Let’s first understand the basics of the metal sector before diving into the theme of the breakout.

Basics of the Metal Industry:

Metals are generally categorized in 3 main categories:

- Ferrous – These are metals where the main ingredient is iron. Example: Steel, Cast Iron and Wrought Iron.

- Non Ferrous: Metals in which iron is not the main element. Example: Aluminium, Lead, Copper, Zinc, Nickel etc.

- Precious Metals: Rare, naturally occurring metals with significant economic worth are known as precious metals. Example: Gold, Silver etc.

But the topic that we will be discussing will primarily deal with Ferrous and Non Ferrous metals.

Let's look at the nature of the industry and the factors that affect it.

Cyclic nature: The demand for metals is directly correlated with industrial and economic growth. The demand for metals usually rises during times of economic prosperity because sectors like manufacturing, infrastructure development, and building need more raw materials. On the other hand, demand for metals tends to fall during economic downturns as manufacturing sputters, infrastructure expenditure cuts, and construction projects are postponed. Cyclicity is a general term used to describe this type of supply and demand fluctuation. As a result, timing the entry and exit of such businesses is crucial for investors.

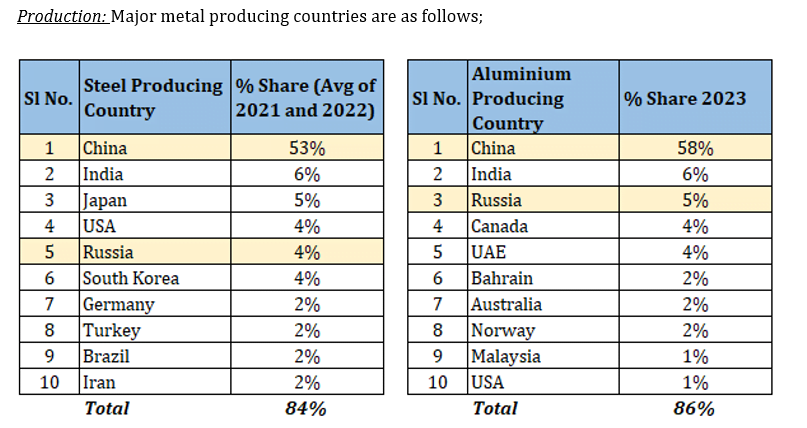

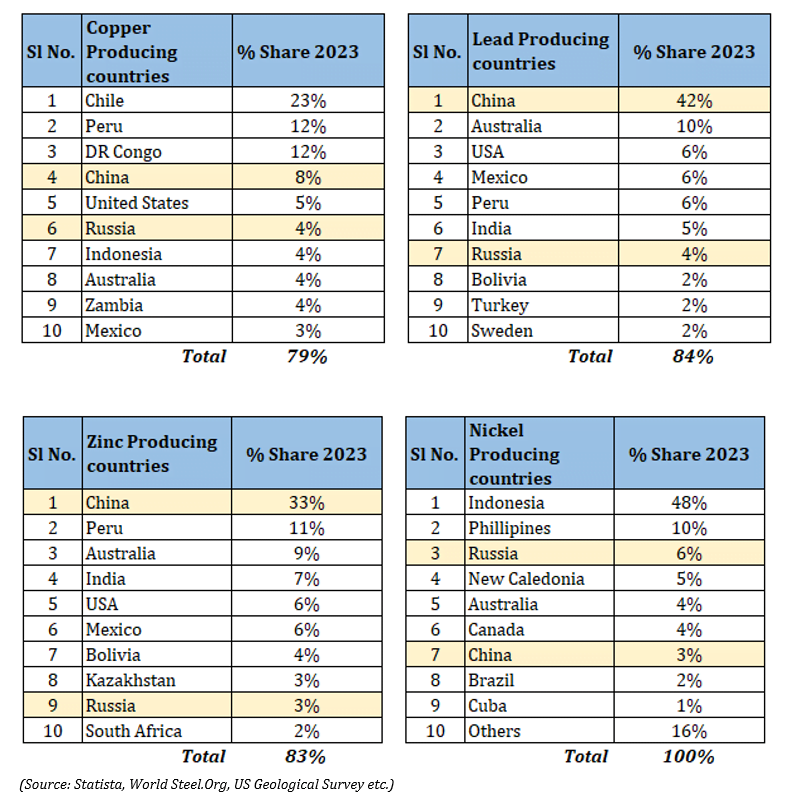

You can see the significance of China and Russia in the world’s metal markets by examining the numbers in these tables. This is crucial because events that have transpired in these two nations over the past few years have had a substantial impact on the current state of the global market.

