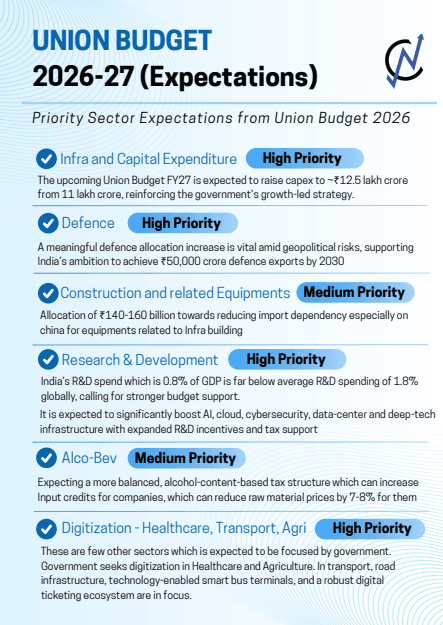

Union Budget 2025-26 had brought a relief to tax payers, Power sector picked up because of higher budget allocation whereas Railways and Fertilisers stocks saw negative reflection. Now here’s the sectors which will stay in focused in Union Budget 2026-27 as per street estimates:

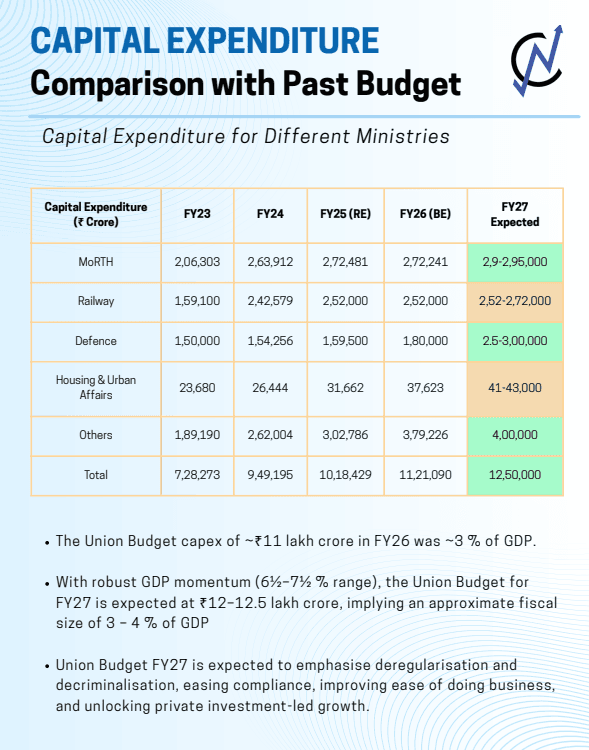

Union Budget 2026–27 is expected to signal a decisive shift toward next-generation reforms, including the sequential privatisation of railway CPSUs operating in competitive, non-core segments. The policy focus is likely to extend across deregulation, decriminalisation, export competitiveness, MSME strengthening, and last-mile implementation. Together, these priorities reflect the government’s intent to preserve growth momentum while navigating an increasingly challenging global and domestic economic environment. Hence, the focus is likely to remain on capex-led growth, with spending rising to ₹12–12.5 lakh crore.

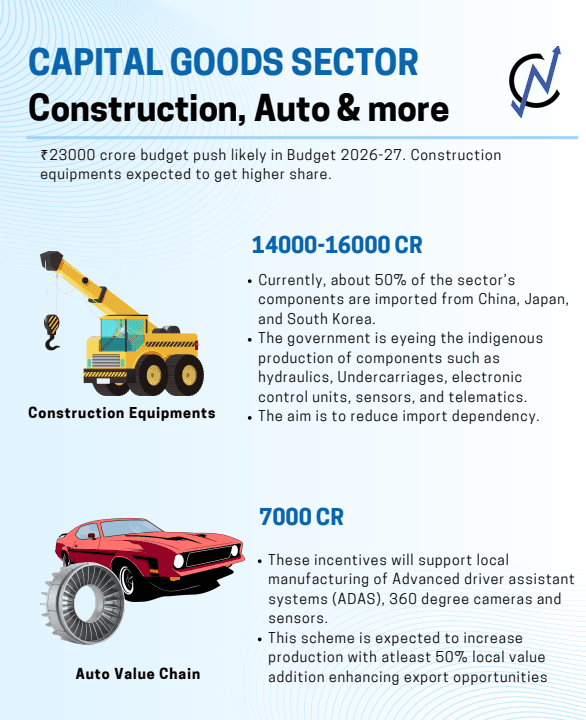

India is considering incentive packages worth up to ₹23,000 crore in the upcoming Union Budget to accelerate domestic manufacturing of high-value capital goods and reduce import dependence.

