ServiceMaster Corporation of the USA

2010: Launched electronic city arm of SIS group under TechSIS brand

2016: Acquired Dusters, becoming India’s 4th largest facility management provider; Crossed INR 4,000 Cr annual revenue mark

2017: The Company becomes the first Security, Facility Management and Cash Logistics company to be listed

2020: SIS Group Enterprises acquires Southern Cross Protection (SXP)

2022: SIS Group Enterprises crosses INR 10,000 Cr annual revenue

SIS Management Profile

In 1985, SIS was founded by RK Sinha, who currently serves as the group’s chairman. Rituraj Kishore Sinha is SIS’s Managing Director (MD). Arvind Prasad serves as the Finance Director and has over three decades of experience. Uday Singh, the former Chief Executive Officer (CEO), is currently a Non-executive Director. Rita Kishore Sinha also serves as a Non-executive Director and has more than three decades of experience in the legal field.

Other directors at SIS include a former SEBI chairman, a former Chief Labour Commissioner, a former SBI Deputy Managing Director, and a former IAS officer.

Board of Directors in SIS:

- RK Sinha – Founder and group chairman

- Rituraj Kishore Sinha – Managing Director (MD) of SIS Group Enterprises

- Arvind Kumar Prasad – Director of Finance

- Uday Singh – Non-executive director, former CEO

- Rita Kishore Sinha – Non-executive director

- Upendra Kumar Sinha – Independent director

- Rivoli Sinha – Independent director

- TCA Ranganathan – Independent director

- Rajan Verma – Independent director

- Sunil Srivastav – Independent director

- Vrinda Sarup – Independent director

SIS Shareholding Pattern

SIS Business Segments

As mentioned earlier, SIS operates in the business segments of security solutions, facility management, and cash logistics. The company operates in India, New Zealand, Australia, and Singapore.

Segment-wise performance in FY23

Security solutions segment

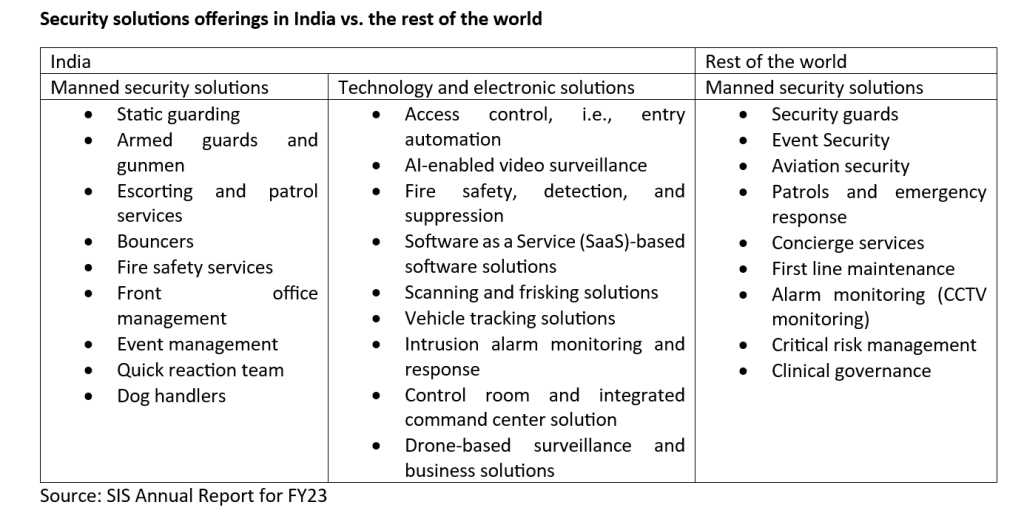

Security Solutions – Domestic

SIS leads India’s private security services, commanding ~5% market share in the organized industry as of FY23. With 182 branches across 630+ districts (penetration rate over 82%), the Company offers a comprehensive suite of manguard, technology, and electronic and alarm monitoring solutions. This segment has exhibited a robust ~14% CAGR over the past four years, elevating its revenue contribution from ~38% (FY19) to ~40% (FY23), and oversees ~33,000 sites as of FY23.

Security Solutions – International

The Company maintains a significant global presence outside India, accounting for its highest revenue contribution of ~43% and the second-highest EBITDA contribution at ~40% as of FY23. SIS operates in diverse international markets, including Australia, Singapore, and New Zealand, providing a wide range of security services such as security guards, armed guards, fire suppression, maritime security, aviation security, command and control center operations, paramedic and allied health services, roving and mobile patrols, and closed-circuit television surveillance, among others. Over the past four years, this segment has consistently achieved impressive revenue growth at ~9% and EBITDA growth at ~7%.

