Recent Slowdown in Credit Growth and Its Importance for Higher GDP Growth

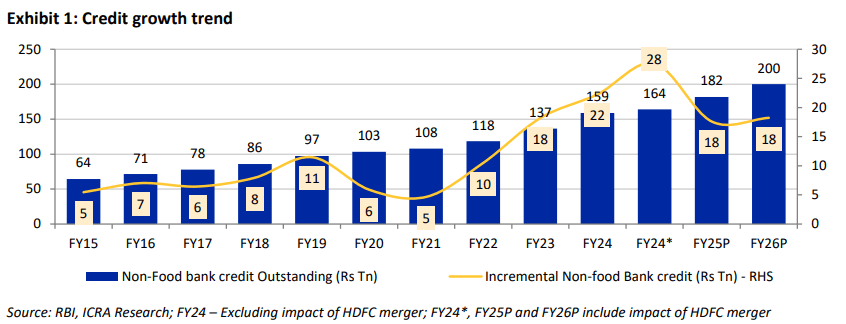

The Indian banking sector has recently experienced a notable slowdown in credit growth, a trend with significant implications for the nation’s economic output. While bank credit growth was robust in FY24, it has since moderated in FY25, and projections suggest a continued muted pace into FY26. Understanding this slowdown and the factors influencing its recovery is crucial for anticipating India’s future GDP trajectory.

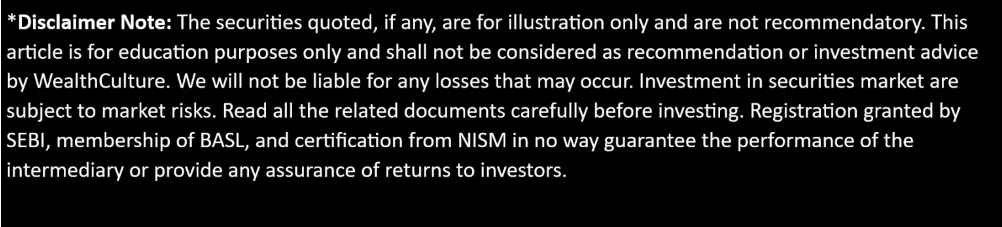

Bank credit growth significantly decelerated from 20.6% year-on-year as of November 15, 2023 (FY24), to 11.1% as of November 15, 2024 (FY25). Even after adjusting for the HDFC-HDFC Bank merger, growth slowed from 16.2% in 2023 to 12.4% in 2024. This moderation is further highlighted by the addition of only Rs 9.3 lakh crore of fresh loans in FY25 (April-November 15, 2024), compared to Rs 19.5 lakh crore in the year-ago period. As of May 31, 2025, bank credit growth for FY25 was reported at 8.97%.

The slowdown has spread beyond unsecured loans to secured segments, with mortgage growth dropping from 18% to 12%, auto loans from 20% to 11%, and unsecured loan growth from over 25% to 11%. Retail bank credit growth also eased from 16.3% in March 2024 to 12.9% in October.

Credit growth is of paramount importance for higher GDP growth. Historically, in the Indian economy, credit has grown faster than GDP, with the ratio of nominal credit growth to nominal GDP growth being about 1.4 for the 60-year period from 1950 to 2020. Research suggests a one-way causal relationship between GDP and credit, with increased credit leading to higher GDP. For an emerging economy like India, a sustained supply of credit for investments is critical for achieving and sustaining a high GDP growth rate. The collapse of private sector investments in the last decade, partly due to constrained credit, illustrates this link.

How Steps Taken by RBI Will Ease Liquidity Concerns and Help Drive GDP Growth

The Reserve Bank of India (RBI) has implemented measures to ease liquidity and stimulate economic activity. A recent repo rate cut of 50 basis points (bringing it to 5.5%) and a 100 basis points cut in the Cash Reserve Ratio (CRR) are key examples.

These actions aim to achieve several objectives:

*E Lower Borrowing Costs for Commercial Banks: The repo rate cut directly reduces the cost at which commercial banks borrow funds from the RBI, making loans more affordable for businesses and households.

* Enhanced Banking System Liquidity: The CRR cut releases a significant amount of funds (thousands of crores) back into the banking system, increasing the money supply and providing banks with more liquidity to lend.

* Stimulus for Economic Growth: By making credit cheaper and improving liquidity, the RBI intends to encourage businesses to invest in new projects and consumers to increase spending, thereby fueling job creation, demand, and ultimately pushing GDP growth towards its target. The phased implementation of CRR cuts, starting in September, is specifically expected to provide a cushion for lenders and support credit pickup in the second half of FY26 (H2FY26).

Additional Steps Needed for Repo Rate Cuts to Translate into GDP Growth

While RBI’s monetary policy measures are a crucial first step, several additional factors need to align for these repo rate cuts to fully translate into sustained credit growth and a robust GDP recovery:

* Addressing the High Credit-to-Deposit (CD) Ratio and Boosting Deposit Growth: A significant constraint is the persisting high credit-to-deposit ratio, as credit growth has consistently outpaced deposit growth. Deposit mobilization remains a challenging and costly proposition for banks.

* Revival of Private Sector Investment and Broader Demand: A major impediment to credit growth has been the sluggish private sector investment and a collapse in demand for credit for capacity expansion and working capital.

* Resolution of Asset Quality Stress and Reduction in Risk Aversion: The persisting asset quality stress in the retail segment and the potential impact of geopolitical and macroeconomic developments are making lenders cautious.

* Structural Changes in the Credit Landscape: Developing a deeper and more liquid corporate bond market and encouraging a larger share of foreign debt capital infusion can diversify credit sources beyond banks.

When Credit Growth is Expected to Revive and Hence When GDP Growth is Expected to Recover

Given the existing headwinds, a significant pickup in bank credit growth is expected to be delayed until the second half of the current fiscal (H2FY26). For FY2026, ICRA projects credit growth to ease further to 9.7-10.3%. Overall, analysts believe that credit growth will settle in the range of 10-11% for FY26.

A more substantial rebound to 15-18% is considered a key trend to watch and is contingent on the RBI effectively managing the economy by ensuring that monetary and fiscal policies work in tandem. The domestic credit cycle is historically skewed towards higher demand in the second half of the fiscal year, and bankers are betting heavily on the festival season, beginning September-October this year, to see a noteworthy pick up in demand for loans.

Therefore, while the initial recovery in credit growth is anticipated in H2FY26, a more significant and sustained acceleration, which would robustly support higher GDP growth, is dependent on the comprehensive resolution of the aforementioned challenges, including improved deposit mobilization, a definitive revival in private investment, and a sustained reduction in banks’ risk aversion.