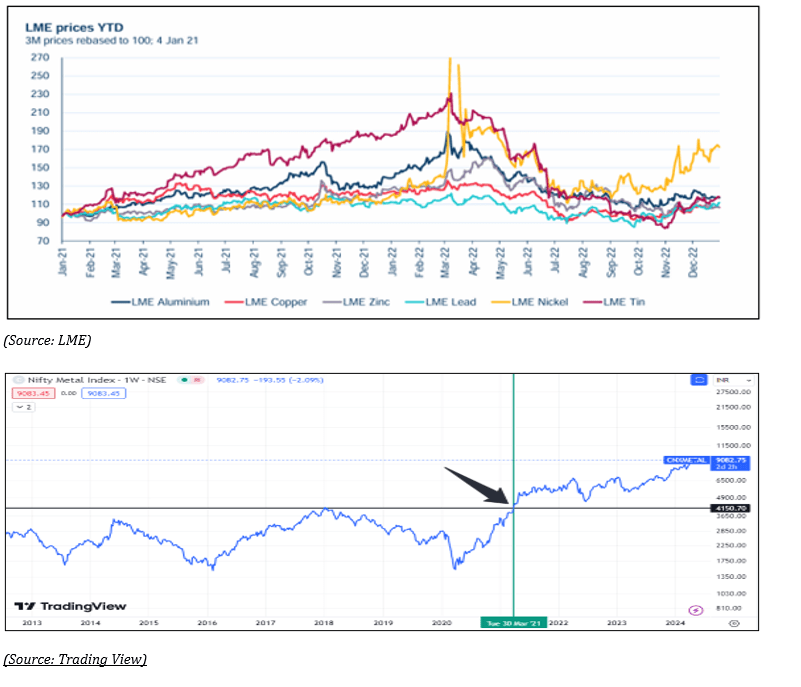

Price determination: Prices of the metal are decided at global level viz LME (London Metal Exchange), Chicago Mercantile Exchange and Shanghai Future Exchange as there’s not much differentiation of product among the producers. This is determined on the expectation of the industrial activity, construction, manufacturing and infrastructure development, production output and any kind of Geopolitical disruption (like Russia Ukraine war, Israel Hamas War etc.).

Since we have understood the basic of Metal sector, now, let’s move to our topic of discussion i.e. breakout in Metal Sector……

Brief:

The metal sector is in focus now, with the Nifty metal index experiencing a significant breakout in December 2023 after plummeting to an all-time low during the COVID-19 pandemic in 2021, followed by a gradual recovery. This article aims to look closely at metal index, pre and post COVID-19 pandemic (2019 – 2024) and finally the reasons for breakout. Thereafter, we will look at the key performance indicators of major Ferrous and Non-Ferrous metals which affects metal indices. And lastly, we will cover two companies, Jindal Steel & Power Ltd and National Aluminium Corporation Ltd, outlook for them.

Emergence of COVID-19, Divergence of Metal Prices:

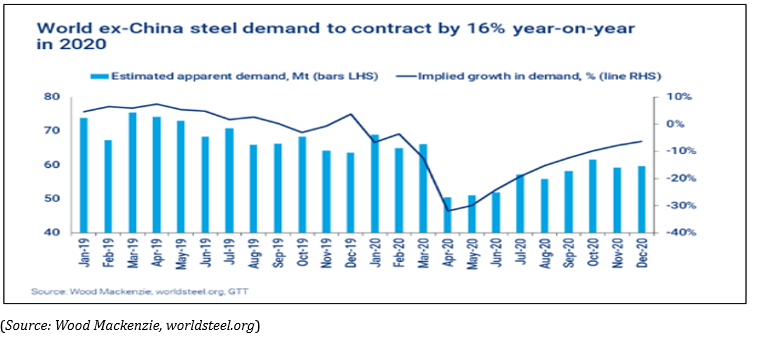

When the COVID-19 pandemic struck, the metal index plummeted to all-time lows primarily due to:

- Fall in Price: Amid the pandemic’s onset, metal demand sharply declined due to stringent lockdown measures and the cessation of activities. This led to a significant reduction in the prices of crucial metal components, as elaborated later.

