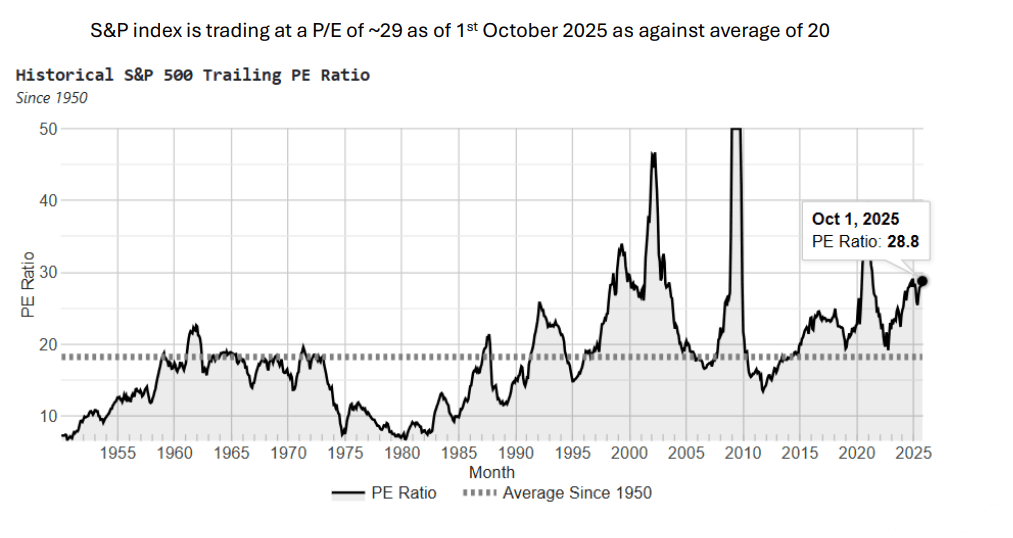

S&P Index (US Markets) – Overvalued Currently?

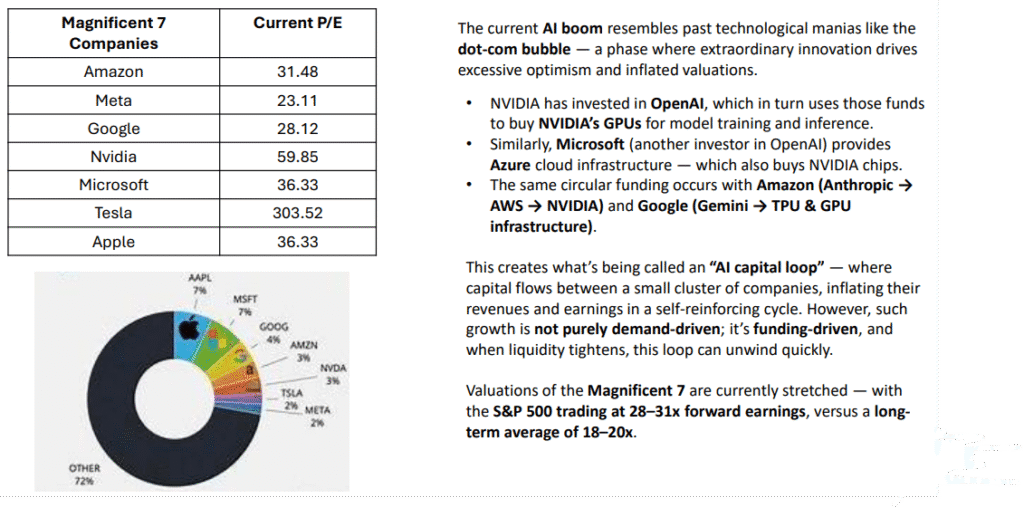

What has led to such high P/E – Is AI boom real?

