About

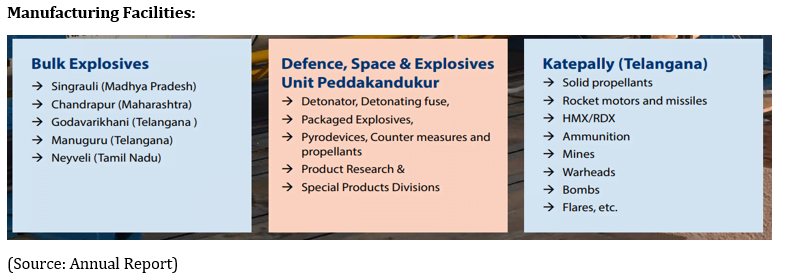

Premier Explosives Limited (PEL), established in 1980, is a publicly listed company on the Bombay Stock Exchange (BSE) in India. It is known for its expertise in manufacturing high-energy explosives and related products. Serving both the defense and commercial sectors, PEL’s diverse product portfolio includes detonators, propellants, pyrotechnics, and specialized ammunition. The company is renowned for its robust research and development capabilities and adheres to stringent quality and safety standards.

With state-of-the-art manufacturing facilities and strategic collaborations, Premier Explosives has solidified its position as a key player in the Indian and global explosives market, making significant contributions to mining operations and defense initiatives.

The company was started in 1980 by Mr. A N Gupta (Chairman), an alumnus of the Indian School of Mines, Dhanbad. Earlier, the company was mainly focused on bulk explosives for the mining sector (especially coal mining). However, the focus has now shifted to manufacturing products for defense and aerospace purposes.

(These are also called High Energy Materials, i.e., compounds that store chemical energy, so you may come across the term that Premier Explosives is a High Energy Material company).

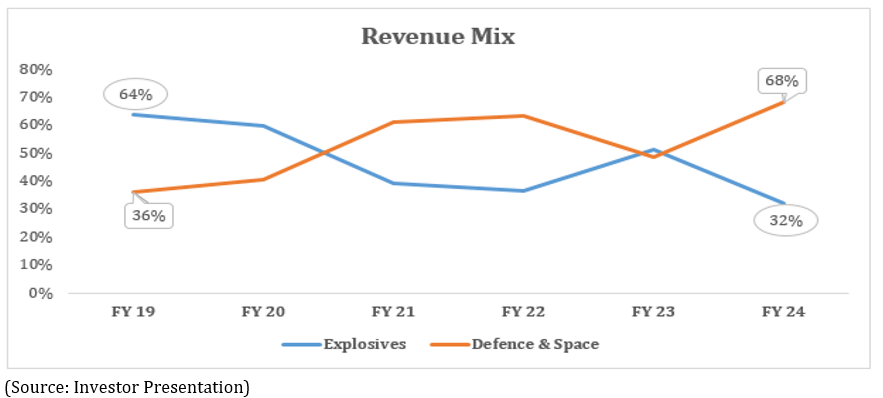

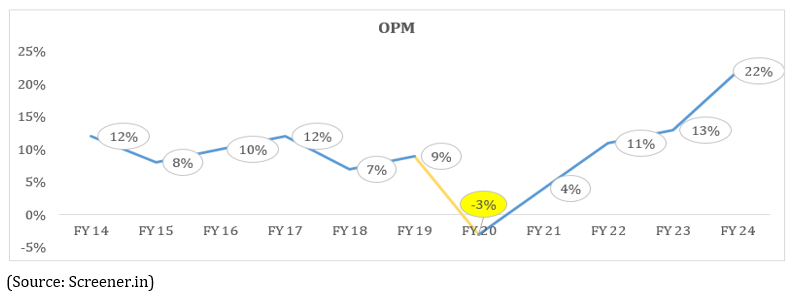

This shift signifies a significant change in the company’s outlook as erstwhile Bulk Explosives were more or less a commoditized business (more than 40 players working on Industrial explosives) with low and fluctuating margins. In contrast, defense and aerospace offers higher and stable margins over the long run.

Most of their new defense and aerospace technology has been absorbed through DRDO and ISRO. They have also licensed technology from foreign arms manufacturers like Balkan Novotech of Serbia and Ukraine-based Adron R&D.

