India’s aerospace and defence (A&D) market is projected to reach $70 billion by 2030. This growth is being driven by escalating air passenger and cargo volumes, dynamic government initiatives like “Make in India,” and substantial private sector investment. Domestic air traffic has surged from 70 million to over 200 million in the past decade, with Indian airlines placing record orders for new aircraft. The local Maintenance, Repair & Overhaul (MRO) market alone is set to touch $4 billion by 2025, pulling in major international aviation players. Key export markets for Indian aerospace products now include the UAE, Saudi Arabia, France, USA, and Czech Republic—a sign of mounting global trust in Indian engineering and manufacturing excellence.

Factors Powering Indian Dominance

India’s precision engineering capabilities are shaping success in global aerospace contracts—including avionics, composite structures, and high-value components. The country’s competitive cost base and deep engineering talent pool make it an attractive hub for aerospace sourcing. Government incentives such as the Production Linked Incentives (PLI) program, R&D investments, and business reforms have dramatically lowered industry barriers, supporting growth for both global and local companies.

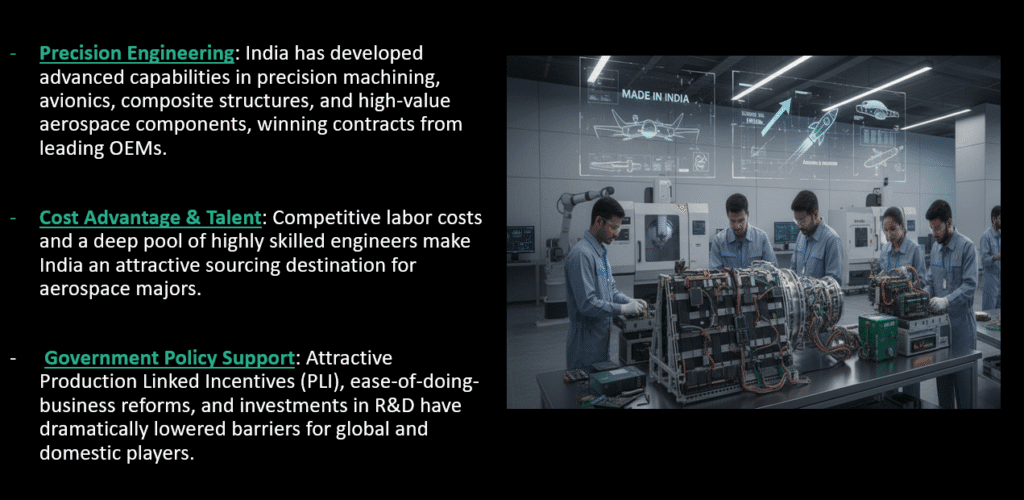

Expanding Ecosystem & Global Partnerships

Indian companies are now preferred suppliers for top aerospace corporations (Airbus, Boeing, Bell, Rolls Royce, ISRO)—supplying everything from engine parts to intricate sub-assemblies. The sector’s ecosystem extends far beyond aircraft and satellite manufacturers; it includes MSMEs, IT and engineering outsourcing firms, offering digital and design services that further solidify India’s central role in the global A&D supply chain. Established giants (HAL, BEL, Godrej Aerospace) and fast-moving innovators (MTAR Technologies, Azad Engineering, ideaForge) are expanding their international reach.

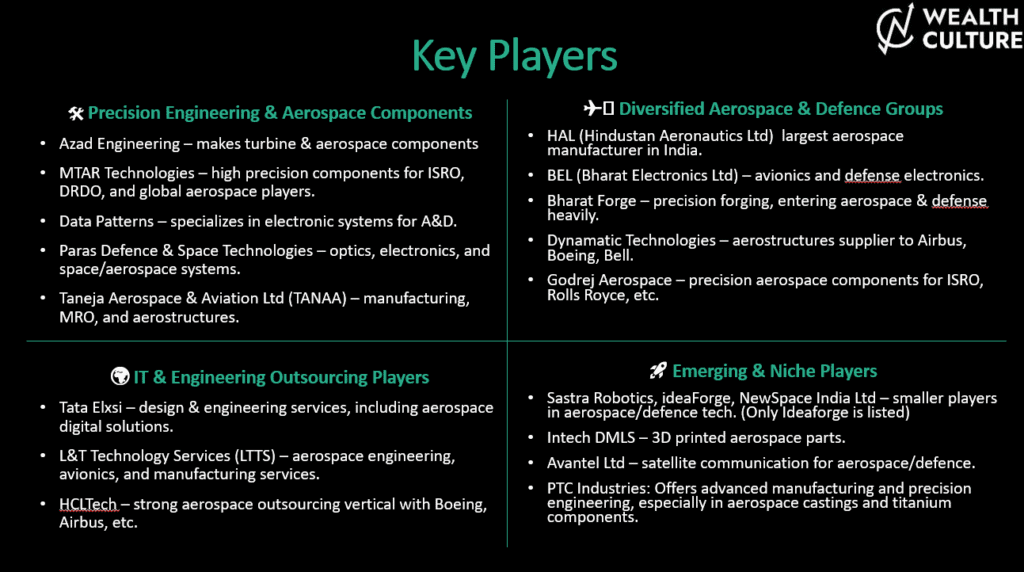

Key players

- Azad Engineering: Turbine and aerospace component manufacturing.

- MTAR Technologies: High-precision parts for ISRO, DRDO, and global OEMs.

- Data Patterns: Electronic systems designer for the A&D segment.

- Paras Defence & Space Technologies: Specializing in optics, electronics, and space/aerospace systems.

- Taneja Aerospace & Aviation Ltd (TANAA): Aircraft manufacturing and MRO services.

- Tata Elxsi: Aerospace design and digital engineering services.

- L&T Technology Services (LTTS): Avionics and manufacturing.

- HCLTech: Aerospace outsourcing services, working with Boeing, Airbus, and others.

- HAL: India’s largest aerospace manufacturer.

- BEL: Specialist in avionics and defence electronics.

- Bharat Forge: Leading in precision forging, with growing aerospace and defence focus.

- Dynamatic Technologies: Major supplier of aerostructures for global OEMs.

- Godrej Aerospace: Provider of aerospace components for ISRO and Rolls Royce.

- Sastra Robotics, ideaForge, NewSpace India Ltd: Small but innovative aerospace/defence technology players (only ideaForge is listed).

- Intech DMLS: Producer of 3D-printed aerospace components.

- Avantel Ltd: Solutions for satellite communication in aerospace/defence.

- PTC Industries: Advanced aerospace castings and titanium components.

Sector Outlook

India is rapidly transforming from a key component supplier to a full-fledged global aerospace and defence hub. This evolution is powered by deepening government support, expanding domestic enterprise, and strategic international partnerships. As exports grow and technology advances, India’s capacity strengthens its prominent global role in aerospace and defence.