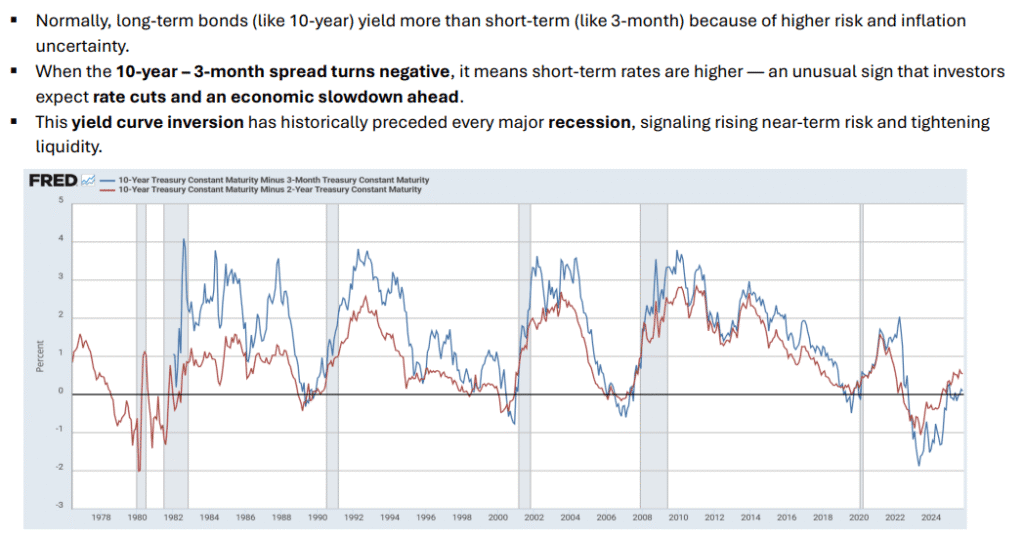

Yield Curve Reversion – Risk in 3 months > In 10 Years?

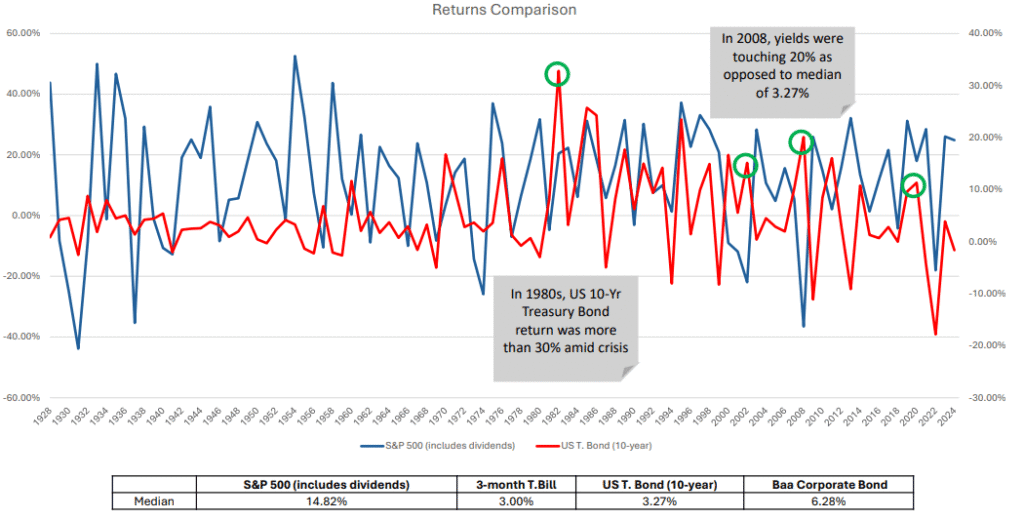

US Treasury vs S&P 500 (Since 1929)