But before we go ahead, let’s first understand the products of the company to get a better understanding of the business:

Commercial Explosives

It includes Bulk explosives, packaged explosives, Cast boosters, Emulsion boosters, Detonators, and Detonating fuse for mining and infrastructure requirements. (Coal mining is the biggest consumer of commercial explosives.)

Propellants

This substance produces thrust through combustion and helps a rocket or missile take off. It is generally found in two forms: solid and Liquid.

Solid Propellants: Gunpowder is an example of a solid propellant. The Army uses it in missiles because it can be stored for extended periods. However, due to its limited thrust generation capabilities, it cannot be utilized in space rockets.

The company has been manufacturing solid propellants since 2003, but the Government of India’s recent focus on defense has changed the fortune of this segment of the company. The company has been supplying solid propellants for use in missiles like Akash, Astra, and long-range surface-to-air missiles.

Liquid Propellants: are primarily used in space launch vehicles. They are generally used in combination with liquid oxygen, Liquid Hydrogen, highly refined Kerosene, Alcohol, or gasoline.

Beyond this, the company has been manufacturing ammunition, warheads, bombs, and mines in its Katepally plant.

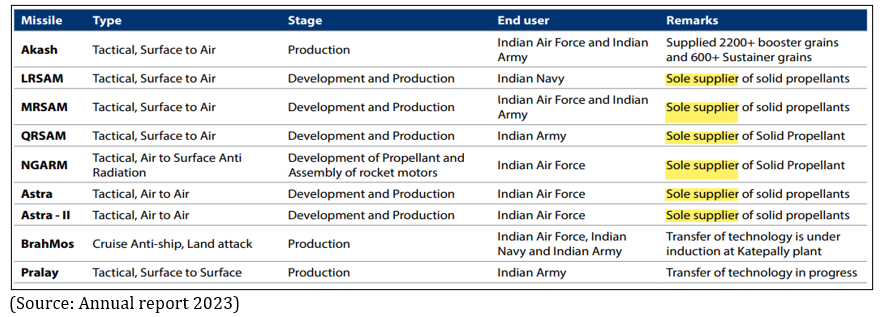

The following are Premier Explosives’ contributions to India’s missile program. As you can see, Premier is the sole supplier of Solid Propellants for many missiles.

According to the company’s management, Premier Explosive Ltd.’s opportunity comprises about 7% of the entire missile value in Akash and less than 5% in other missiles.

Apart from missiles, other defense ventures of the company are as follows;

Operation & Maintenance

Maintenance: The Company has been providing O&M services for solid propellant plants in ISRO (Andhra Pradesh) and DRDO (Chhattisgarh). This business generates around 8-10% margins.

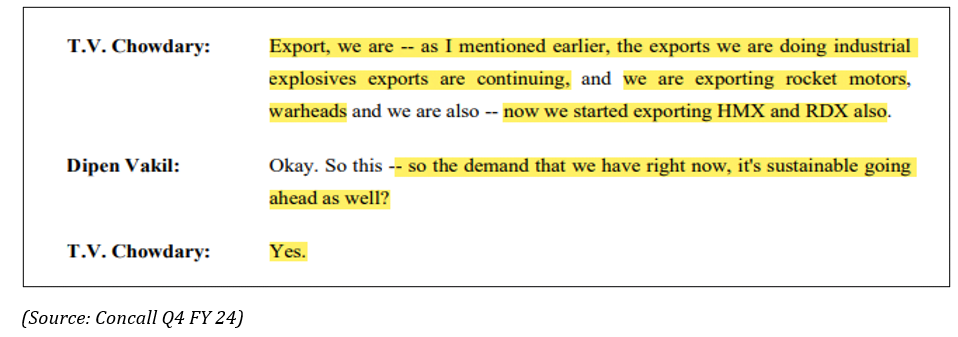

On the geography front, around 85+% of the revenue is generated domestically, and the balance is from exports to countries like Nepal, Israel, Indonesia, Greece, Jordan, Thailand, Philippines, etc…

Raw Material: Ammonium Nitrate and Fuel Oil (Diesel and furnace Oil) are the two main raw materials used to manufacture explosives. The company also uses steel, Aluminium, and magnesium. Due to the commoditized nature of the explosive industry, passing on raw material costs was a challenge for the company.