Facility Management Solutions Segment

In the facility management sector, SIS is commanding a ~4.5% share of the overall market as of FY23. With operations spanning ~74 branches across numerous districts, the Company serviced over 9,000 sites in FY23. The facility management portfolio encompasses a range of services, including:

- Sanitation

- Cleaning

- Fumigation

- Pest control, and more.

This segment has demonstrated robust growth at a 19% CAGR over the past four years, ending in FY23.

SIS boasted ~2,000 clients in FY23 as part of its impressive growth, with a remarkable retention rate of ~95%. The small portion accounting for the remaining 5% is intentionally reduced each year by the Company as they seek to safeguard their margins, while the remaining half is attributed to unavoidable losses stemming from competition, fixed-term contracts, or other factors.

Cash Logistics Segment

As a cash logistics solutions provider, the company operates through SIS Prosegur and SISCO subsidiaries. In this segment, SIS provides the following services:

- Cash in transit

- Cash processing and outsourcing

- ATM replenishment

- Cash processor

- Vault solutions for bullion and cash

This segment has evolved to become India’s second-largest cash logistics company, boasting a workforce of over 10,500 employees, a fleet of 3,000 cash vans, and a network of 60 vaults/strong rooms. As an associate of the Company, this segment contributes directly to the bottom line, contributing ~ 4% to consolidated profits during FY23.

Over the past five years, the Company has strategically transitioned from a Cash Logistics business to a Bank Outsourcing and Support Solution (BOSS) business. This strategic shift has yielded remarkable results, with route density growth in Doorstep Banking (DSB) surging by 84%, while route density growth in ATMs grew by a modest 3% from FY18 to FY22. The Company’s exceptional growth and margin improvement can be attributed to a shift in revenue mix, with non-ATM activities now constituting the majority of revenue alongside tariff adjustments.

During the past four years, the Company has expanded its revenues at 17% CAGR and operating profit at 166% CAGR, improving its EBITDA margin from < 1% in FY19 to ~16% in FY23.

SIS Financials

Annual performance

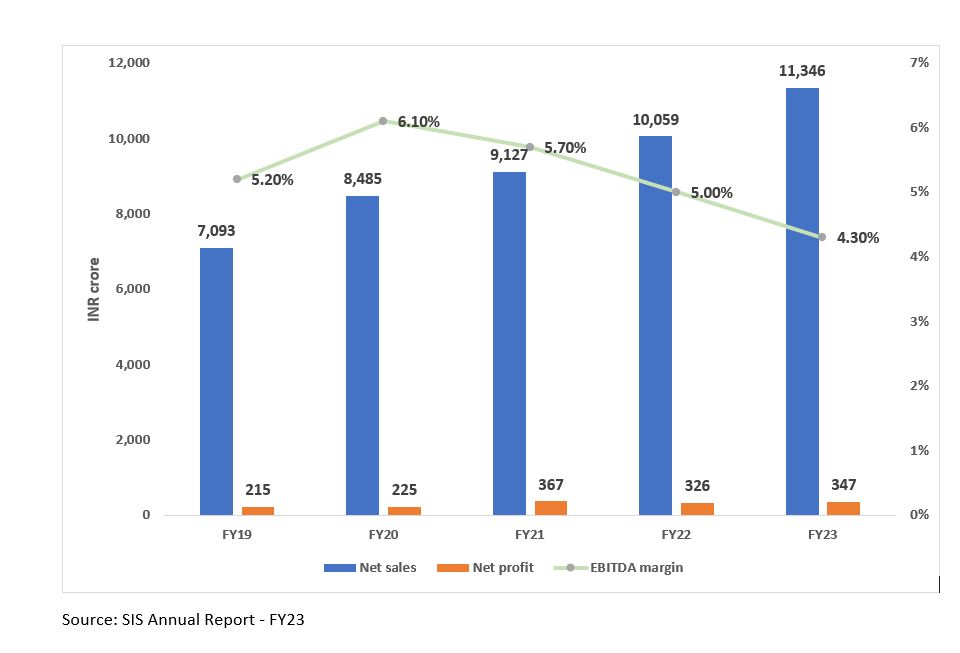

Over the last five years, SIS’s net sales grew at a CAGR of 12.46% from INR 7,093.27 Cr to INR 11,345.78 Cr. Similarly, the company’s net profit grew at a CAGR of 12.71%, from INR 215 Cr to INR 347 Cr. The company’s EBITDA margin declined from 5.2% to 4.3%.