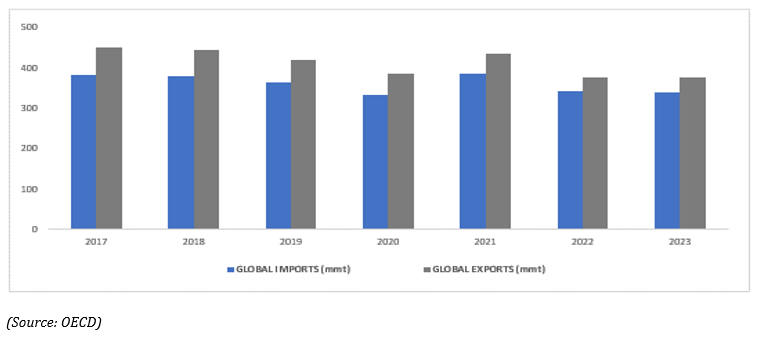

2. Cut in capital spending: The short-term supply was disrupted with closure of manufacturing plants, as a result, global exports and imports saw a little hit.

Recovery:

Faster than expected recovery of markets in first half of late 2020 and first half of 2021.

In 2020, most of the economies in COVID-19 came to a complete standstill, which led to the cessation of various economic operations, such as mining and additional metal processing.

But things got better in different parts of the world, business as usual resumed, and the demand for metals and other services increased.

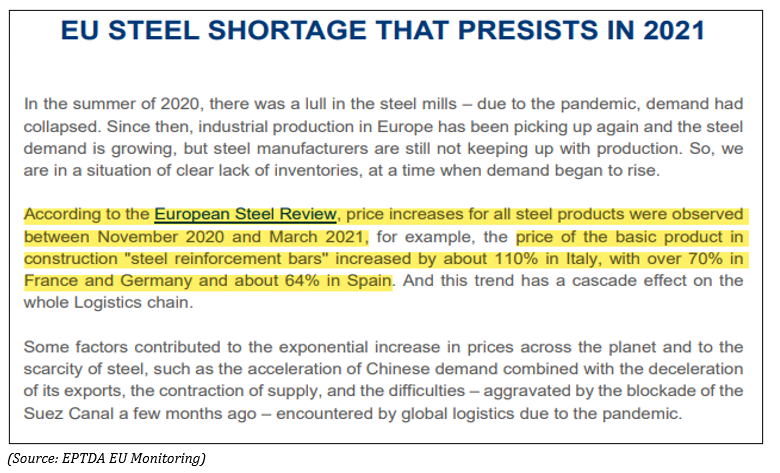

However, a lack of labour, logistical difficulties, and other limitations in some regions of the world led to a shortage of the metals on the international markets, which drove up metal prices across International markets.

As there was not much clarity on the Covid then, it lead to more optimism in the sustenance of these elevated prices and ultimate bullishness of investors in metals or markets in general. Look at the charts below the first breakout or 10 year breakout in March 2021.

In the following picture you find a relation between the shortage, resultant increased prices and ultimate rally/breakout of Nifty Metal in 2021.

Finally reasons for the current Nifty Metal breakout:

- Rebound in China’s manufacturing and Infrastructure: China’s economy surged beyond expectations in the first quarter of 2024, as revealed by official data released on Tuesday. From January to March, China’s gross domestic product (GDP) expanded by 5.3%, surpassing the 4.8% growth forecasted by analysts polled by Bloomberg. (http://surl.li/sqids).

- Outlook for USD: In last 9 months, the dollar has already decline as can be seen from the chart, and the future is uncertain with growing geopolitical tensions, and other reasons mentioned above, with weakening of dollar, the investors would not like to hold dollar rather invest that money in the metals, including precious metals, ferrous and non-ferrous metals.

- Inflation: Inflation plays a major role in the profitability of the metal companies, when the revenue increases with the increase in price of finished goods, the profits for firm as well increases, especially when the raw material prices are proportionately increasing lesser, this creates positive outlook for the metal companies and instils positive outlook for metal value added products manufacturing and selling companies.

- Positive Growth Outlook: China’s exports in 2023 hit all-time high, so there was oversupply of steel all across the globe with consumption being stable, as can be seen from the chart, so the metal prices were going down and metal sector consequently. Now with the positive outlook for the China’s growth as mentioned above, the export import balance can be maintained.

