Snapshot of India’s Chemical Industry

As of 2023, India’s chemical industry is valued at approximately $220 billion, contributing around 7% to the national GDP, and positioning the country as the 6th largest chemical producer globally and 3rd in Asia.

The sector is primarily driven by petrochemicals, along with a growing specialty chemicals segment valued at $40–45 billion, which includes high-value products like dyes, surfactants, and agrochemicals.

Despite this, India accounts for only 3–3.5% of global chemical consumption and continues to be a net importer, with a $31 billion trade deficit in 2023

Problems with Indian Chemical Industry

- Limited feedstock (raw material), poor infrastructure, regulatory hurdles, and talent shortage.

- Production focuses on commoditized products over high-value derivatives.

- For example, In India, 95% of propylene is used for low-value polypropylene, compared to 70% globally.

- Similarly, India uses 75% of ethylene for polyethylene vs. 63% globally, showing a tilt toward low-value outputs over higher-value materials.”

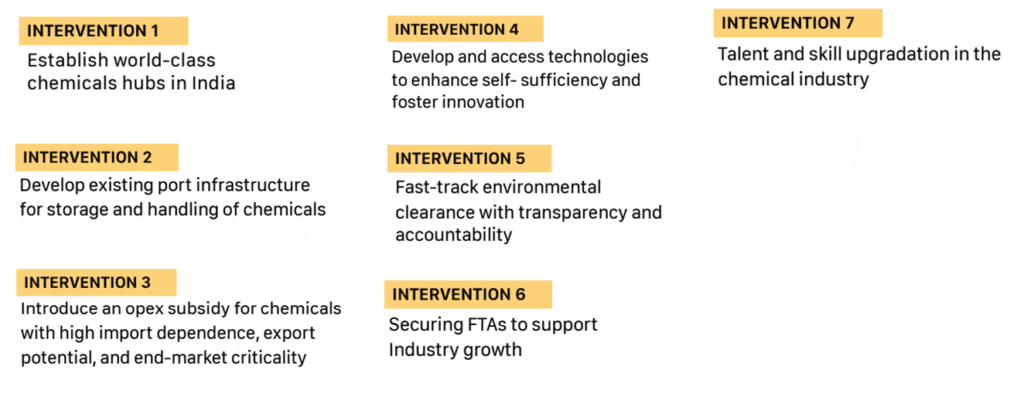

NITI Aayog’s Proposed Plan of Action for Chemical Sector

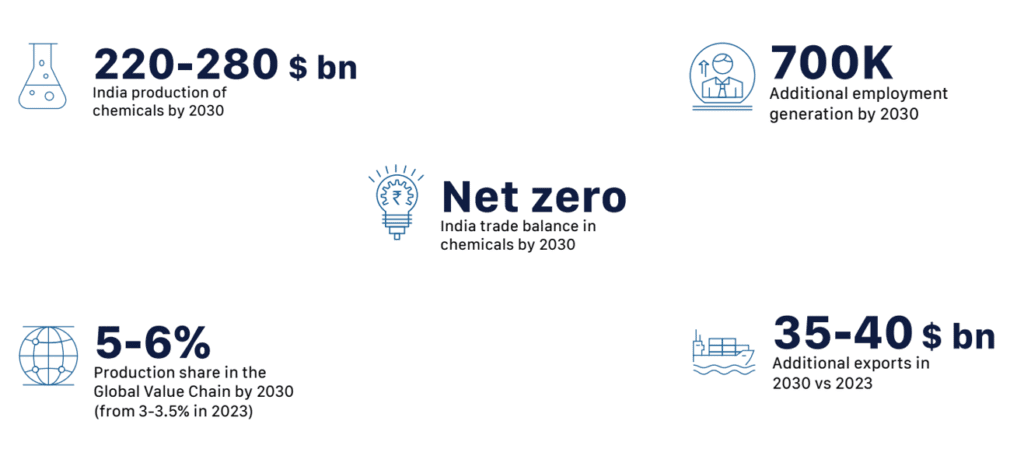

Potential Impact of the Proposed Plans

NITI Aayog has laid out a vision for strengthening the industry—focusing on world-class chemical parks, better port and logistics infrastructure, production incentives, and improving access to advanced technology and R&D. These are designed to support high-value chemical production.

Progress on India’s Plan of Action?

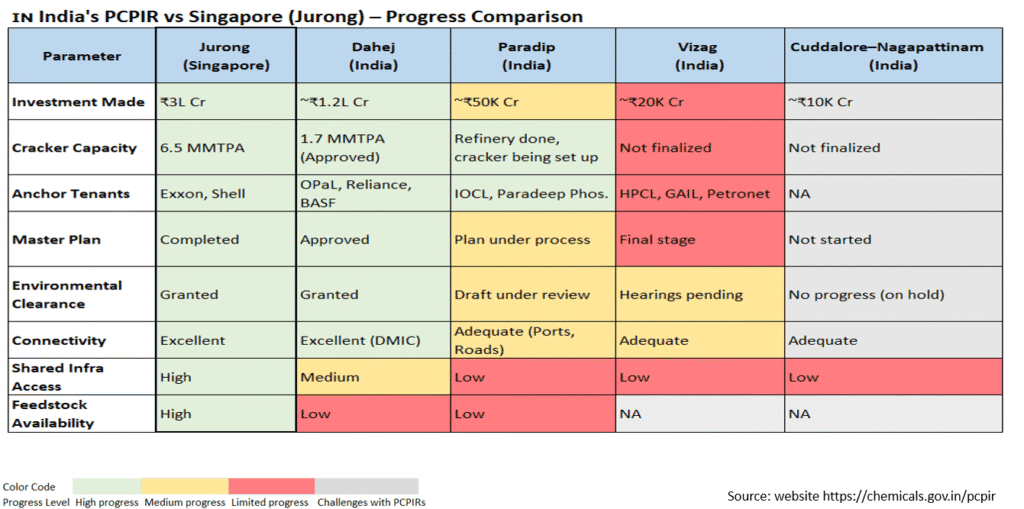

Many planned chemical hubs like Dahej, Paradeep, Vizag, and Tamil Nadu are still in early stages, with infrastructure and feedstock supply gaps from anchor tenants. This slows down integration and weakens India’s competitiveness compared to China or Singapore.

So, can India replicate China’s success with the proposed plan?

Despite government efforts, coordination among multiple stakeholders delays execution, making it hard to match China or Singapore’s chemical hub efficiency and scale.

So, in our opinion, over the next 5–10 years, India is likely to continue lagging in operational efficiency and global competitiveness in the chemical industry, making it challenging to replicate the scale or growth achieved by China.