SIS annual historical performance

Quarterly performance

SIS Revenue, PAT, and EBITDA Margin over the last five quarters:

Key Financial Ratios

SIS Share Price Analysis

SIS became a publicly listed company on 10 August 2017. On the listing day, SIS’s closing share price was INR 756.70, and the market cap was INR 5,520cr. In December 2019, SIS underwent a stock split from a face value of INR 10 to INR 5.

SIS stock price has delivered a three-year CAGR of 7% from (20th Oct 2020 to 20th Oct 2023). However, over the last six months, starting from April 2023, SIS’s share price grew by approximately 34%. This growth in share price can be attributed to net sales and net profit growth over the last five quarters.

Beyond the basic financial statements

Here we look at some key details that might miss your eye:

Tech-enabled cost reduction in the Security solutions segment

A significant portion of SIS’s revenue goes to financing employee benefit expenses. As such, manned security solutions represent a low-margin segment for the company. In the future, SIS is looking to increase technology and electronic security solutions in its product mix, across SIS subsidiaries.

TechSIS is SIS’s electronic security division that offers fire alarms, 24/7 monitoring, drones, and access control services. Tech SIS aims to penetrate new segments and secure big-ticket projects.

MSS Security and Southern Cross Protection (SXP), SIS’s subsidiaries in the international security solutions segment, also attempt to incorporate tech-enabled solutions in their production mix.

In addition to cost reduction, tech-enabled solutions have higher scalability, which can provide better economies of scale.

Synergies for VProtect and Cash Logistics segment

VProtect is an SIS venture that provides services like 24-hour monitoring and providing clients with remote access to their property. VProtect services the Central Bank, Canara Bank, and Equitas Small Finance Bank. In the future, VProtect will be focusing on attracting clients from PSU banks, private banks, non-banking finance companies (NBFCs), and business-to-consumer (B2C) companies.

In FY23, VProtect recorded 80% revenue growth. VProtect’s growth could open up cross-selling opportunities for the cash logistics segment.

In the last five years, the EBITDA margin in cash logistics increased because of the transition to bank outsourcing and support solutions by adding services like door-step banking, value cargo, and valuables management.

City-level CEOs

As of FY23, SIS operated in 21,000 venues and had 2,83,322 employees. To improve efficiency and provide autonomy in the top 15 cities contributing to about 70% of the revenue, the SIS management will be designating city-level Chief Executive Officers (CEOs). The city-level CEOs would have the autonomy to improve offerings, make personnel decisions, recruit employees, and make branding decisions, among other things.

Growth potential

SIS’s growth potential depends on its success in increasing domestic contributions to the security solutions segment, increasing the cross-selling ratio, increasing tech-enabled services in the product mix, and unlocking value in the cash logistics segment.

SIS can benefit from higher scalability and improved margins by increasing tech-enabled services in its product mix. Since income levels and cost of living are higher in foreign countries, concentrating on expanding the domestic security solutions business would increase margins.

As per Mordor Intelligence, from FY23 to FY28, commercial real estate is expected to grow at a CAGR of 21.1%, which would directly generate demand for facility management services.

Due to VProtect’s focus on banking clients and the transformation of the cash logistics segment, there could be cross-selling opportunities.

Key risks

Declining profitability: Over the last five years, SIS has experienced a consistent improvement in revenue. However, in the same period, the return on capital employed dropped by 6.6%. If you look at the numbers since FY19, RoCE dropped from 18.60% to 12.0%.

Wide-spread operations: In FY23, SIS operated in 21,000 venues. A security solutions provider must manage these locations to a high-quality standard. Any security lapses in a single location could affect the company’s reputation and, in turn, its customer retention

Frequently asked questions

Is SIS Ltd a good long term investment?

SIS is a formidable player in an extremely competitive industry, which has made its way to leadership through forms of inorganic growth, vesting power at different levels of the hierarchy, uncommonly deploying funds in technology to become a securi-tech company, and fostering its employees with training so that they themselves become more powerful to drive their locus of control, whereby taking the entire company in the best direction.

Although SIS’s growth prospects look good, one should be careful about the entry valuation.

What is the face value of SIS Ltd?

As of 20th Oct 2023, the Face value of SIS Ltd. is INR 5 per share.

Who are the promoters of SIS Ltd?

Mr. Ravindra Kishore Sinha, Mrs. Rita Kishore Sinha, and Mr. Rituraj Kishore Sinha are three major promoters of SIS Ltd. These three promoters control 66% of the total shareholding.

1 Comment.

Hi everyone, it’s my first go to see aat this web site, and article is really fruitful designed for me, keep up

posting these articles or reviews.