5. Accumulation of metals: With the increase in scope for electric vehicles, renewable energies, automotive and transportation, and government focusing on infrastructure development, need for metals are going to rise, however with inflation rising each day and US economy falling for debt trap, as can be observed from the graph, making US Dollar uncertain, nations are trying to accumulate metals as they are sustainable and used for future projects. In any case, China remains the highest producer and consumer followed by India.

Hence, because of above reasons the metal prices and as a result metal indices are seeing bullish move. Let’s look at individual metals now.

We covered the general outlook of the metals, now let us take a look at the individual metal’s outlook……….

Outlook of Individual Metals:

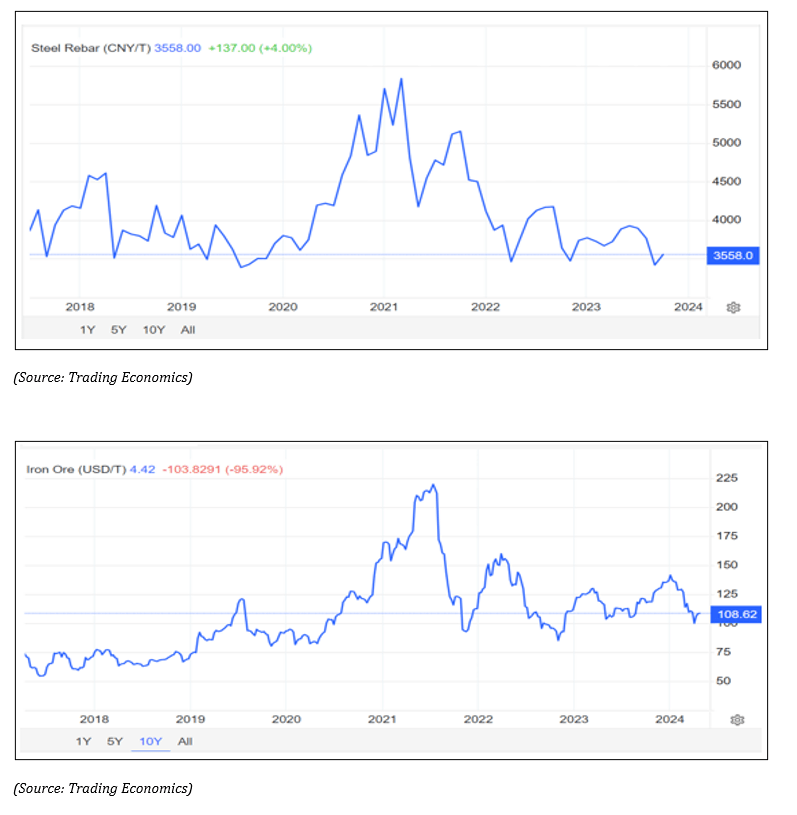

Ferrous Metals (Steel): One of the most important raw materials for any steel manufacturing company is Iron ore. As can be observed from the chart, both iron ore and steel rebar were able to come down at pre-COVID levels. Mainly on account of poor demand in China due to weak real estate sector. This has resulted in increased exports out of China which has the potential to drive down steel prices. On the Domestic front, market consensus is of 8%–10% growth in domestic demand (India) in FY25. This gives a cautious short term bullish outlook for Indian Steel Companies.

Copper: There are rumoured shortage of Copper around world due to increasing adoption of EV’s around world. EVs rely heavily on copper for their electrical systems, including wiring, motors, batteries, and charging infrastructure.

Due to these factors Copper is at all-time high in China and 16-month high in US on 3rd April, 2024. Indian firms including Hindustan Copper showed breakout with the CIA report indicating China’s continuation in spending on energy transition and increasing demand and supply mismatch. The inventory levels of copper are at 25 years low (as can be seen from the chart below) suggesting a 25 year all time high price levels.

Aluminium: Aluminium is considered best substitute of steel. And here also EV adoption and transition to green energy has played its role. Electric vehicle makers favour aluminium for its lightweight qualities and strength-to-weight ratio. Aluminium is being used in vehicles more frequently by automakers as they look to increase the efficiency and range of EVs.

Surprisingly, Japan, a major importer of light metals in Asia, is paying $145/t premium for buying Aluminium. Moreover, positive manufacturing data coming from US and China is keeping the prices at a 3-month high all across. In India as well, with the positive news coming in, companies including Hindalco Industries has seen a good rally at the start of FY25. Moreover, the inventories for Aluminium is at 25 years low as well indicating strong upward price movements.

