Company Background

- Paramount Communications Ltd is India’s leading cable and wire manufacturing company.

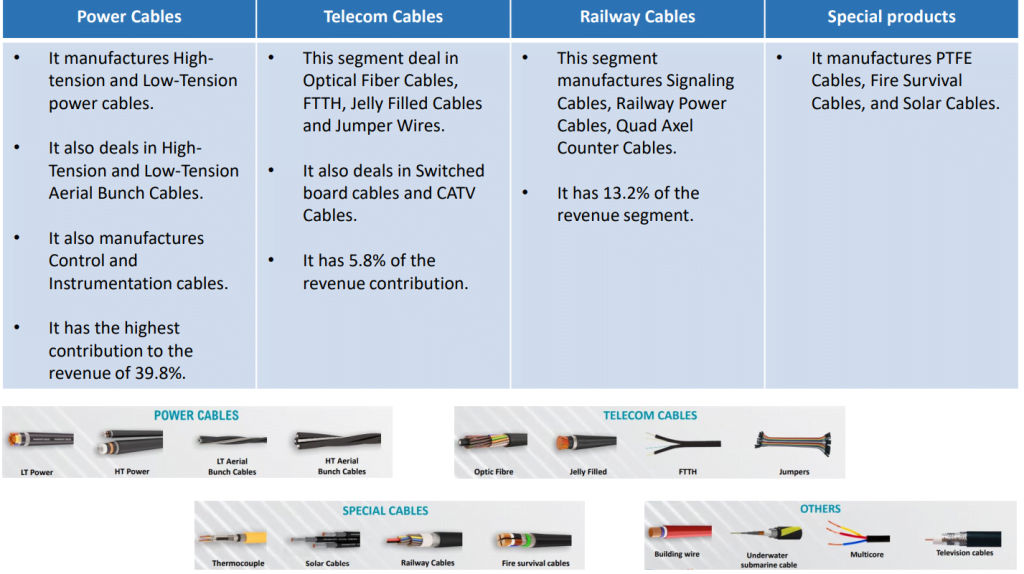

- Established in 1955, it has expanded into a wide range of product portfolios such as Power Cables, Domestic Wires, HT Cables, Optical Fiber Cables, Telecom Cables, Railway cables, Specialized cables, Instrumentation and Data cables, etc.

- The company has 2 major manufacturing facilities – (Khushkhera plant) Rajasthan and (Dharuhera plant) Haryana.

Key business segments

Turnaround Story

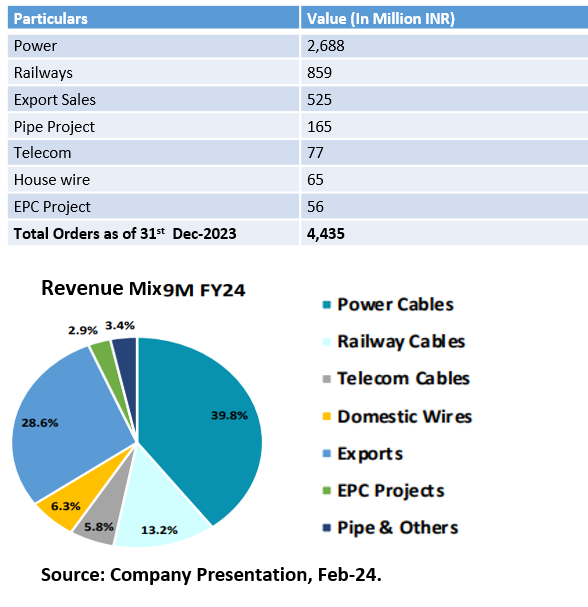

- In Dec 2007, Paramount acquired 100% of AEI Cables, world’s oldest cable manufacturing company based in UK. With this acquisition Paramount became the largest listed cable manufacturer in India.

- Acquisition was done by raising debts of ~100 Crores INR while the company had a cash balance of only INR 6.3 Cr. The additional debt raised to fund the acquisition led to a huge debt problem post the global financial crisis.

- In 2010, Paramount was forced to approach the banks for restructuring of its debt under the Corporate Debt Restructuring (‘CDR’) program and in 2016, The bankers exited from the CDR and the Company was taken over by Invent Asset Securitization & Reconstruction Pvt. Ltd.(ARC).

- Turnaround starts in 2017 and the company starts generating profits between 2018-23 on the back of quality products and loyal clientele. Promoters infuse more than INR 100 Cr during this time.

Improving Financials

- Revenue from Operations grew at a CAGR of 16.77% between FY17 and FY23, despite the lack of working capital support from banks.