Primary user industry of the explosives: The coal industry, with its recent surge in demand due to the Russia-Ukrainian war and the resultant shift back of the EU/China towards cheaper Coal-based thermal energy, has increased the use of explosives.

Historical Performance

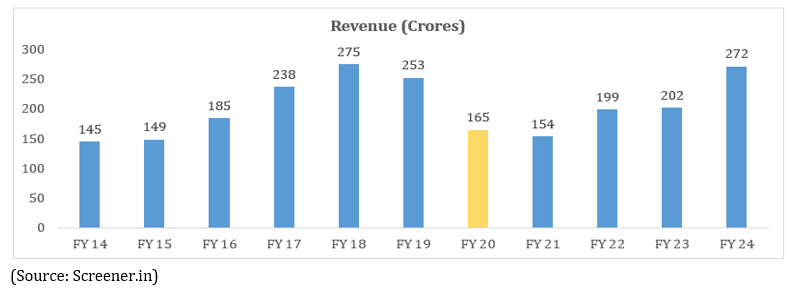

Revenue was on an uptrend until FY18 and 19, but after that, it crumbled and has recently come closer to its all-time high levels of FY18.

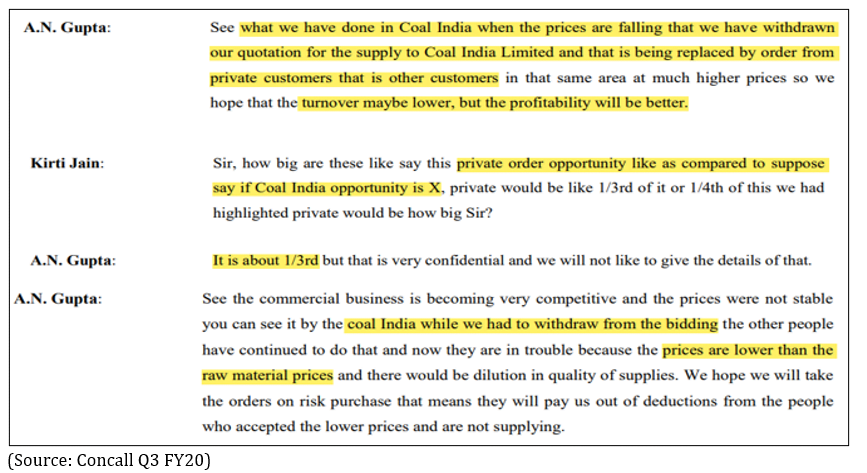

The company lost business from Coal India in the second half of FY20 because the prices given were lower than the cost of the raw material, which would have caused losses. We appreciate that the management is not ready to compromise on profitability for additional sales. Seeing the company improve its margin profile with a higher focus on defense and space segments is encouraging and we believe that this strategy will create value for shareholders in the future.

Following is the extract of the Concall from Q2 FY20 stating this issue;

Industry Outlook

The year 2023 was a landmark year for the Ministry of Defense as it witnessed defense exports reaching an all-time high of almost INR 3,000 Cr more than the previous financial year–and defense productions crossing the figure of INR One lakh Cr for the first time.

India is now exporting to over 85 countries. Indian industry has shown its capability to design and development to the world, with 100 firms exporting defense products at present. Reports suggest that, Indian defense exports have jumped by 8X over the last 8 years.

Rajnath Singh (Defense Minister) released the fifth Positive Indigenization List (PIL) of the Department of Military Affairs (DMA), comprising 98 items. The list includes highly complex systems, sensors, weapons, and ammunition. With this, the list has reached 509 items that will be procured from Indigenous sources. Separately, the Department of Defense Production (DDP) has notified four PILs comprising 4,666 items.

Several policy reforms have been taken to achieve ease of doing business, including integrating MSMEs and start-ups into the supply chain. Due to these policies, industries, including MSMEs and startups, are forthcoming in defense design, development, and manufacturing, and the government has issued almost 200 percent more defense licenses to industries in the last 7-8 years.

(Source: ET)

Growth Drivers

The company’s management has guided revenue of INR 500 Cr by FY25 with stable margins of 20-25%.