Example; Approximately 8 kg (18 pounds) of lithium, 35 kg of nickel, 20 kg of manganese, and 14 kg of cobalt are needed for a typical electric vehicle battery pack, while significant amounts of copper are needed for charging stations. Solar panels require a lot of copper, silicon, silver, and zinc to produce green power, whereas wind turbines need iron ore, copper, and aluminium. So we can say that Green Energy Transition is the key reason for rise in Non Ferrous demand. This rally/surge in price of Non-ferrous metals is expected to sustain in the long run as majority of the countries have already set their vision for Net Zero Emission goals.

Now that we know the reason for the metal stock’s breakout, let’s explore our Techno Funda picks…………

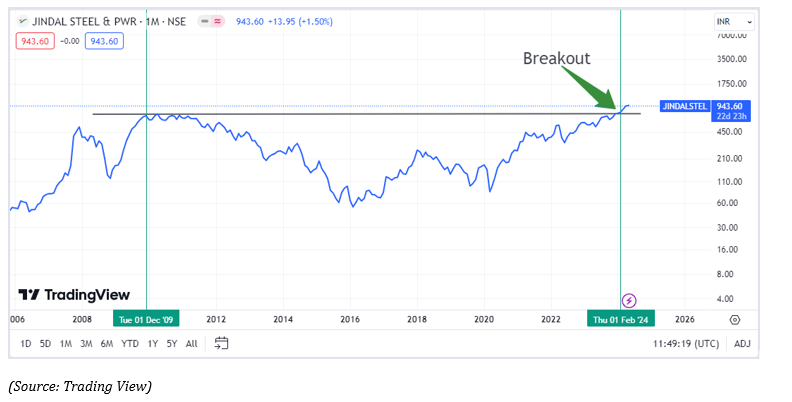

Jindal Steel and Power Ltd:

Jindal Steel and Power is integrated steel player with 65% revenue from value added products. Presence in value-added product categories allows the business to report higher operational profitability and better total realisations at a competitive cost of production, which helps to prevent margin contractions during downturns.

The company specializes on lengthy products and specialist grade flats, where import competition is less of a concern. Also, the business has made a name for itself as one of the Indian Railways’ preferred suppliers of rails, including specialty rails, to the company’s controlled businesses, such as the Dedicated Freight Corridor Corporation of India Limited (DFCCIL) and metro projects. In addition to this, company is venturing going through cost saving and raw material security initiatives which makes it really attractive from Fundamental perspective.

On the technical front, this stock has given 14 year breakout which makes it a perfect Techno Funda pick.

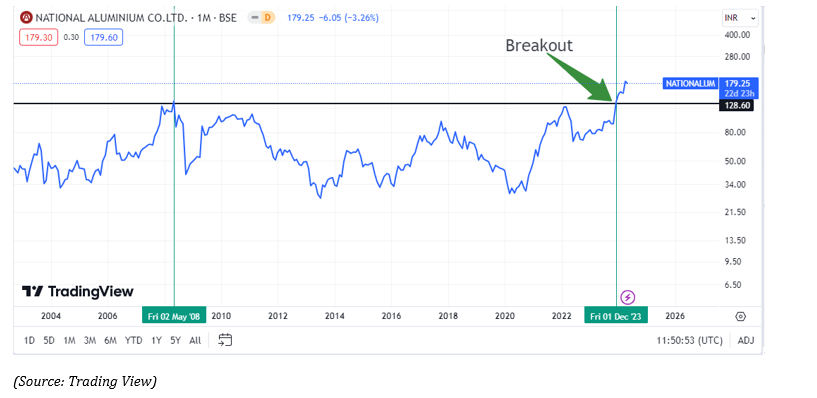

National Aluminium Company Ltd (NALCO):

NALCO is one of Asia’s biggest integrated primary aluminium producers, operating throughout the whole value chain from the extraction of bauxite to the refining of alumina, the smelting of aluminium, the production of electricity, and the downstream goods. All these factor results in good margins for the company and the best part is that with this the company boosts long term debt free balance sheet.

This makes it one of the biggest beneficiary of rising Aluminium demand and prices. Even on the technical basis, the stock has given a 15 year breakout.

Both of these reason has make NALCO a perfect Techno Funda pick for medium to long term.