This includes a ₹14,000–16,000 crore incentive scheme for construction equipment, nearing finalisation, and a ₹7,000 crore programme to strengthen resilient global value chains (GVCs) in the automobile sector, signalling a strong push toward manufacturing self-reliance and localisation.

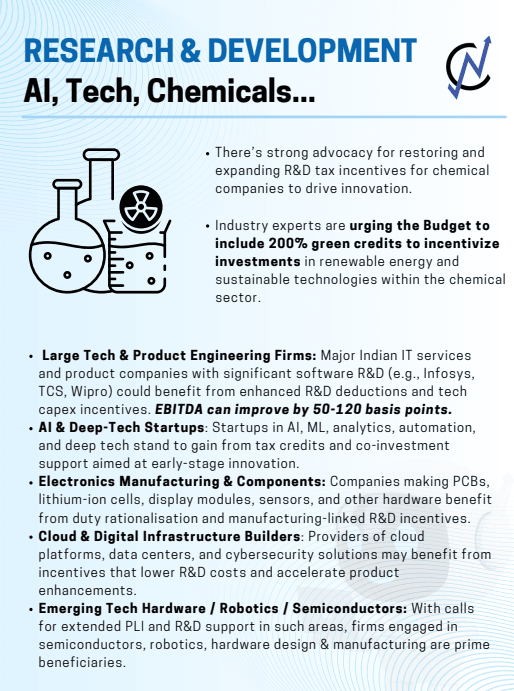

The Electronics manufacturing ecosystem (PCBs, Li-ion cells, display modules, sensors, hardware) likely to benefit from duty rationalisation and manufacturing-linked R&D incentives.

The chemical sector is seeking restoration and expansion of R&D tax incentives, with proposals for 200% green credits to accelerate innovation and sustainability investments.

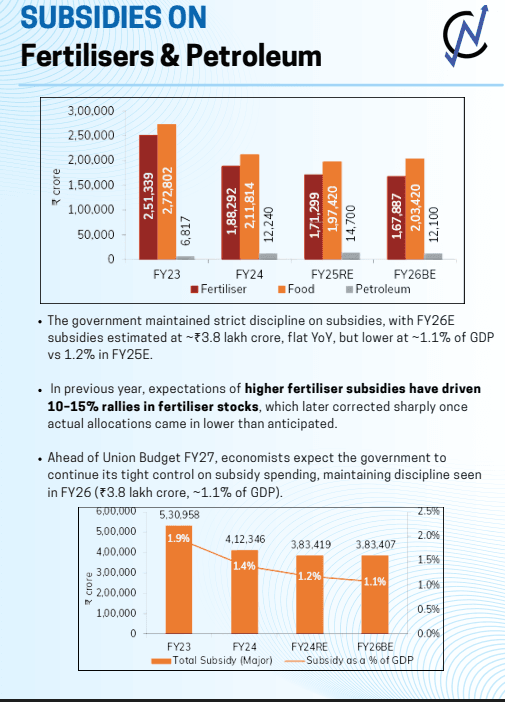

Subsidy discipline, across Fertilizers, Food and Petroleum, is expected to continue, with FY26 subsidies at ~₹3.8 lakh crore (~1.1% of GDP), broadly in line with prior budgets.

Real estate industry groups are urging the Budget to deliver policy and fiscal support for affordable housing and rental housing initiatives — including incentives, regulatory clarity, and demand-revival measures.

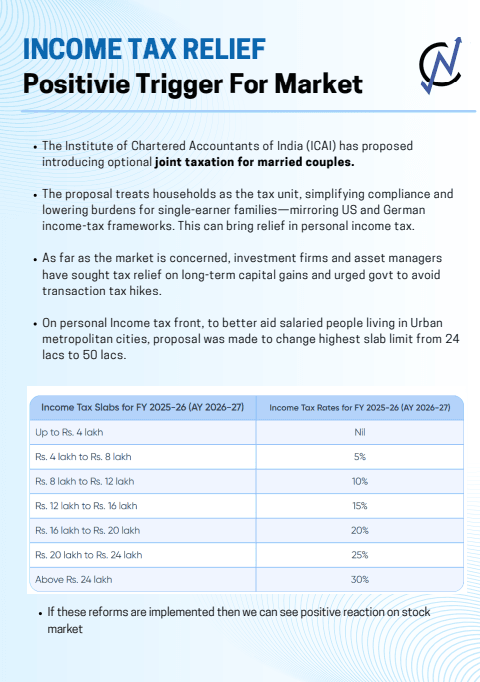

Personal tax reforms under consideration include optional joint taxation for married couples and raising the highest income slab threshold from ₹24 lakh to ₹50 lakh to support urban salaried taxpayers. Analysts expect reforms such as higher tax deductions on home loan interest, relaxed capital gains rules, and possibly GST rationalisation to make housing more affordable and encourage first-time buyers.