A common question among investors during the current metal rally is why one should avoid chasing metal stocks such as Hindustan Copper, Hindalco Industries, Vedanta, Hindustan Zinc and SAIL, and instead prefer precious metals like gold and silver.

To address this, we have analysed the 2008 Global Financial Crisis period.

Why 2008? – Because it represents the closest macro parallel to the current environment, characterised by a sharp rally in metal stocks, rising prices of gold and silver, elevated equity market valuations, and growing macroeconomic uncertainty.

Precious metals have historically been one of the most obvious investment choices for large institutions after a market crash.

Whenever a crash happens, everything corrects — equities, commodities, cyclical stocks. But the real question is: how fast does each asset recover?

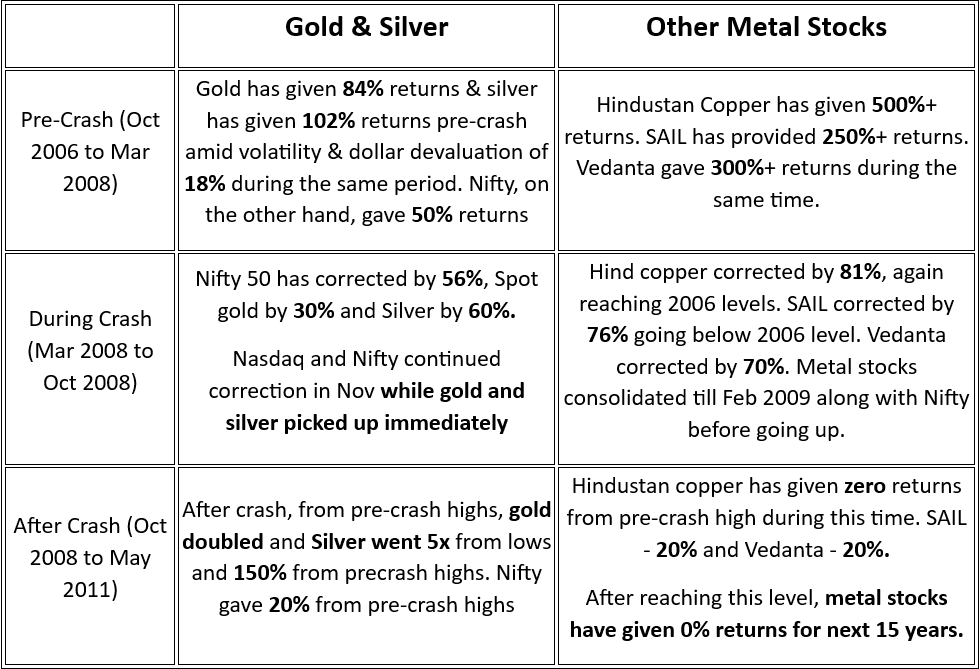

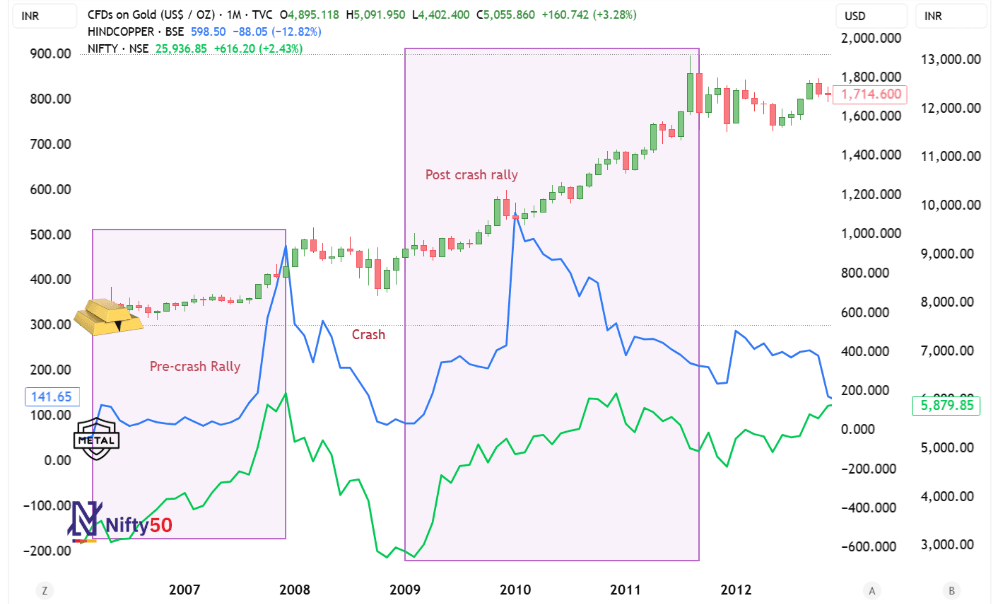

If we look at the 2008 crisis period:

The NIFTY 50 took several years to meaningfully reclaim its pre-crash highs.

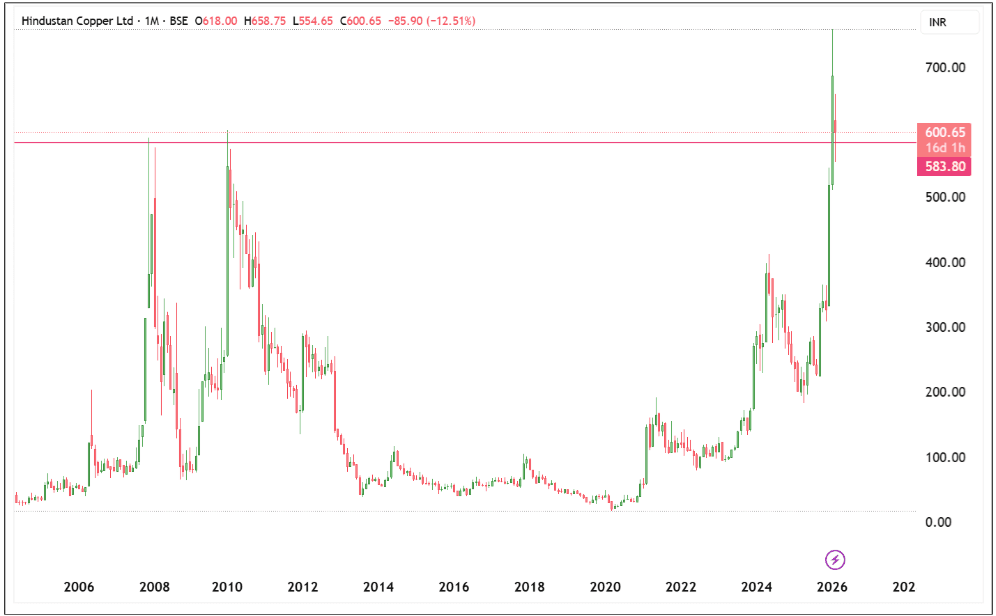

Metal stocks like Hindustan Copper also struggled and did not sustainably break past their pre-crash levels for a long period.

In contrast, Gold corrected briefly during the crash, but then rebounded sharply and nearly doubled in the years (2009-2011) that followed — at a time when many equities were delivering muted returns.

This creates a stark difference in investor experience.

An investor who entered metal stocks at peak valuations before the crash may have had to wait nearly a decade o see meaningful returns.

An investor who allocated to gold saw a temporary drawdown — but experienced a much faster recovery and strong returns in the subsequent years.

From Oct 2023 to Dec 2025, metals saw a sharp pre-crash rally — Gold rose ~150%, Silver nearly 2x, while Hindustan Copper surged ~300%, Steel Authority of India Limited ~100%, Hindustan Zinc ~150%, and Vedanta Limited ~260%.

Since Jan 2026, almost everything, Indian equities, US equities, gold, silver, and other metals, has shown weakness.

It’s beyond anyone to say whether this is the start of a deeper correction. But if markets simply mean-revert from elevated valuations, cyclical metal stocks are unlikely to move meaningfully higher during and after a crash.

Precious metals, however, have historically outperformed other asset classes in periods of stress and post-crash recovery phases.

The key difference is this: cyclical metals depend on growth. Precious metals benefit from uncertainty.

The takeaway: cyclical metals can deliver explosive pre-crash gains, but mistimed entries can trap capital for years. Precious metals, by contrast, tend to recover faster and outperform during prolonged uncertainty.