The company’s management has declared that its next growth drivers will be the aerospace and defense industries. Over the next ten years, they aim to achieve revenue of INR. 4,000 Cr, at a compound annual growth rate of about 30%.

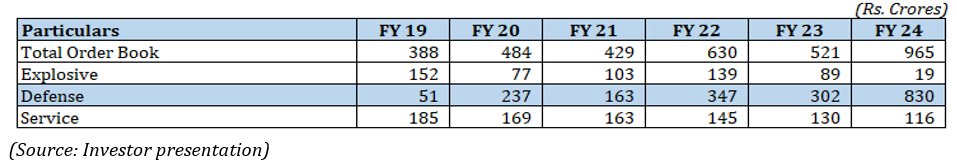

Summary of order book:

Based on the above table, we can see that defense’s share of the overall order book is on an uptrend, which provides medium-term revenue visibility as well (PS: Revenue for FY24 is just INR 272 Cr). Management has also stated that the majority of this order book will be executed within the next two years. Ninety percent of these orders are for domestic markets.

Premier Explosives is the only qualified Indian company for countermeasures (Chaffs and Flares) and the only Indian company that exports fully assembled rocket motors. In addition to rocket motors and warheads, Premier has entered into manufacturing mines and ammunition.

Premier Explosives creates solid propellants for rockets like Pinaka and empower tactical marvels such as Astra, Akash, LRSAM/MRSAM/QRSAM, Agni, Brahmos, Veda, and strap-on motors that drive satellite launch vehicles (SLV).

The Company is the sole supplier of solid propellant for some ammunition and missile segment products.

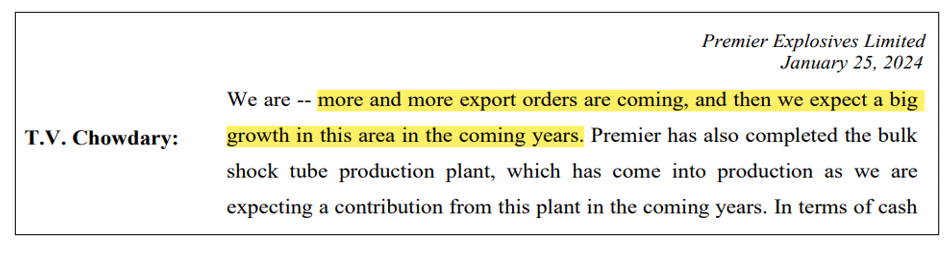

Additionally, it began exporting Space Rocket Motors, with the first shipment reaching in February 2023. This illustrates the possibility that the company will find buyers for its space products domestically and abroad. Premier is the only Indian Company that specializes in exporting fully assembled rocket motors. This increased demand for exports will be undertaken through the new capital expenditure the company plans to invest in over the next few years.

The Company has been allotted land in Odisha, where management has directed that INR 864 Cr of capital expenditures will be made for the next ten years (three phases). The initial phase will be ready by the end of 2025. It will have the raw materials for explosives (backward integration) and will further expand into ammunition and raw materials for propellants.

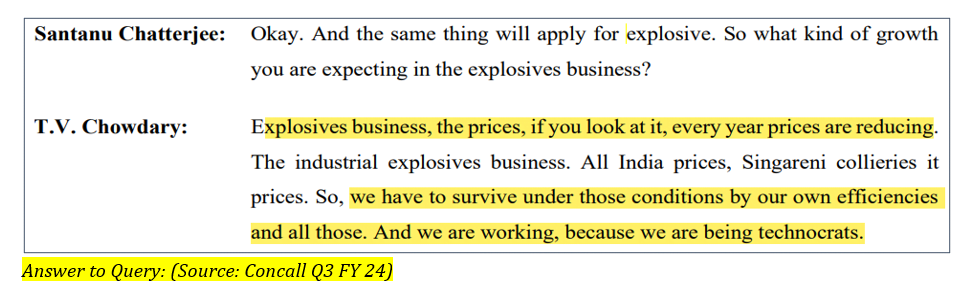

On the bulk explosives front, the demand for industrial explosives is directly related to mining operations and a rise in construction activities in the nation. Both are witnessing good traction due to the Government’s focus on making India self-reliant on coal and infra development.