- Turned negative EBITDA margins to 4.13% in FY22 and 7.90% in FY23.

- Revenue from Operations in FY23 grew by 37.10% YoY.

- Improving Asset Turnover Ratio to 6.2 in FY23, representing better use of assets & enhanced capacity utilization.

- Continuous reduction in gross debt levels with debt to equity standing at 0.54 in FY23 compared to 1.05 in FY21.

- Turned negative Return on Capital Employed in FY18 to 9.43% in FY23.

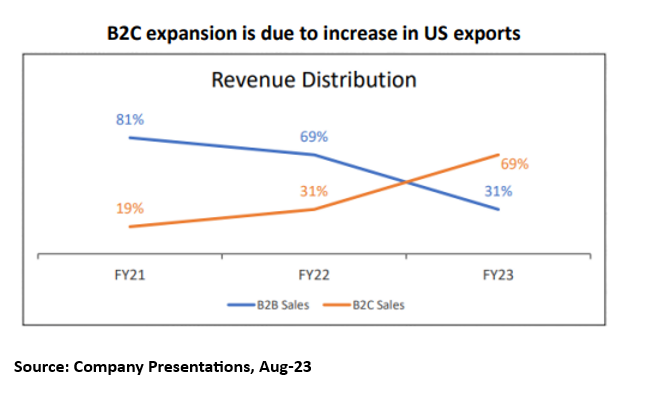

Growth in Exports

- Global exports are growing at the fastest rate, with a contribution of 50% in FY23 compared to 4.3% in FY20.

- The number of dealers in the USA has tripled in the last 1.5 years.

- Increase in exports is a direct result of B2C business growth in the USA.

- The company is focused on replicating a similar success story as the USA on the back of superior product quality in other geographies as well.

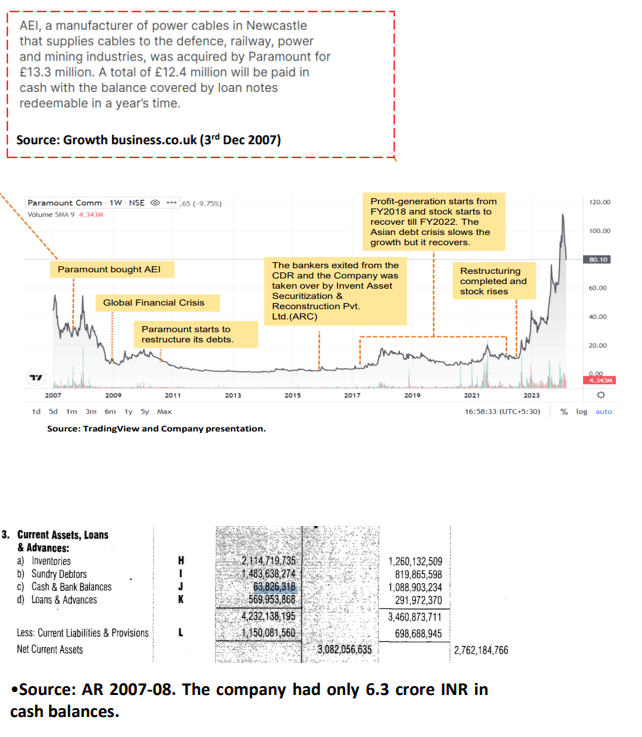

Fundraise & New Opportunities

- The company has 2 manufacturing facilities, with new ones upcoming and estimated to be set up using the INR 135 Cr equity capital raised by the company in Jan 2024.

- The government’s programs like Bharat Net and expansion from companies like Jio and Airtel are expected to increase the demand for cables. The growing focus on renewable energy sources has led to a robust demand for solar cables.

Valuation

- Paramount has raised ~135 crore INR via equity financing. Since the company has already paid off most of its debts, the only course left for it is capacity expansion.

- Current Net Fixed Asset Turnover for the company is ~6x. Assuming the new capacity takes 2 years to reach maximum utilization we could be looking at overall Revenue of ~1,600 Cr with a net profit margin of ~9% by FY26.

- With Net PAT of ~130 Cr and a P/E multiple of ~30x, we could be looking at a MCap of ~4,320 Cr by FY26.

Conclusion: Accordingly, we assign a “BUY” rating to Paramount Communications with a Target Price of INR 154 per share. The stock has an upside potential of 95% from current levels.

Risks to our thesis

- Significant delay in repaying its debt with the ARC and offtake are critical as Paramount would be competing with stronger peers with non-levered balance sheets.

- Replicating export growth in European and Australian markets is a key risk.

- Delays in new capacity expansion and scaling of new manufacturing facilities is a major execution risk.