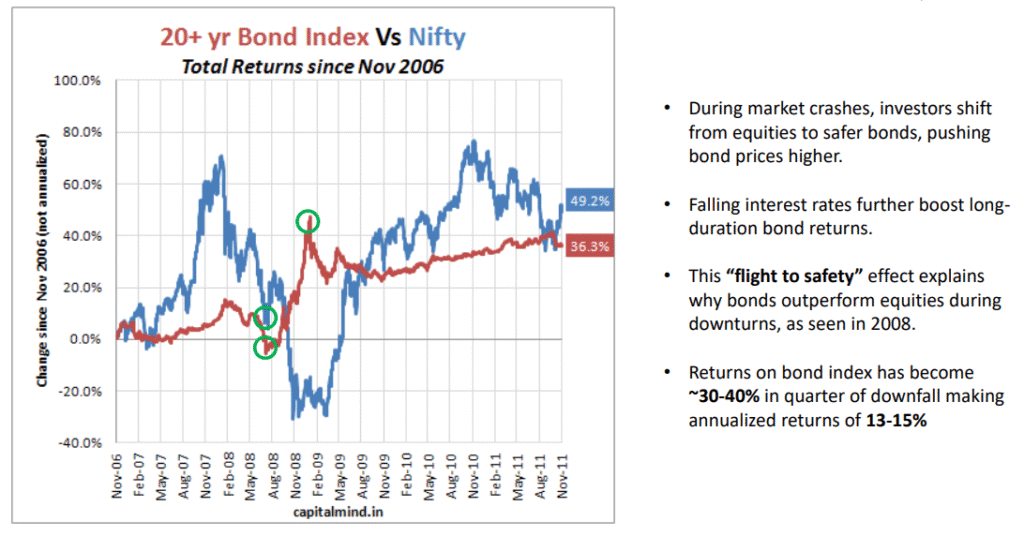

Bond Returns vs Nifty Returns – Indian Markets

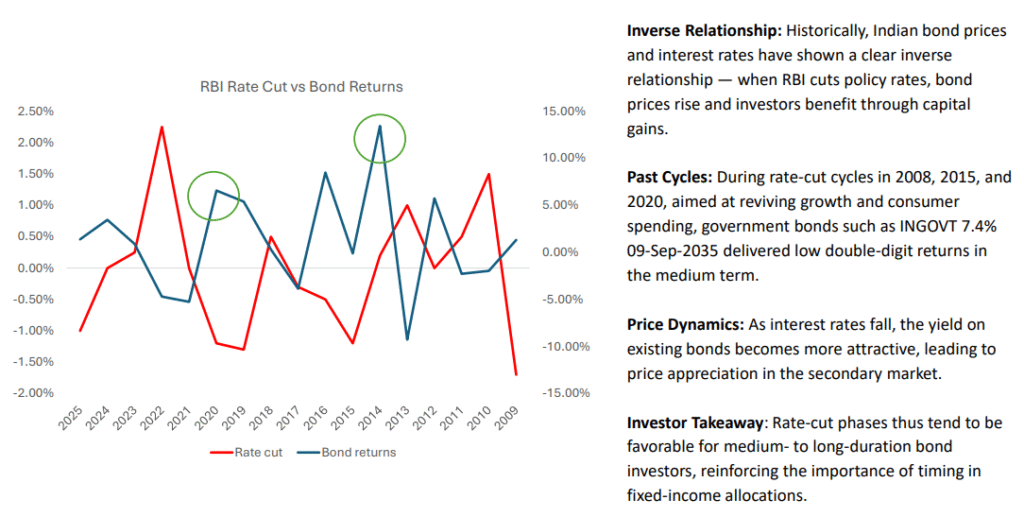

Indian Bond Prices in Contractionary Monetary Policy

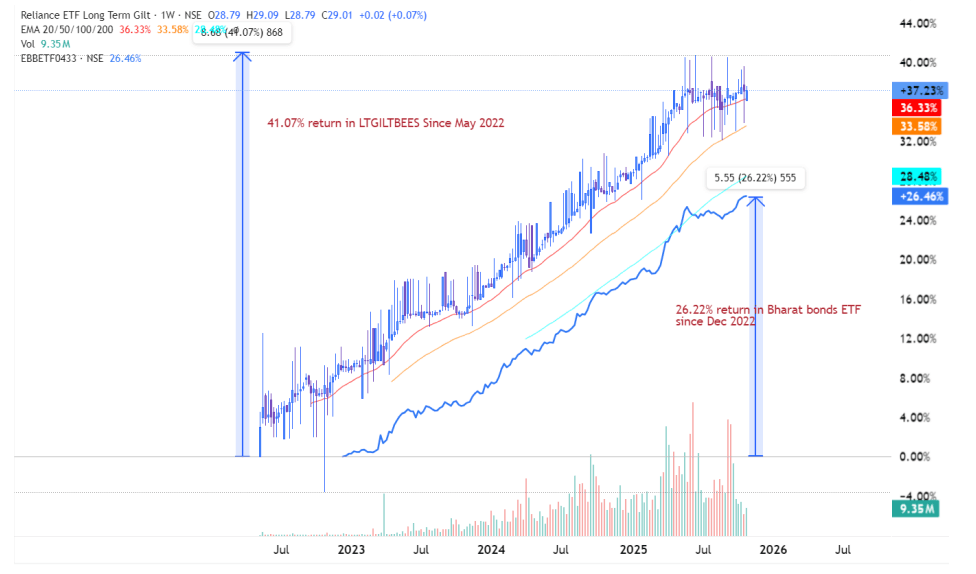

Indian Instruments to invest in bonds

Conclusion

With valuations in the US markets (S&P 500 and Nasdaq) running ahead of fundamentals, the risk of an economic slowdown or mild recession is rising — driven by high debt levels, excessive liquidity printing, and the potential onset of stagflation. The yield curve inversion, where short-term (3-month) yields are riskier than long-term ones, signals caution.

Historically, bonds have performed well during rate-cut phases and market downturns, offering stability and double-digit returns when interest rates fall. Given this setup, we prefer to shift part of the portfolio toward bonds, precious metals, and select emerging markets, while reducing equity exposure, as 2026 is unlikely to be a strong year for global equities.

1 Comment.

Such a nice blog