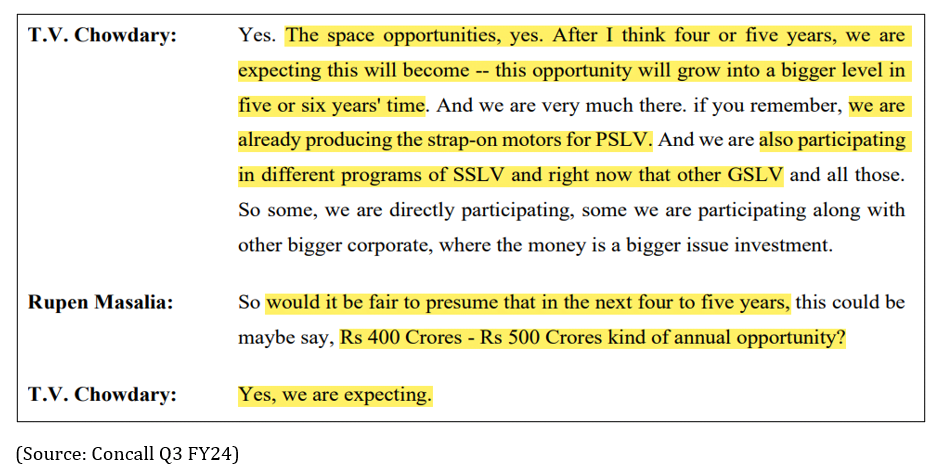

On the space business front, management is optimistic that they can expect INR 400-500 Cr kind of annual revenue from ISRO itself. Refer to the screenshot below from Concall Q3 FY24;

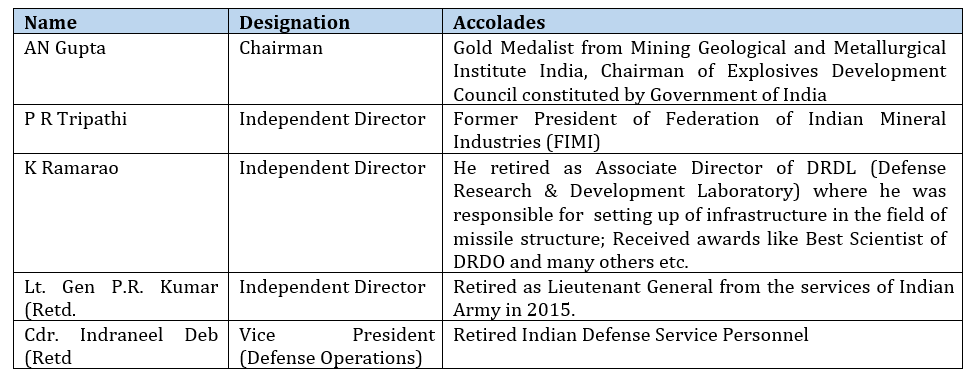

Board/Management

Looking at the above table, we can see that the management is led by a highly skilled and resourceful group of people, with one army veteran present leading the defense division and one veteran holding the position of independent director.

Valuation

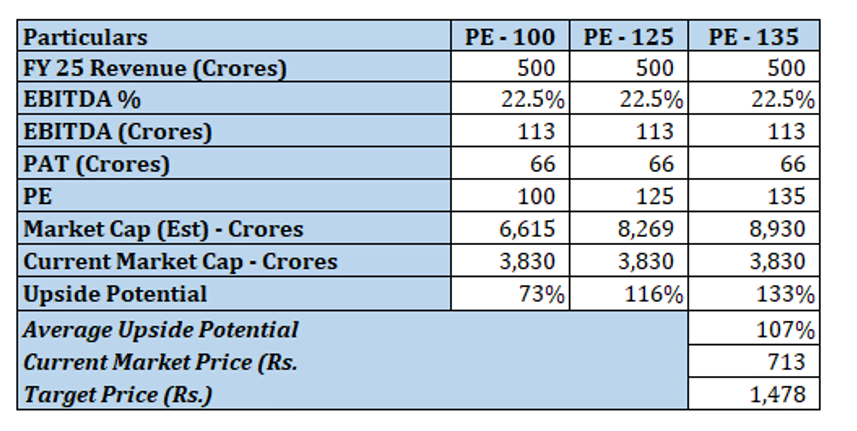

The company has a PE multiple of 135 times and is valued at INR 3,830 Cr. On the surface, one might think the company is overvalued, and the P/E ratio is exceptionally high. However, looking at his idea from a 3 to 5-year perspective is essential. We believe that Premier Explosives will create significant value in the high-margin Defense and Space research areas. There is a lot of push to do import substitution and manufacture domestically, and the budget allocation is also very healthy.

According to management, the new Capex should help the company reach a revenue target of INR 4000 Cr over the next ten years, which we believe will help the company become an INR 15000 Cr+ market cap company by that time.

In our opinion, investors should start building their position in Premier Explosives and use every significant correction as an opportunity to add more. Defense is a decadal theme that will play out over the next 15 to 20 years.

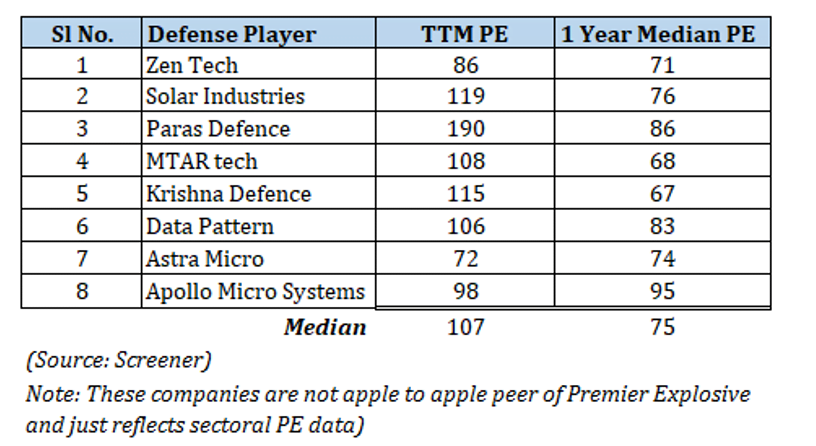

As you can see from the table below, the whole industry is fetching extremely high PE multiples;

So, assuming that this trend will continue for at least another 1-2 years and PE will stay around more or less in the same range, the target price that the firm can accomplish is;

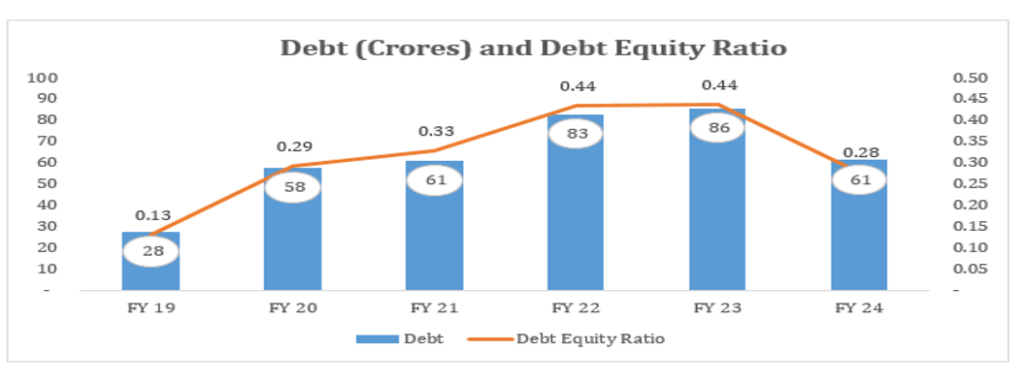

Regarding debt – the company’s balance sheet shows a relatively low debt.

The company split its stock in May 2024 (1 share was split into five shares), and the management authorized plans to raise INR 400 Cr rupees. This amount will be used mainly for the Capital Expenditure Plan, and some part will be used for debt repayment.

Conclusion

India is the largest arms importer. However, thanks to increased government spending on defense, driven by national security concerns, modernization efforts, and the journey towards self-reliance or Aatmanirbhar, the government is trying to transform India into a defense export Hub.

Liberal FDI norms and licensing requirements are poised to attract significant investment in this sector. Hence, with policy reforms encouraging private sector participation, there’s a favorable environment for growth and innovation, making it an attractive investment opportunity. Therefore, Premier Explosive, a company that is a sole supplier for some categories of defense and aerospace components, appears to be an excellent choice to invest.